By Francisco Rodrigues (at any time and unless otherwise indicated)

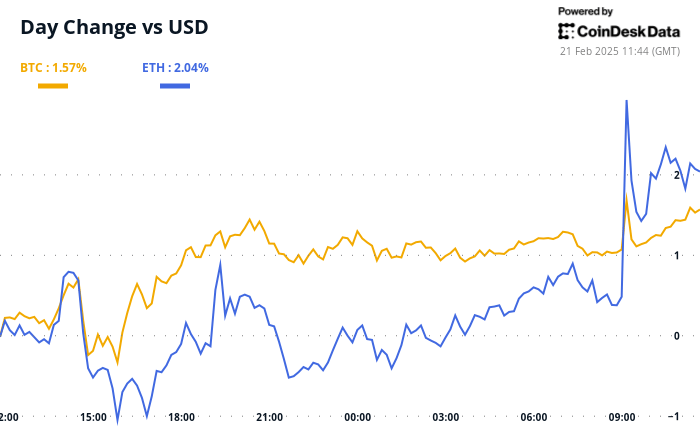

The prices of cryptocurrencies increase after the former unit of application of the cryptography of the Securities and Exchange Commission of the United States has passed to the unit of Cyber and emerging technologies and in the midst of the dominant comments of the president of The Fed of Atlanta, Raphael Bostic.

It is important to rename cryptographic assets and cyber

“Above in the medium term, clearer regulations will probably strengthen institutional participation, leading to improvements in market infrastructure,” the founder and CEO of Backpack, Armani Ferrant. Bitcoin is now more than $ 98,000 after adding 1.2% in 24 hours, while the larger Coindesk 20 index increased by 1.35%.

However, volatility is still relatively low. “These environments can be slow and frustrating, but they rarely persist for a long time – volatility tends to signify return,” said Wintermute OTC trader, Jake O.

With tensions between the United States and its growing European allies, investors hope that the German elections will lead to a stable coalition government on Sunday that will excite economic reforms to stimulate growth and stimulate defense expenditure. Germany is the largest economy in Europe and a positive result could lead to a more at risk approach.

Open interest has already evolved before the elections. However, the cryptography market lacks short -term positive catalysts, JPMorgan analysts led by Nikolaos Panigirtrzoglou wrote in a report.

In fact, the market is approaching arrears – where cash prices exceed the long -term prices – in “negative development” which is “indicative of the low demand” by institutional investors using regulated CME contracts to obtain Exhibition at the market. Stay vigilant!

What to look at

- Crypto:

- Macro

- February 21, 9:45 a.m.: S&P Global Order (Flash) ‘S Purchase Managers’ Index (Flash) Reports.

- PMI composite PMI Prev. 52.7

- PMI manufacturing is. 51.5 against prev. 51.2

- PMI services is. 53 against prev. 52.9

- February 24, 5:00 am: Eurostat publishes data on the inflation of consumers in the euro zone for January.

- YOY central inflation rate is. 2.7% against Plan. 2.7%

- Yoy inflation rate is. 2.5% against Plan. 2.4%

- February 21, 9:45 a.m.: S&P Global Order (Flash) ‘S Purchase Managers’ Index (Flash) Reports.

- Gains

- February 24: Riot platforms (Riot), post-marketing, -0.18 $

- February 25: Bitdeer Technologies Group (BTDR), pre -commercialization, -0.17 $

- February 25: Cipher Mining (CIFF), pre -market, -0.09 $

- February 26: Mara Holdings (Mara), post -marchand, -0.13 $

Token events

- Governance votes and calls

- Unlocking

- February 21: Fast Token (FTN) to unlock 4.66% of the supply in circulation worth $ 78.6 million.

- February 28: Optimism (OP) to unlock 1.92% of the supply in circulation worth $ 34.23 million.

- March 1: SU (SUI) to unlock 0.74% of the supply in circulation worth 81.07 million dollars.

Conferences:

Coindesk consensus to take place in Toronto from May 14 to 16. Use the code’s day book and save 15% on passes.

