XRP held steady near $1.42 as volatility fell to levels not seen before a major 2024 rally, raising questions about whether the downtrend is exhausting.

News context

- XRP has fallen approximately 61% from its all-time high during the current period of market turmoil, but recent price action suggests the sell-off may be slowing. Losses have eased in favor of consolidation, with small gains over shorter periods replacing sharp directional moves.

- Notably, XRP’s historical volatility has fallen to 96, matching levels last seen in June 2024 – a period that marked the bottom of an earlier downtrend before a rally in November.

- The squeeze has fueled speculation that XRP may be entering a similar base-building phase.

- Some analysts point to parallels with the structures of previous cycles, including the prolonged consolidation that preceded the 2017 breakout.

Price Action Summary

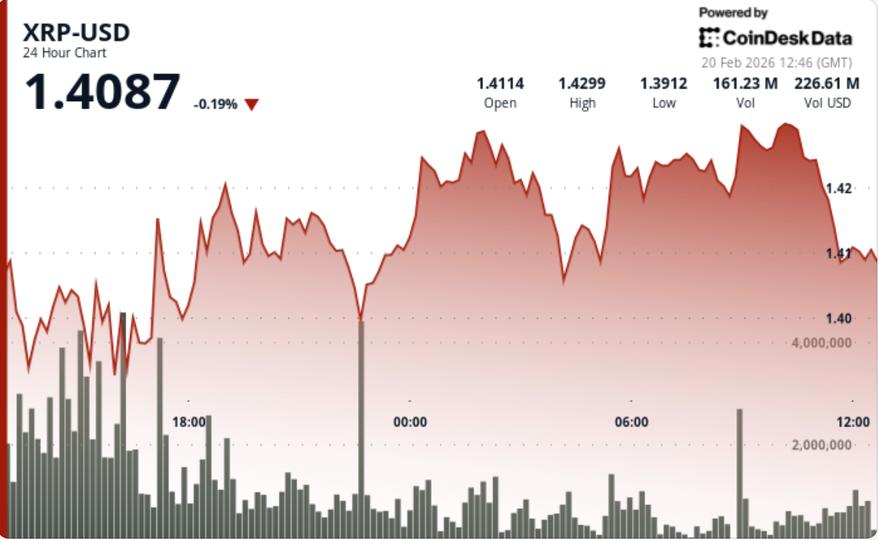

- XRP slipped 0.14% to $1.42

- Price tested and held support near $1.39

- Volume jumped nearly 94% above average during the outage

- Recovery stalled near resistance at $1.428 to $1.431

Technical analysis

- The key moment of the session came when XRP tested $1.3915 on heavy volume before stabilizing. As the rebound completed a 38.2% retracement, momentum faded as the price approached $1.44, the daily pivot and near-term high.

- The structure remains cautious below $1.44 to $1.45, but the successful defense of $1.39 suggests sellers are losing their urgency. Decreasing volume during consolidation indicates compression rather than new distribution.

What do traders think is next?

- Traders view this as a squeeze setup.

- If XRP recovers $1.44, it opens the way to $1.50 and potentially $1.62.

If $1.39 breaks, the downside risk shifts towards $1.35. - With volatility near previous cycle lows, the next decisive move could be less a question of current direction – and more a question of how long this squeeze can last before expansion resumes.