Amid a broad decline in the traditional market, crypto was once again the most notable underperformer on Thursday.

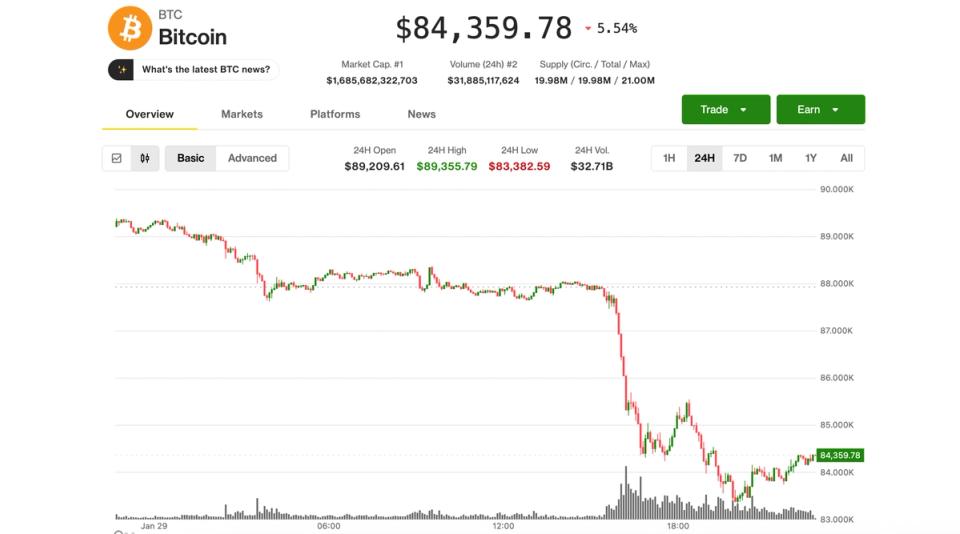

Modest overnight declines in crypto turned into a major rout in the US morning as the Nasdaq lost more than 2% and gold fell almost 10% from an overnight record. But while both of those markets managed significant rebounds in the afternoon — the Nasdaq closed down just 0.7% and gold reclaimed the $5,400 an ounce level — bitcoin and the rest of crypto held close to session lows. Bitcoin was trading just above $84,000 at press time. Losing nearly 6% in the past 24 hours, bitcoin is on the verge of falling below its two-month range, which could be the prelude to an even deeper pullback.

Other cryptocurrencies and related assets showed similar declines. Ethereum Solana XRP And were all down around 7% over the past 24 hours, while crypto exchange Coinbase (COIN), stablecoin issuer Circle (CRCL), and treasury firm Bitcoin Strategy (MSTR) suffered losses of 5-10%.

What’s next for Bitcoin

Matt Mena, crypto research strategist at 21Shares, said holding above the $84,000 support level is “critical” for bitcoin. If that fails, he said, the next target is $80,000, where buyers stepped in in November, and below that is the low of $75,000 reached during the April 2025 tariff crisis.

Still, current prices offer a “compelling entry point,” Mena said. He still expects bitcoin to reach $100,000 by the end of the first quarter, or even a new record high of $128,000 if macroeconomic conditions permit.

Other analysts have warned of a deeper pullback on the horizon.

John Glover, CIO of bitcoin lender Ledn, argued that today’s selloff is part of a broader correction in bitcoin from October’s record highs. The move could ultimately take BTC to $71,000, a 43% drop from the $126,000 level from early October.

With the United States a major source of uncertainty in today’s markets, Glover explained, investors are favoring alternative safe havens like gold and the Swiss franc over traditional safe assets like the U.S. dollar and Treasuries. While many expected bitcoin to act like “digital gold,” it is still treated as a risk asset and sold alongside stocks, he said.

Like Mena, Glover believes the current difficulties will not last. “I think this is a somewhat temporary situation and we will see a rebound in BTC prices over the next few quarters,” he concluded.

“The technical levels have all been suppressed to the downside, and I don’t see a lot of support for bitcoin here,” said Russell Thompson, chief investment officer of the Hilbert Group. He also thinks bitcoin could fall as low as $70,000. “The Clarity markup from the committee is bullish, but there is really only a general risk movement here.”