Talk about tokens

By Oliver Knight

- With a sloppy launch of the Argentinian president Javier Milei and a token offered by the Nazi self -proclaimed Kanye West, now known as Ye, this week at the same time was to be forgotten.

- The partner of Castle Island Ventures, Nic Carter, said that the craze is “undoubtedly finished”, a view that could be cemented by a report revealing that West is plans to present Yzy Token – and will hold 70% of the offer.

- The rest of the cryptography market remains relatively not disrupted by the potential disappearance of the sector: ETH and LTC are up 3% this week, while TRX increased by 7.7% because liquidity seems to turn from of speculative tokens to more useful projects.

- Friday, near the 11% pack at the top of 11% after announcing the AI agents “first really independent”. Agents will be able to own, exchange and manage independently and manage chain assets.

Positioning of derivatives

- The open interests of the BTC on centralized exchanges increased by almost 5% to 37.3 billion dollars in the last 24 hours. This, associated with the inversion of the financing of the positive to the negative, suggests a short potential compression scenario. Short liquidations dominated the markets over this period, exceeding a total of $ 110 million, compared to $ 6.11 million long.

- Among the assets with more than $ 100 million in open interests, the manufacturer DAO, Virtuals Protcol and Artificial Super Intelligence experienced the highest increase in one day, increasing 39.2%, 35.5% respectively and 28.00%.

- Among the options of options, the BTC call option with an exercise price of $ 99,000 and the expiration of February 22 exchanged with the most volume on the drunkenness. The next instrument of the most popular options is the BTC call with an exercise price of $ 108,000, expiring on February 28. The action suggests the short -term optimistic feeling on the market in the last two days.

Market movements:

- BTC increased by 0.28% compared to 4 p.m. HE Thursday to $ 98,632.42 (24 hours: + 1.35%)

- ETH is up 2.09% to $ 2,800.02 (24 hours: + 2.15%)

- Coindesk 20 is up 0.92% to 3,298.29 (24 hours: + 1.49%)

- The CESR ether composite pace is unchanged at 2.99%

- The BTC financing rate is 0.0010% (1.0961% annualized) on Binance

- Dxy is up 0.29% to 106.68

- Gold is down 0.31% to $ 2,929.76 / Oz

- The money is down 0.12% to $ 32.91 / Oz

- Nikkei 225 closed + 0.26% to 38,776.94

- Hang Seng closed + 3.99% to 23,477.92

- FTSE is up 0.20% to 8,680.19

- Euro Stoxx 50 is up 0.18% to 5,471.08

- Djia closed Thursday down -1.01% to 44,176.65

- S&P 500 closed -0.43% to 6,117.52

- Nasdaq closed -0.47% to 19,962.36

- The S&P / TSX composite index closed -0.44% to 25,514.08

- S&P 40 Latin America closed + 0.76% to 2,480.21

- The 5 -year American treasure rate fell from 2 BPS to 4.49%

- E-Mini S&P 500 The future are unchanged at 6,138.25

- The term contracts on the NASDAQ-100 E-Mini increased by 0.13% to 22,170.75

- E-Mini Dow Jones Industrial Index Futures index increased by 0.10% to 44,309

Bitcoin statistics:

- BTC dominance: 61.02 (-0.35%)

- Ethereum / Bitcoin ratio: 0.02842 (2.01%)

- Hashrate (Mobile average at seven days): 807 EH / S

- Hashprice (spot): $ 54.92

- Total costs: 5.34 BTC / 526 892 $

- CME Futures open interest: 178,500 BTC

- BTC at the price of gold: 33.4 oz

- BTC vs Gold Bourse Capt: 9.49%

Technical analysis

- Tao became one of the most efficient assets during last week, fed by the launch of the upgrading of DynamicTao. This momentum propelled the price above all the key exponential displacements on the daily time, signaling a renewed force.

- Adding to the bullish feeling, the price of the prices has formed a model of the opposite head and shoulder.

