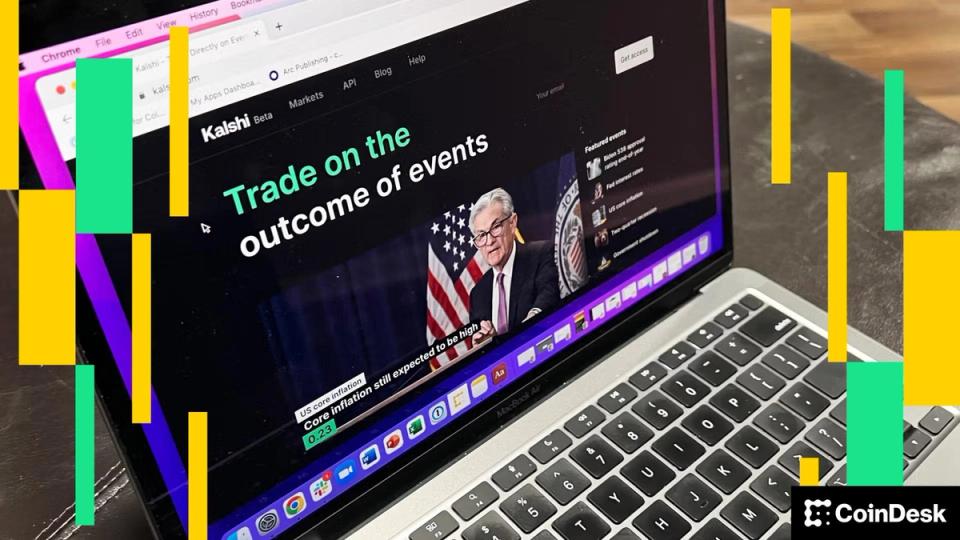

A research paper from the US Federal Reserve praised the usefulness of prediction markets – particularly as it relates to Kalshi – for gaining real-time insight into economic policy.

“Kalshi’s forecast for the federal funds rate and [the U.S. Consumer Price Index] provide statistically significant improvements over federal funds futures and professional forecasters, while providing continuously updated comprehensive distributions rather than infrequent point estimates,” according to the document released Thursday.

And the markets, where retail investors can buy contracts on virtually any yes or no issue in areas as diverse as economics, politics and sports, examine topics live in a way that other news sources do not.

Prediction markets “provide unique information, especially for variables such as [gross domestic product] growth, core inflation, unemployment and payroll, for which there is currently no other market-based distribution.

And in this study, Kalshi’s predictions “matched perfectly with the federal funds rate achieved on the day of every meeting since 2022, a feat that neither surveys nor futures have managed to achieve.”

Part of the secret that distinguishes prediction markets as a useful tool might be the inclusion of retail participants, making them “distinct from institutionally dominated markets,” the paper notes.