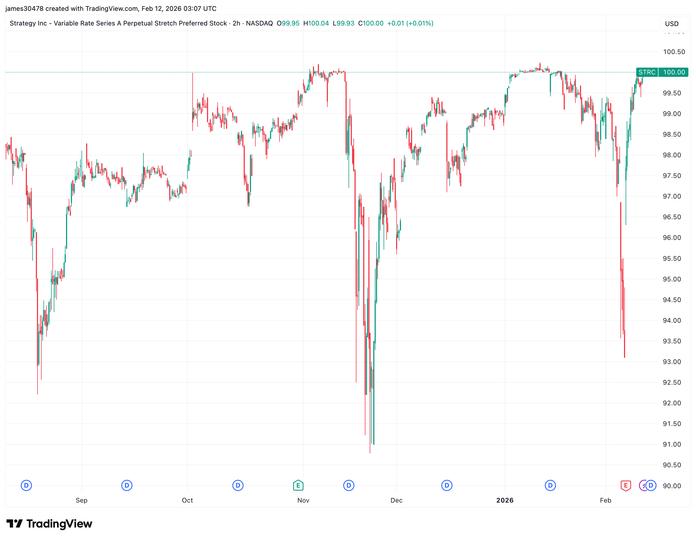

Stretch (STRC), the perpetual preferred stock issued by Strategy (MSTR), the world’s largest Bitcoin holding company, reclaimed its par value of $100 during Wednesday’s US session for the first time since mid-January.

Trading STRC at or above par allows the company to resume on-the-market (ATM) offerings to fund further Bitcoin acquisitions. STRC last hit the $100 level on January 16, when bitcoin was hovering near $97,000; However, while the largest cryptocurrency by market capitalization fell to $60,000 on February 5, STRC dropped to as low as $93 before its recent rebound.

Positioned as a short-duration, high-yielding credit instrument, STRC currently offers an annual dividend of 11.25% distributed monthly. To mitigate volatility and encourage near-par trading, Strategy resets this rate monthly, most recently increasing it to the current yield of 11.25%.

MSTR common stock has faced pressure, sliding 5% on Wednesday to close at $126, while bitcoin hovers around $67,500.