The 11.5% sliding of Ether (ETH) of 11.5% in the last 24 hours has compared the second largest cryptocurrency in a series of liquidations of $ 340 million to gigantic on the platform Makerdao guaranteed debt form.

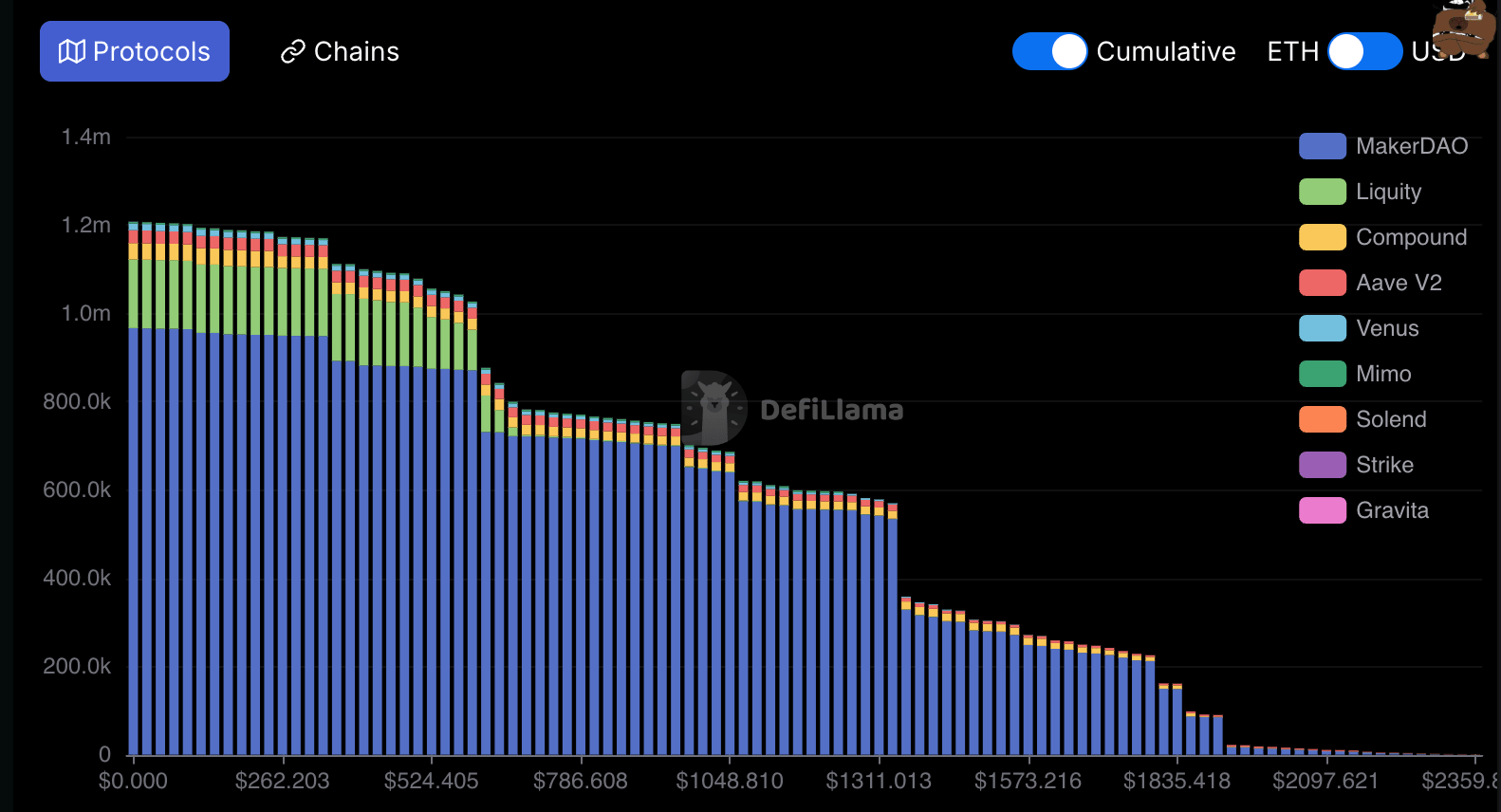

Channel data shows that three manufacturer’s stations will be liquidated when the ETH price reaches $ 1,926, $ 1,842 and $ 1,793. Each position is between 109 and 126 million dollars.

Ether, the Ethereum blockchain token is negotiated around $ 2,390 following a market -scale sale triggered by a feeling of decrease and a decrease in global actions.

It remains to be seen if the dive is the trigger for a lower market. The active ingredients have generally dropped up to 30% in the previous bull markets to shake Over-onlyfet before returning to the rise, the ETH has been down 42% since December 16.

In order to trigger Makerdao liquidations, ETH must drop by an additional 19%, how much it could trigger a liquidation cascade through decentralized protocols and finance exchanges (DEFI).

In the past 24 hours, $ 296 million in ETH posts have already been liquidated on the scholarships, according to Coinglass.

It should be noted that the deleveraging of events stimulated by sales may have an opportunity for warned merchants to buy undervalued assets, because the cash price is determined by a lack of short-term liquidity and not what could be considered the true value.