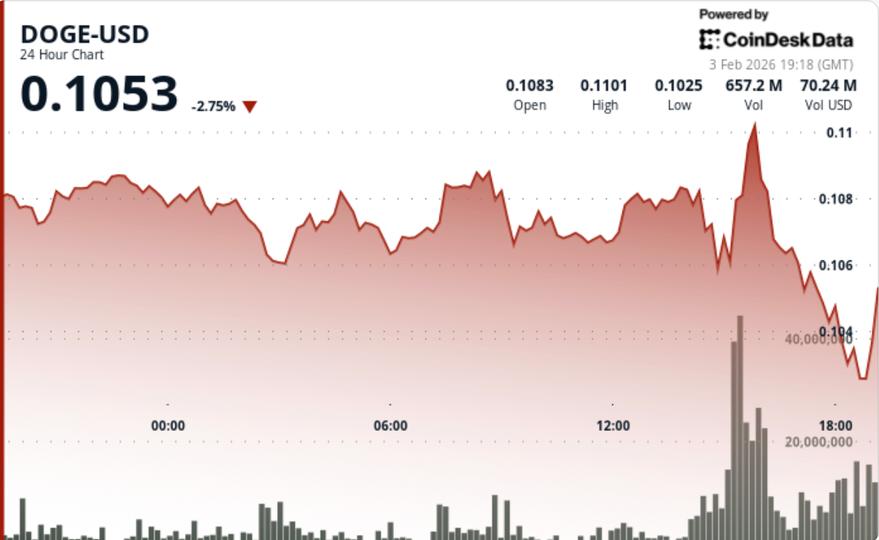

DOGE fell sharply as sellers pushed the price through several support levels, with a spike in derivatives activity signaling speculation rather than conviction buying.

News context

- Dogecoin fell alongside broader crypto weakness, acting as a high-beta proxy as ether slipped around 7% over the same period.

- This move was not driven by DOGE-specific news, but by risk-free positioning that weighed on speculative assets.

- Macroeconomic sentiment remained mixed, even as U.S. lawmakers narrowly passed a funding bill aimed at ending the partial government shutdown, eliminating some near-term uncertainty but doing little to improve risk appetite in crypto markets.

Price Action Summary

- DOGE fell 6.9%slippery $0.1085 to $0.1030

- Multiple support levels failed during the decline

- A strong volume spike nearby $0.110 scored a failed breakout and reversal

- The price stabilized at the end of the session near $0.103 to $0.104

Technical analysis

- DOGE strongly rejected near $0.110, where a high volume spike gave way to a quick reversal, turning this area into resistance. Selling accelerated once the price fell below $0.106, confirming a breakdown due to distribution rather than a brief liquidity sweep.

- The final hour saw capitulation-style selling in the $0.103 area, where bids finally emerged to slow the decline. While this suggests near-term stabilization, the structure remains bearish unless DOGE can reclaim lost support.

- A notable feature of the session was the disconnect between futures and spot: derivatives volume surged while spot trading declined, indicating speculative positioning rather than new demand.

What do traders think is next?

- Traders see $0.10 as the immediate line in the sand.

- If $0.10 holds, DOGE could consolidate as liquidation pressure fades – but bulls would need a recovery to $0.106, and ultimately $0.110, to affirm that the sell-off has run its course.

- If $0.10 breaks, downside risk opens towards $0.08, with momentum likely to accelerate given the recent failure of multiple support levels.

- For now, DOGE remains a high beta trade, with futures activity amplifying moves, but spot demand was needed to confirm any significant recovery.