When Inauguration Day approaches in the United States, the first political domino to fall may be obstacles to the banking sector, although the White House may not be the right place to oversee the most consequential actions.

The crypto industry will surely cheer loudly at some of the executive order’s fireworks when President-elect Donald Trump takes the oath of office, which could include crypto guidelines, but such orders may be more smoke than fire. (President Joe Biden, after all, issued a crypto order in 2022 directing the federal government to take better control of crypto.)

As the White House touts its vision for the direction of crypto policy, concrete steps will be taken at regulatory agencies, such as the Securities and Exchange Commission and the Federal Deposit Insurance Corp. They are nominally independent regulators, but they will have new leadership closely aligned with Trump’s views, even if there is a delay in confirming the permanent heads of the agencies.

At the SEC, former Commissioner Paul Atkins is on deck to receive his official nomination to take over. But the conservative SEC veteran could be stuck in the middle of the potential Senate confirmation bottleneck, where the most urgent nominees, like the new Treasury secretary, will be first in line.

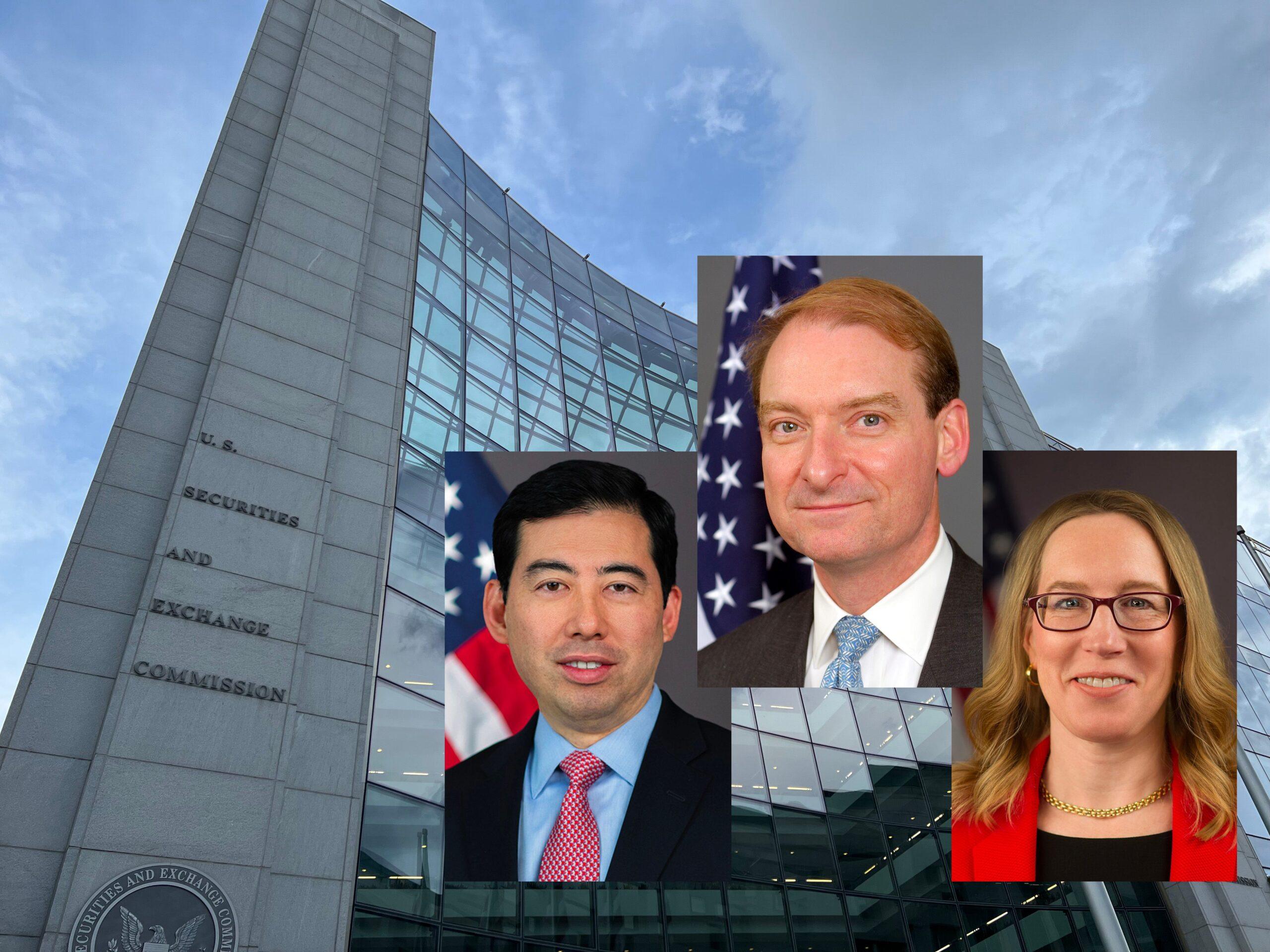

On January 21, the day after the inauguration, the commission will have only three members: two Republicans and one Democrat. Trump will be able to appoint one of the two sitting Republicans as interim president, just as Biden appointed Allison Herren Lee to the position on January 21, 2021, at the start of his presidency. The two Republican commissioners, Mark Uyeda and Hester Peirce, previously served Atkins as advisers to the SEC, so they are probably on the same page as him, anyway.

