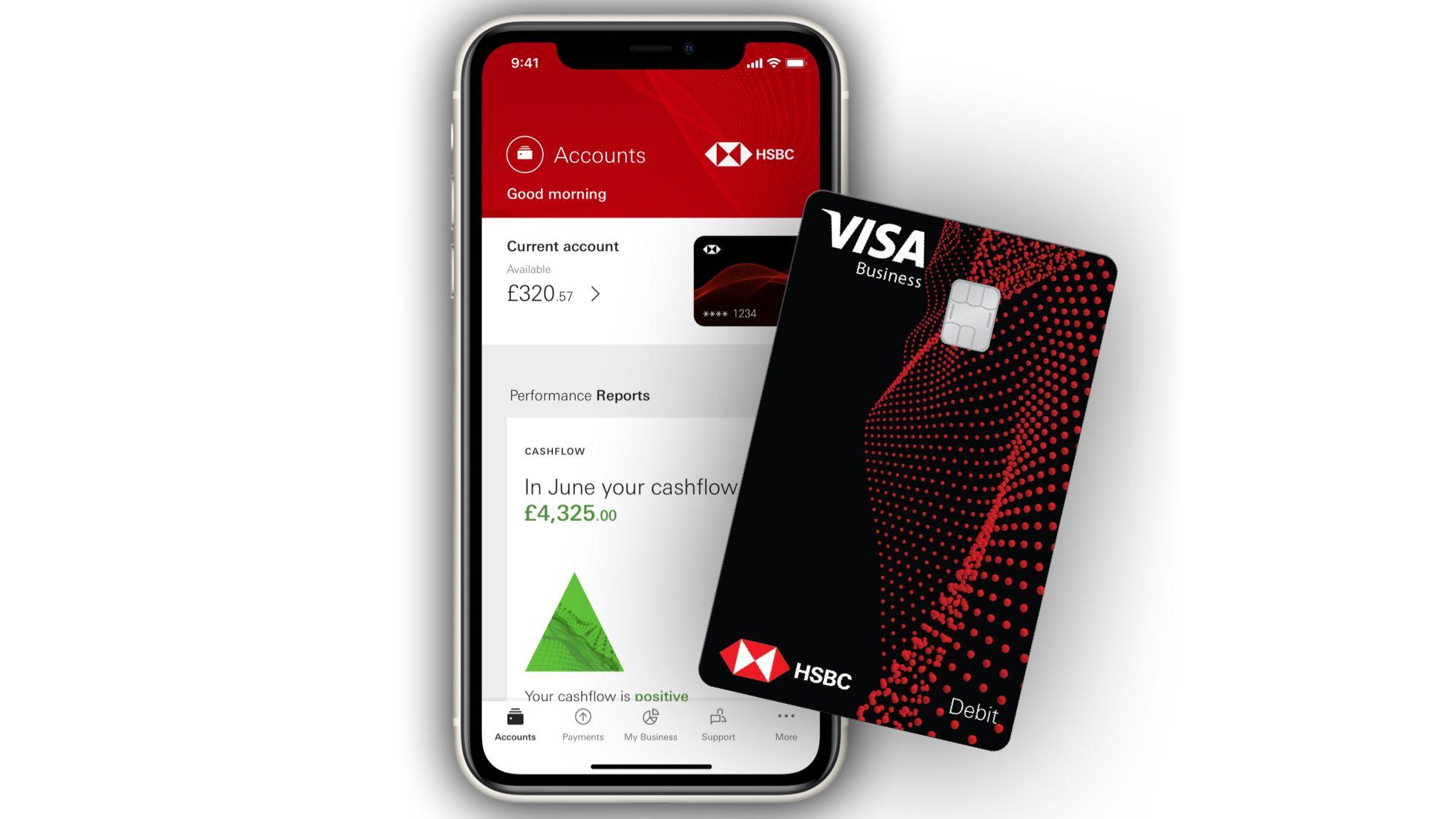

- Sage accounting tools will be integrated into the HSBC app in a new My Business Finances tool

- 70% of sole traders are not ready for the imminent BAT changes planned from April 2026

- Nearly one in three people still use pen and paper to track their finances.

HSBC is teaming up with accounting software provider Sage to help prepare sole traders for the looming requirements of Making Tax Digital (MTD), with 70% of them unprepared for the rule change.

As part of the partnership, Sage’s accounting tools will be integrated directly into the HSBC app to enable small business owners to manage their accounts and invoices, track their finances and submit their digital tax returns directly to HMRC.

Putting the tools in the hands of sole traders marks significant progress, with up to a third still tracking their income and expenses with pen and paper.

Sage will be integrated into the HMRC app for sole traders

Both companies have expressed their desire to tackle the complexity currently experienced by sole traders when it comes to digital finance, saying the integrated tools will save them time and help them stay compliant with the MTD rules.

“HSBC My Business Finances will take care of a business’s invoicing, accounting and tax compliance in one place,” said Tom Wood, HSBC’s head of SME banking in the UK. “This is particularly helpful as we approach the new tax reporting requirements in April.”

Accounting and tax software is already available with various third-party integrations to link tools, including live banking feeds that pull transactions directly into accounting dashboards, but HSBC wants to turn that around by integrating these accounting tools with its mobile banking app.

“With our integrated accounting technology, HSBC UK can deliver trusted accounting and tax in a unified experience,” added Gordon Stuart, senior vice president of Sage Fintech & Embedded Services.

My Business Finances within the HSBC app will first be available to sole traders and owners, they confirmed, implying that a wider rollout could potentially be considered for other types of businesses.

Although it is not yet available to everyone, HSBC and Sage promise to provide the tool “before” the rule changes in April 2026.

Follow TechRadar on Google News And add us as your favorite source to get our news, reviews and expert opinions in your feeds. Make sure to click the Follow button!

And of course you can too follow TechRadar on TikTok for news, reviews, unboxings in video form and receive regular updates from us on WhatsApp Also.