Bitcoin (BTC) has fallen below $98,000, a drawdown of nearly 10% from all-time highs, as investors question whether the Bull Run will continue.

The drop has been attributed to concerns about China’s hyper-efficient deep artificial intelligence model competing with U.S. industry at a fraction of the cost.

Since President Trump won the US elections, Bitcoin has surged from $66,000 to new highs of $109,000. During the rally, BTC corrected by up to 15% twice, in addition to several double-digit draws. Therefore, Bitcoin’s 10% drop appears consistent with previous drawdowns.

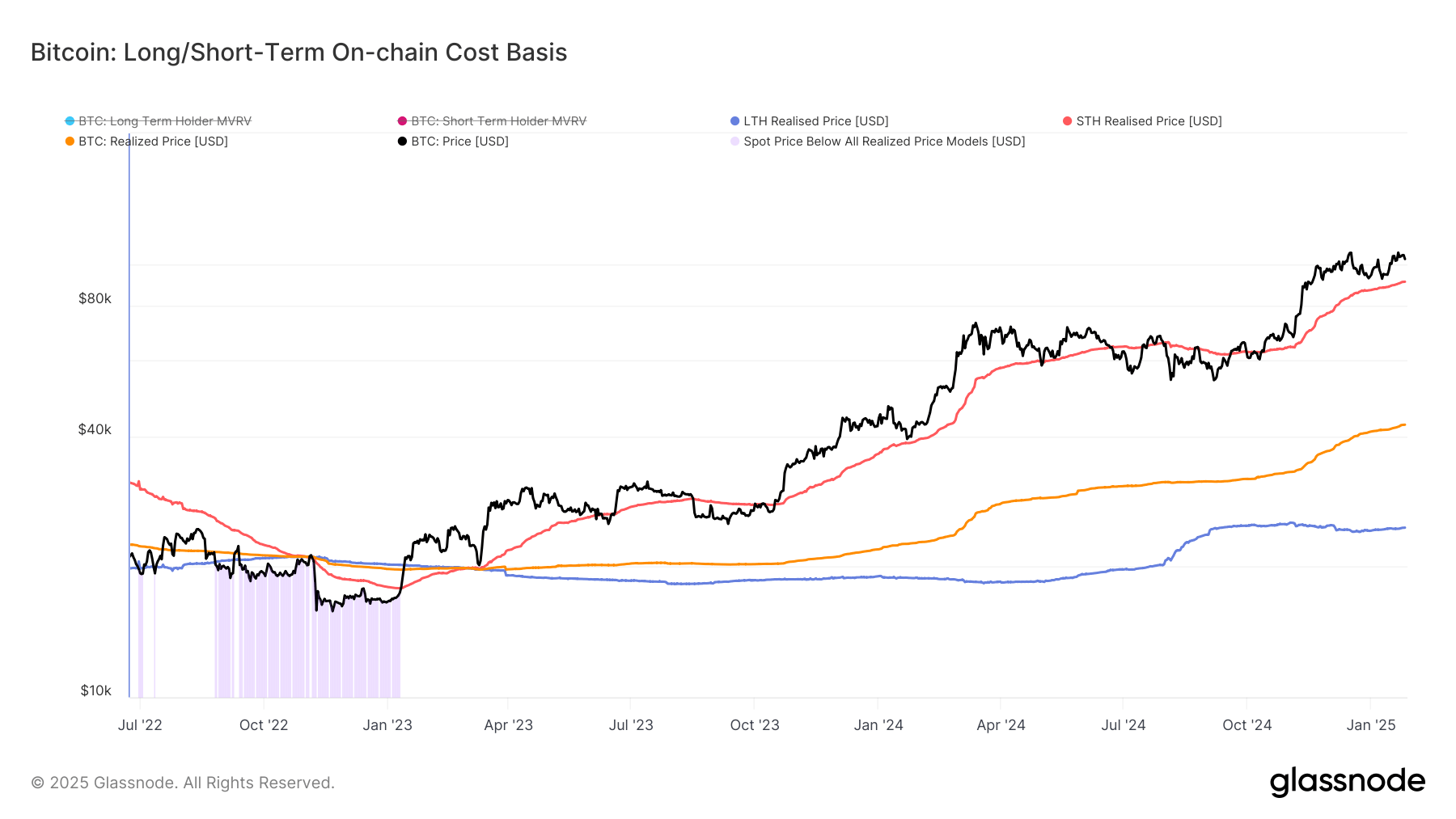

A reliable indicator of support during a bull market is the short-term holder cost basis, which is the average on-chain cost for coins that have moved in the last 155 days. This level is around $91,000 at the moment, meaning if BTC falls below this point it could put pressure on the bull run.

But bearish sentiment is already starting to heat up, as Bitcoin funding rates have started to turn negative. Arthur Hayes, co-founder of Bitmex, is also calling for a correction between $70,000 and $75,000, before seeing $250,000. Omkar Godbole of Coindesk also reported that Bitcoin could fall to $75,000 if it triggers a bearish “double top” reversal pattern.

The withdrawal was not contained to crypto; US markets are selling off, with NASDAQ futures up 4%.