Bitcoin (BTC) remained stable during Asian hours on Friday after the Bank of Japan (BOJ) raised the benchmark borrowing cost to the highest in 17 years while raising inflation forecasts.

“If the outlook presented in the January Outlook Report is realized, the Bank will accordingly continue to increase its policy interest rate and adjust the degree of monetary easing,” the statement said, citing a positive outlook on salaries and now its directions to continue to increase. rate, according to ForexLive.

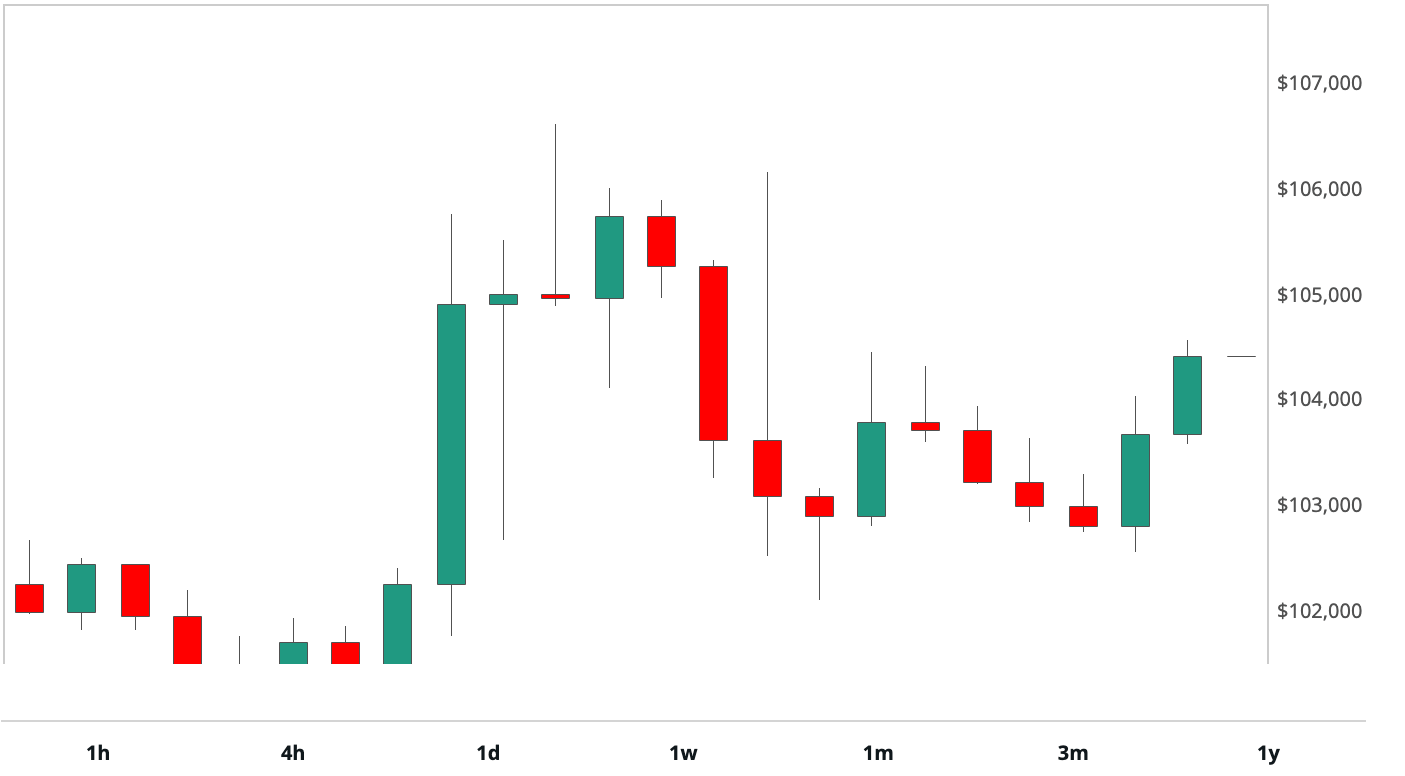

The risk-off Japanese yen rose more than 0.6% to 155.12 against the U.S. dollar following the rate decision. Risky assets nevertheless remained resilient. Bitcoin showed no signs of stress and traded little above $104,000 during the day. Futures contracts linked to the S&P 500 also traded flat.

This resilience of risk assets suggests that market attention is increasingly focused on potential political developments under Donald Trump’s presidency. In comparison, the Bank of Japan’s rate hike at the end of July had already shaken risky assets, notably cryptocurrencies.

On Thursday, President Trump signed an executive order banning the digital dollar and promoting crypto and AI innovation in the United States. Meanwhile, recently released U.S. data showed that the “all tenant rent” index, which leads CPI housing inflation, grew at a slower pace. last quarter. This has raised hopes that the Fed will reverse its hawkish rate forecast from December.