Pakistan didn’t wake up one morning and decide it liked crypto, the chairman of the country’s Virtual Assets Regulatory Authority (PVARA) has said.

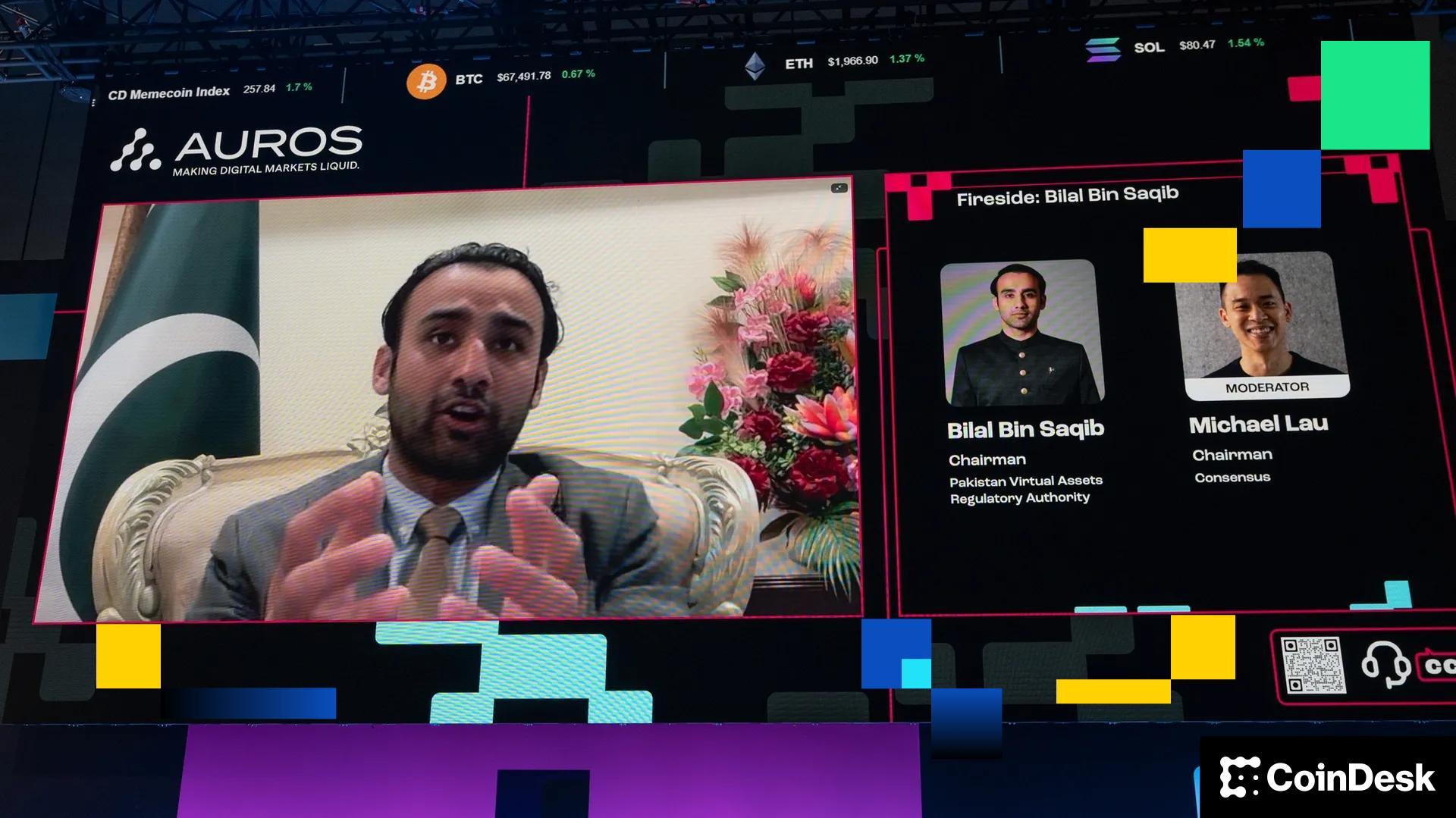

The country was in the unusual position of having one of the largest crypto markets on the planet, but no safeguards at all, PVARA Chairman Bilal Bin Saqib told Consensus Hong Kong 2026 on Thursday.

“In 2025, Pakistan realized that around 40 million of its citizens are already trading digital assets without any rules, protections and profits accruing to the state,” Bin Saqib said via a virtual link. “The market existed, but the regulation didn’t. So basically we tried to move from a gray market to a governed market.”

In fact, Pakistan has the third largest crypto market in terms of retail activity, ahead of countries like Germany and Japan, Bin Saqib said. Indeed, Pakistan is not only an emerging economy, it is also a young country in demographic terms. Around 70% of the 250 million inhabitants are under 30 years old.

“We are one of the most tech-savvy youth populations on the planet,” said the PVARA president. “We have over 100 million unbanked citizens, people who have no savings tools, no investment tools, no way to get out of their economic class. That’s why crypto and blockchain is not a luxury for Pakistan. It’s a scale for the masses.”

Pakistan Strategic Bitcoin Reserve and National Mining Plans

One area of interest for the crypto industry was Bin Saqib’s announcement last year at Bitcoin Las Vegas that Pakistan planned to establish a strategic Bitcoin BTC reserve of $68,087.00 and support Bitcoin mining.

Bin Saqib emphasized that this was not just an “announcement,” but added that “when it comes to something as strategic as the Bitcoin reserve or national energy allocation, speed without structure can be dangerous.”

Regarding the reserve, “the first step is to identify state-owned digital assets, placing them in a formal state-controlled custody framework, which establishes transparency, accountability and standards. This is not about speculation, but about treating digital assets as sovereign wealth,” Bin Saqib said.

On the mining side, he said: “We have identified sites where we have surplus electricity, and now we are assessing the economics and impacts, and at the same time we are also engaging with global miners and AI compute operators. »

The project is about following a “responsible partnership model,” Bin Saqib said, because it is not just a standalone crypto experiment.

“This is part of a broader strategy around energy optimization, computing capacity and our national digital infrastructure. Because Bitcoin mining and AI data centers are the two mechanisms to convert unused energy into production capacity for our country.”