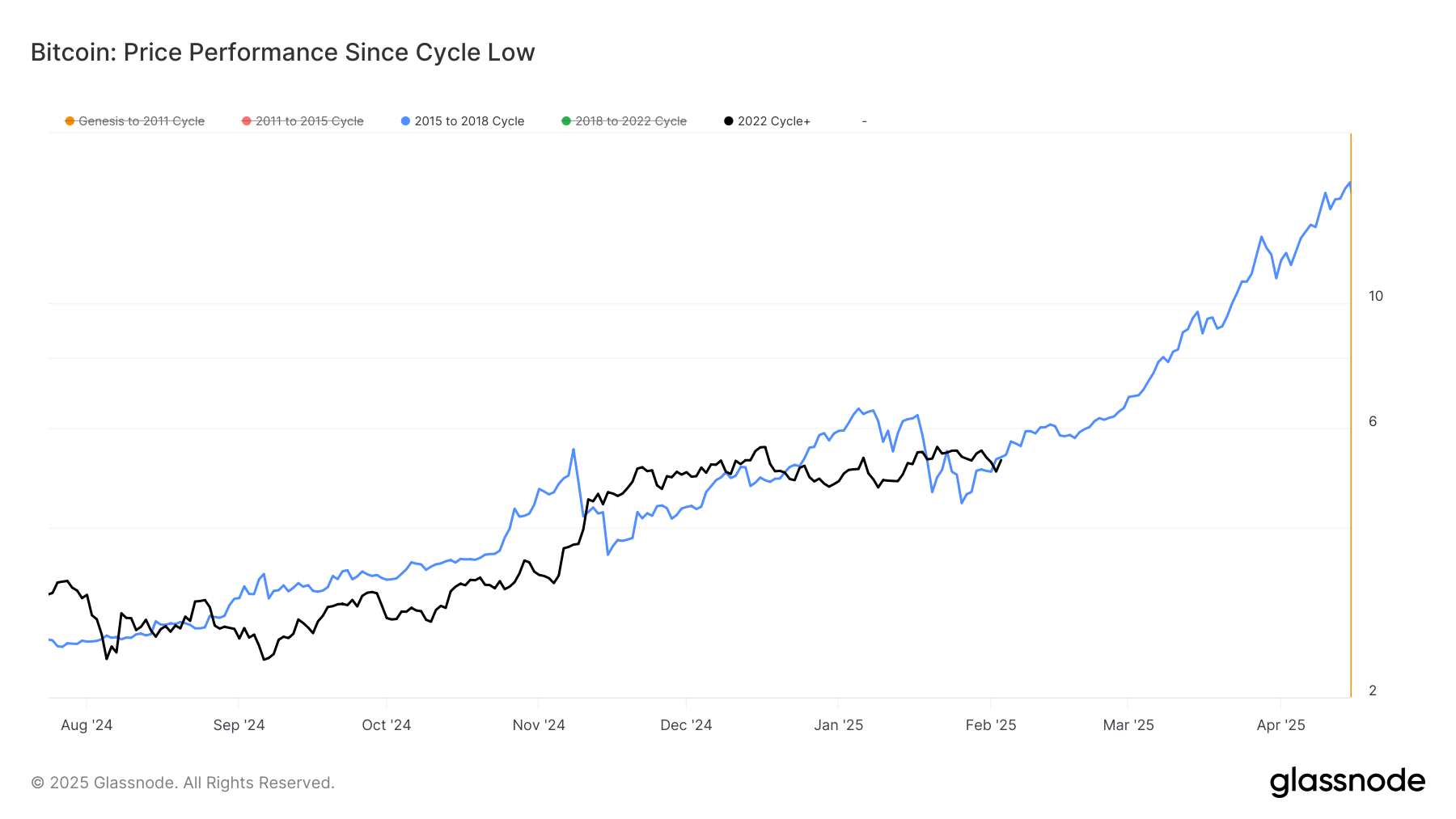

Bitcoin (BTC) continues to follow the trajectory of its 2017 cycle. Despite the recent market turbulence, motivated by climbing tariff tensions between the United States and its neighboring countries, as well as China.

Bitcoin rises approximately 525% of its low cycle during the collapse of the FTX in November 2022. Compared, at the same stage in the 2017 cycle, Bitcoin had increased by 533%.

While another method to assess Bitcoin cyclic behavior is to measure the yields of the summits of all previous time. The peak of the last cycle market occurred in April 2021 at around $ 64,000, although in nominal terms, the summit of all Bitcoin time was $ 69,000 in November 2021.

However, many chain indicators suggest that ARIL 2021 has marked the real top of the cycle. Despite the ongoing geopolitical tensions, Bitcoin has demonstrated remarkable consistency in monitoring previous cycles.

In addition, Bitcoin (BTC) remained linked to the beach in a channel of $ 90,000 to $ 109,000 in the last 2.5 months, or even in the mid -market of the market. Bitcoin continues to test the upper and lower limits of its current trading channel.

Meanwhile, the previous research of Coindesk identified $ 91,000 as a local background for Bitcoin.