- The recent TAO list on Coinbase has provided an additional catalyst, which has increased by almost 20% to a summit of $ 495 from the initial ad.

Cryptographic actions

- Microstrategy (MSTR): closed Thursday at $ 323.92 (+ 1.65%), up 0.37% to $ 324.85 in pre-commercialization

- Coinbase Global (corner): closed at $ 256.59 (-0.80%), up 0.86% to $ 258.80

- Galaxy Digital Holdings (GLXX): closed at $ 25.65 C (+ 1.30%)

- Mara Holdings (Mara): closed at $ 15.95 (+ 1.08%), up 0.38% to $ 16.01

- Riot Platform (Riot): closed at $ 11.60 (+ 0.35%), up 0.52% to $ 11.66

- Core Scientific (CORZ): closed at $ 11.84 (-1.50%), up 0.51% to $ 11.90

- Cleanspark (CLSK): closed at $ 10.06 (+ 1.72%), up 0.80% to $ 10.14

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): closed at $ 22.49 (-1.27%), down 0.31% to $ 22.42

- Semler Scientific (SMLR): closed at $ 52.24 (+ 0.04%), unchanged

- Exodus movement (Exodus): closed at $ 47.80 (-1.26%), down 2.72% to $ 46.50

ETF Flows

BTC ETFS spot:

- Daily net flow: – 364.8 million dollars

- Cumulative net flows: $ 39.63 billion

- Total BTC Holdings ~ 1.169 million.

ETH ETFF SPOT

- Daily net flow: – $ 13.1 million

- Cumulative net flows: $ 3.16 billion

- Total ETH Holdings ~ 3.807 million.

Source: Wacky investors

Nightflow

Graphic of the day

- The action of Bitcoin prices sparked short liquidations totaling $ 97.9 million in $ 98,890, according to Coinglass. The following key resistance levels, based on the thermal liquidation card, are $ 99,185 and $ 99,332, where liquidations worth $ 65.2 million and $ 67.9 million, respectively, are grouped.

- Upon decrease, large long liquidations are positioned at $ 97,415 and $ 97,194, or $ 69.3 million and $ 70.7 million, respectively. These key levels highlight the potential areas of volatility as Bitcoin sails in its current price range.

While you slept

- Crypto Market Faces Weak Dequest, Needs Trump Initiatives To Kick in, Jpmorgan Says (Coindesk): Jpmorgan Said Cme Futures Data Reveals Weak Institutional Interest in crypto, with any pro-Crypto Initiatives from the Trump Administration UNLIKELY TO EMERGE UNTIL The Second Half of the year.

- South African Firm to Amass Bitcoin Hoard in First For Continent (Bloomberg): Altvest Capital adopted Bitcoin to be a cash reserve. He bought a BTC and plans to sell a shares of $ 10 million to extend his digital assets.

- Bloc actions are on the benefit, returned Miss (CNBC): During his profit to benefit from the fourth quarter 2024, the leaders of Block (XYZ) commented Proto, their Bitcoin extraction initiative. Financial director Amrita Ahuja said the project should stimulate growth in the second period.

- Japan gives falls like Ueda warns that Boj can intervene for Spix Market (Bloomberg): the governor of the Bank of Japan, Kazuo Ueda, has promised to buy government obligations if the long -term yields have been picked. Earlier, yields at 10 years reached 1.455% – the most since 2009.

- Retail sales in the United Kingdom are increasing for the first time in five months (the Wall Street Journal): in January, retail expenses in the United Kingdom increased by 1.7% compared to December, led by An increase of 5.6% of sales of food stores because more and more people ate at home.

- The new Microsoft chip shortens the calendar to make bitcoin quantum -resistant: River (Cointelegraph): the Bitcoin financial services company, River, said that Microsoft Major – although it was not yet a threat – could reach a scale of 1 million quons by 2027-2029, which can be potentially allowed to allow Potentially to make it possible to potentially allow 1 million bit attacks against blockchain.