BitMine Immersion’s aggressive ether accumulation backfired sharply after the latest decline in crypto markets, leaving the company with over $6 billion in paper losses on its ETH holdings.

The publicly traded company added more than 40,000 ether last week, bringing its total balance to approximately 4.24 million ETH, according to portfolio tracking data from Dropstab.

Since then, prices have fallen sharply, driving the value of BitMine’s reserve to around $9.6 billion, down from nearly $14 billion at the high seen in October.

Ether slipped towards the $2,300 level on Saturday as selling accelerated for major tokens.

The timing of BitMine’s latest purchases has put renewed emphasis on its balance sheet strategy. Corporate crypto treasuries have become a prominent feature of the current cycle, but high exposure can amplify swings as markets turn and deals fade.

Losses also widened as forced selling spilled over into derivatives markets, adding downward momentum. Liquidations at major venues accelerated alongside ether’s decline, adding pressure on spot prices.

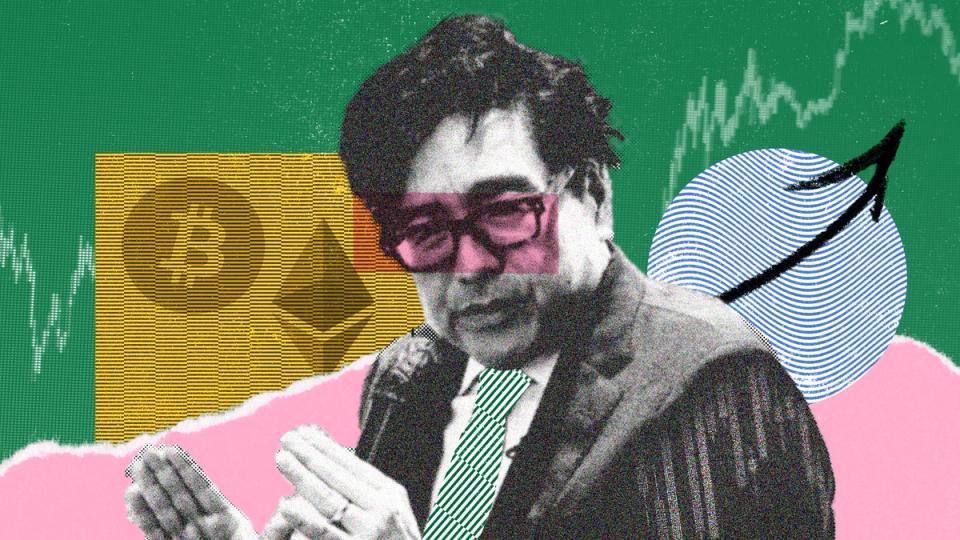

The company’s chairman, Tom Lee, recently took a more cautious tone in the near term.

While remaining constructive on the long term, he warned that the market was still deleveraging and the start of 2026 could be difficult before conditions stabilize.

In a recent interview, he highlighted October’s sharp sell-off — which wiped out about $19 billion in market value — as a breakup that reset positioning in crypto.

BitMine previously said a portion of its ether position was staked, estimating annual staking revenue at around $164 million. This income stream, however, fluctuates based on network returns and does little to compensate for sharp price fluctuations during rapid withdrawals.