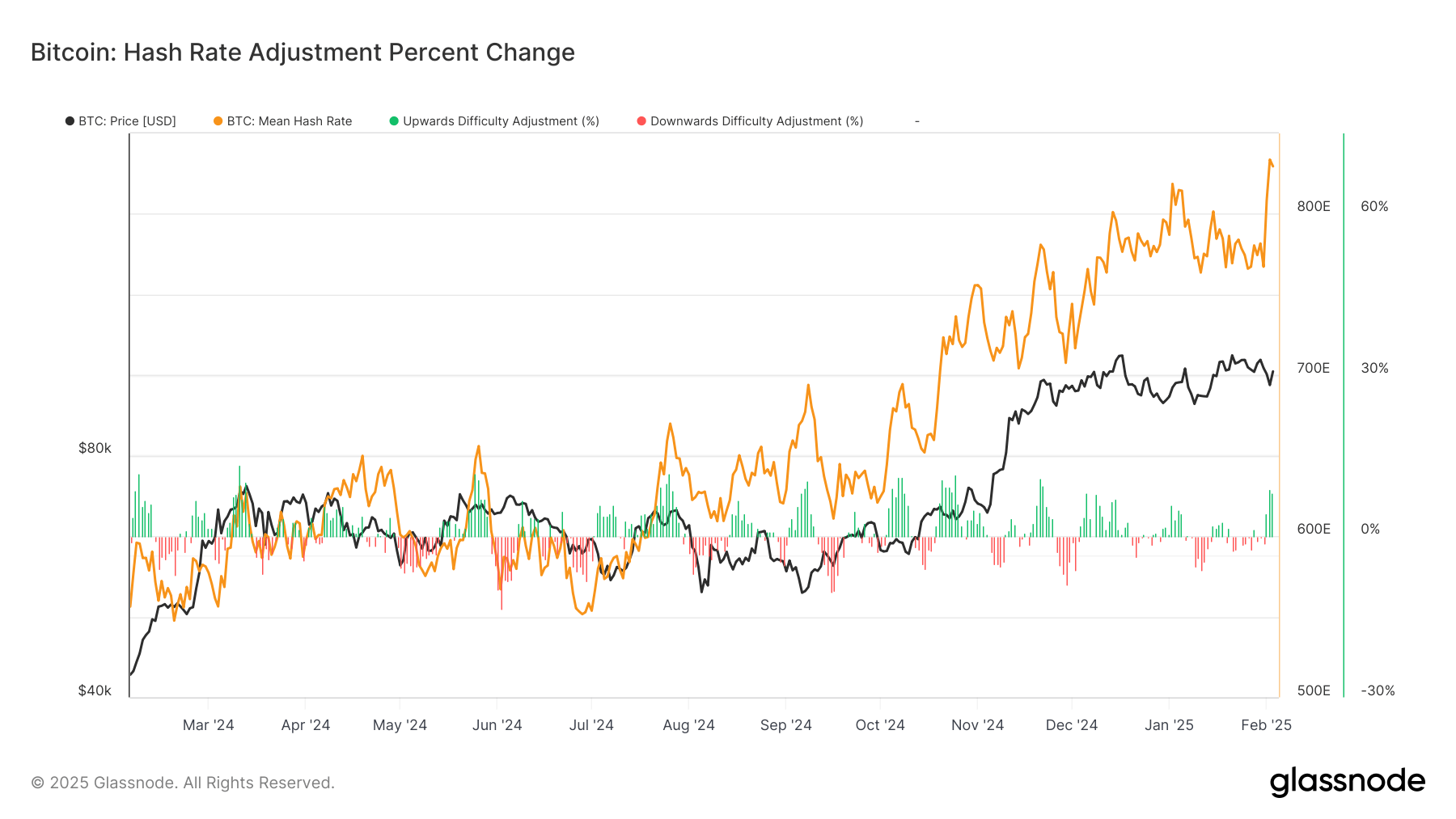

The Bitcoin hashrate (BTC) has reached another top of all time, with a mobile average at seven days jumping at 833 exams per second (EH / S), according to Glassnode data. This represents an increase of 9% compared to 767 EH / S in the past few days.

According to Miner Mag, pre-orders for mining equipment began to decline after the pre-reward overvoltage. Many mining companies had full of equipment in anticipation of this event, ensuring that their operations have remained competitive; However, analysts are now expecting a slowdown in the growth of the hashrate.

Hashrate measures the computing power used to secure the Bitcoin network via mining, and a higher hashrate means greater network security.

According to Miner Mag, the network has experienced a significant increase in hash in the last 18 months, largely by institutional investments in mining infrastructure.

The push was ahead of the reduction of half of the bitcoin in April 2024, which occurred approximately every four years and reduced the block reward by 50%. Since the reduction in half, the hashrate has increased by more than 40%, indicating continuous expansion of mining operations.

The increase in hashrate has coincided with the mining profitability remaining relatively stable in recent months. One of the main reasons for this is historically low transaction costs, which have reduced minors’ income.

In Bitcoin Mempool, a high priority transaction costs only 5 SAT / VB ($ 0.69) – one of the lowest costs of costs in recent years. With fewer transactions generating costs, minors gain less transaction costs, which makes it more difficult to compensate operational costs.

The long -term economic model of the Bitcoin network is based on transaction costs which gradually replace the block grant as the main source of minors’ income, but the current market dynamics pose challenges to this model.

For the future, the next difficulty adjustment is planned in four days and should increase by more than 6%, bringing it to a record level and exerts additional pressure on minors.

Non-liability clause: Certain parts of this article have been generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.