Bitcoin is now around 20% lower than its estimated average production cost, increasing financial pressure in the BTC mining sector.

The average cost to mine one bitcoin is around $87,000, according to Checkonchain data, while the spot price has fallen to $70,000. Historically, trading below production costs has been a hallmark of a bear market.

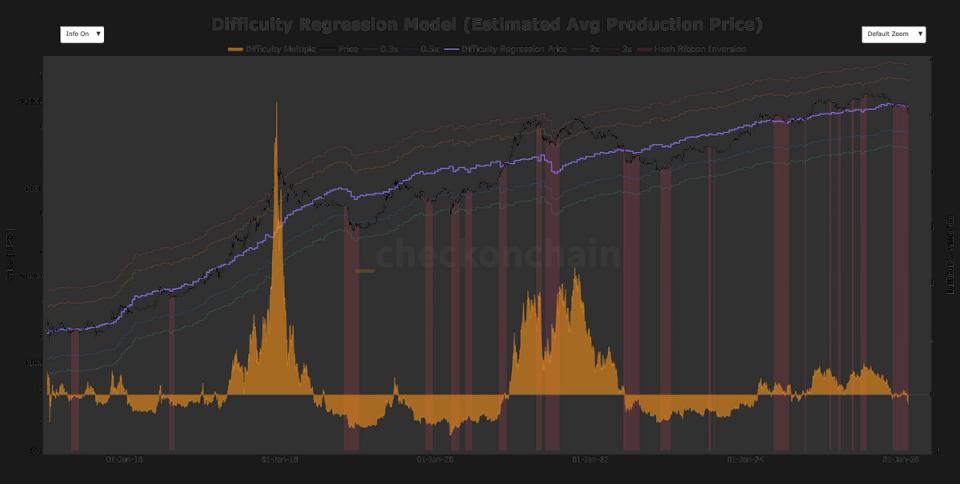

The production estimate uses network difficulty as an indicator of the industry’s all-inclusive cost structure. By tying difficulty to Bitcoin market capitalization, the model provides an estimate of average mining costs.

During previous bear markets, notably in 2019 and 2022, bitcoin traded below the cost of production before gradually returning towards the latter.

The hash rate, which measures the total computing power securing the Bitcoin network, peaked at nearly 1.1 zettahash (ZH/s) in October, subsequently declining by around 20% as the least efficient miners were forced offline. More recently, the hash rate has rebounded to 913 EH/s, suggesting some stabilization.

However, many miners are still unprofitable at current prices. With revenues below operating costs, miners continue to sell their bitcoin holdings to fund daily operations, cover energy expenses, and pay down debt. This current capitulation of miners highlights ongoing tensions in the sector.