Some $7.8 billion worth of Bitcoin (BTC) options expire at the end of the month, and with the largest cryptocurrency exchange well above the so-called maximum pain point, it’s possible that next few days.

Data from Deribit, the largest decentralized options exchange, shows up to $6 billion in notional value to expire cash, or worthless, when contracts end on January 31 at 08:00 UTC. 50% of these are put options, which give holders the right, but not the obligation, to sell BTC at a predetermined price within a specific time frame.

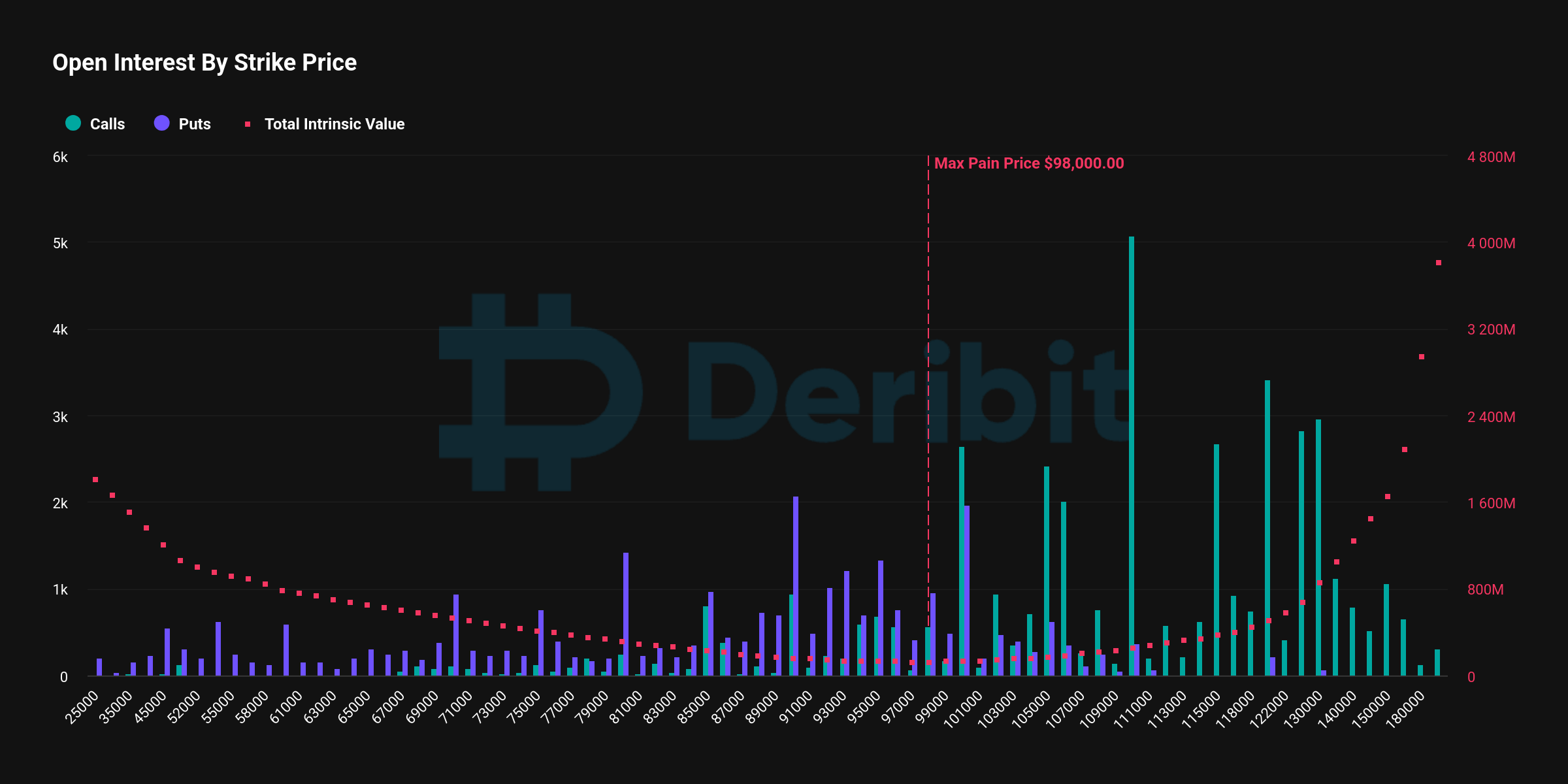

“The maximum pain level for this expiration stands at $98,000, with significant market momentum expected to influence near-term price movements,” Deribit CEO Deribit told Coindesk. “The recent termination of SAB 121 allows banks to hold bitcoin, which has potentially unlocked new institutional flows while speculation on a strategic Bitcoin reserve announcement adds an additional layer of market anticipation.”

The pose holders were most likely either a hedge against downside risk or a bearish decline with the uncertainty surrounding President Donald Trump’s inauguration.

The maximum pain price is where option buyers suffer the highest losses, while market makers, the other side of the trade, profit the most. Prices often tend to gravitate towards the maximum pain price as expiration approaches, meaning $98,000 is the key level to watch in the week ahead.

“Next week BTC Options Expire represents a notable event as approximately 74,000 contracts expire. Total BTC Options Notional Open Interest is now at $28 billion, of which $7.8 billion is expected to expire, with approximately 22 .6% of the money (ITM), potentially triggering Delta hedging flows into the market.

DVOL is the deribit index for tracking Bitcoin implied volatility (IV). Coindesk Research noted that IV reached the highest level on January 20 since August due to bitcoin breaking to new all-time highs.