International Finance Corporation (IFC), the World Bank’s private investment branch increases equity investments and focuses on the financing of large -scale infrastructure in Pakistan.

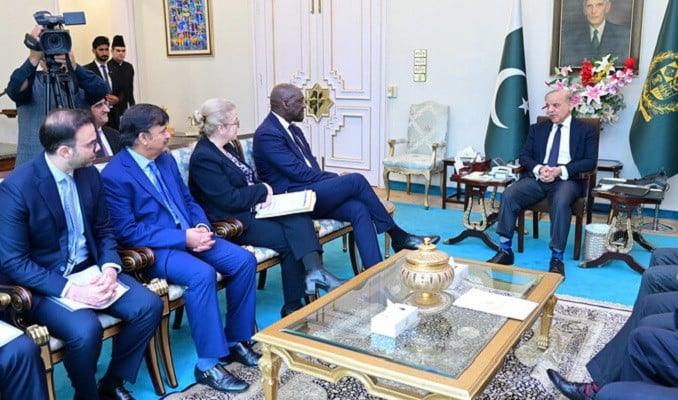

According to the IFC chief, Makhtar Diop, the investment plan could unlock up to $ 2 billion per year in the next decade. Diop’s visit to Pakistan follows the announcement by the World Bank of a national partnership manager of $ 20 billion for the country, the CFI corresponding to this allowance.

Diop stressed that the annual investment of $ 2 billion is not significant for Pakistan, which requires extensive development of infrastructure in sectors such as energy, water, ports and international airports.

He expressed his confidence that in a few months, progress on key projects will bring Pakistan’s desire to receive large -scale funding for critical infrastructure.

Pakistan, currently less than a rescue program of $ 7 billion in the International Monetary Fund (IMF), is sailing a difficult economic recovery. The country narrowly avoided a defect in sovereign debt, its insufficient reserves to cover even a month of imports.

IFC exposure to Pakistan reached a record of $ 2.1 billion for the year 2024. DIOP highlighted the interest of IFC in sectors such as agriculture, infrastructure, finance and digital industries in Pakistan.

In addition, DIOP noted that actions -based transactions will play a more important role in the development of the country, because IFC increases its investments in equity worldwide, including in Pakistan.