Some expect Commissioner Uyeda to get the green light to be interim president, and he could immediately make a change that would have huge consequences for crypto banking. He said he supports erasing the controversial Staff Accounting Bulletin No. 121 (SAB 121), which effectively requires banks to treat their customers’ crypto assets as their own, accounting for the tokens on their balance sheets and taking into account the impact on the capital they need. expensive to maintain. A hypothetical interim president Uyeda could order this bulletin removed, easing pressure on big banks that have had to tread lightly in crypto matters.

Commissioner Peirce also openly opposed SAB 121 within the agency, issuing a statement asserting that “SAB fails to recognize the Commission’s own role in creating the legal and regulatory risks that justify this accounting treatment.” . So, if she were to take over, the bulletin could be deleted in the same way.

SAB 121 has been under fire since its publication, and Congress moved last year to strike it from the books in a broad bipartisan vote to use the Congressional Review Act to overturn the SEC’s action . But President Biden extended his veto to protect the accounting standard.

In a public statement in September, SEC Chief Accountant Paul Munter held the line on SAB 121, saying his accounting staff still believed the same way that a bank’s balance sheets should “reflect its obligation to protect crypto-assets held on behalf of others. But the agency announced Tuesday that he will retire next week. The revamped agency will have a new chief accountant.

If the acting president waits for Atkins to arrive, the former commissioner will have to get rid of SAB 121 himself. When his name emerged last month as Trump’s pick for the SEC, Rep. Mike Flood, a Republican from Nebraska who led the House charge against the accounting standard, posted on the social media site X that he looked forward to “working with him to end SAB 121.” “

Meanwhile, U.S. banking regulators could quickly direct their teams of banking supervisors that crypto no longer needs to be segregated. At the FDIC, longtime Chairman Martin Gruenberg is expected to leave the day before the inauguration. That puts Republican Vice President Travis Hill at the helm, at least in an interim capacity.

“We expect Hill to present a proposal that both clarifies that banks can engage in crypto activity and clarifies when regulators must first approve an activity,” Jaret Seiberg said , financial policy analyst at TD Cowen, in a note to clients. “This will likely also include strict deadlines for the FDIC to act.”

Last week, Hill outlined several pro-crypto policy thoughts, saying the agency was “stifling innovation and contributing to the public’s impression that the FDIC is out of business if institutions are interested in anything related to crypto.” blockchain or distributed ledger technology. He also argued that the FDIC launched an inappropriate campaign to sever the banking ties of crypto companies and those involved in them.

“I continue to think that a much better approach would have been – and remains – for agencies to clearly and transparently describe to the public what activities are legally permitted and how to conduct them in accordance with safety and soundness standards,” Hill said . “And if regulatory approvals are necessary, they must be made in a timely manner, which has not been the case in recent years.”

Read more: US banking industry should ease path to crypto, suggests Republican taking FDIC reins

The FDIC’s restrictions on bank involvement in crypto do not take the form of rules but of guidelines that can be more easily revised. There are, however, two other agencies that share the task of regulating U.S. banks: the Office of the Currency Comptroller (OCC) and the Federal Reserve.

The OCC has actually been led by an interim administrator, Michael Hsu, for more than three years. Hsu said he was waiting for the new choice to replace him, which is as simple as the president asking his Treasury secretary to appoint a “first deputy comptroller,” a designation that automatically inserts that person into the comptroller role by interim according to OCC rules. Trump had already appointed Brian Brooks to the interim role, where Brooks – a former executive at Coinbase and other crypto companies – quickly moved to explode entry into the banking system for crypto companies, including through a new approaching charter.

At the Fed, the vice chairman of the board responsible for supervision, Michael Barr, announced that he would resign at the end of February. Barr was in this role when the Fed warned the banks it supervises that any crypto activity must be meticulously managed by the regulator before the institutions can move forward. His departure potentially leaves room for a future vice president who wants to encourage lenders to move into digital assets.

As the old guard heads out of the SEC and banking agencies, some of the key constraints of crypto banks are particularly vulnerable.

Seiberg, however, added a bit of Washington wisdom to his note: “Our caution – with a tip of the hat to Mike Tyson – is that everyone has a plan until they get punched in the face. »