This year’s rapid interest in the American states to put public money in cryptocurrencies before the federal government could establish a strategic reserve of digital assets has encountered mixed results after five efforts of this type have ignited, although UTAH remains a single vote far from the finish line and would have advanced a bill to its state Senate.

Pennsylvania, Wyoming, Montana, South Dakota and Northern Dakota are below the brand in legislative efforts to put public money in the crypto. Others – in particular UTAH – have made significant progress towards the transition from bills which could link their financial health to the digital asset markets, and the land is moving an hour.

The US Congress and President Donald Trump made noise about a federal reserve of digital assets, with the public campaign of the idea from the Bitcoin 2024 scene in Nashville, Tenump, before Trump won his elections and the Republicans have risen to the majority of the Congress. Trump spoke widely in favor of the concept, which was also more recommended by Michael Saylor de Microstrategy and presented by Senator Cynthia Lummis, the Wyoming republican who heads the crypto sub-comity of the Senate banking committee.

Many states have run to beat the federals to punch, but in the weeks that marked this trend, the market value of the assets, most of which are talking about – Bitcoin (BTC) – has slipped considerably from the post -electoral euphoria which seemed to stimulate enthusiasm.

Read more: Us Bitcoin Reserve can happen, but the states win the race

The drop in price at around $ 86,000 compared to an inauguration day of Trump inauguration of $ 106,000 was associated with another high -level exchange hack in Bybit who would have succeeded with more crypto than thieves never seized in a single outing. These setbacks may have more attenuated the good will of state government enthusiasts.

“This feeling of emergency seems to have decreased now,” said Johnny Garcia, Managing Director of the Vechain Foundation who followed the actions of the State. “My point of view is that states have a certain margin of breathing to assess and contemplate a path to follow.”

Montana and Northern Dakota have experienced clear losses when their legislatures considered the idea of cryptography reserves at state level. The two legislatures voted to reject the bills. The other three states in which initiatives have failed have seen these discharges occur at the level of the committee.

Meanwhile, UTAH legislation to allow cryptographic investment of up to 5% of certain public accounts authorized the State Chamber and a Senate committee on its way to the consideration of the entire Senate. But obtaining this vote is never a certainty in the limited windows that most states give their legislative activity.

“Although UTAH seems best placed to finalize its bill first, nothing is guaranteed,” said Dennis Porter, CEO of the Satoshi Action Fund who has put pressure for the States to adopt Bitcoin reserves. “It’s a dynamic process.”

Porter said that campaign in the United States was based on them as the “democracy laboratory”. He posted on the social site of the media X (formerly Twitter) that most invoices will fail, which is “normal” for the process, that his group will continue to continue each year.

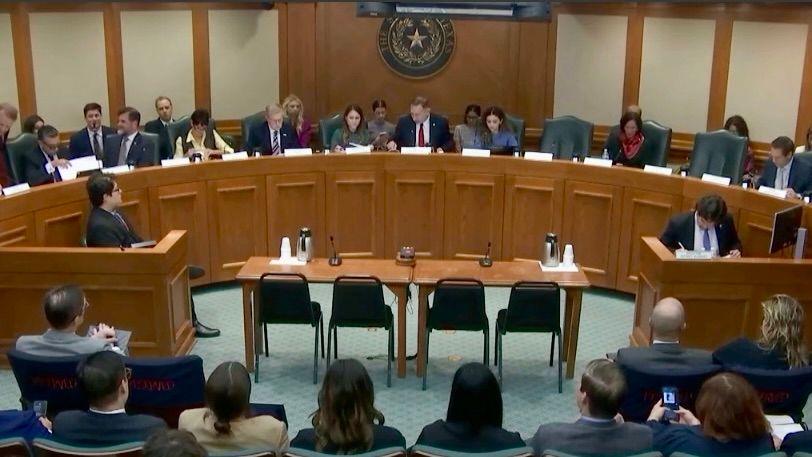

Texas, a large mining center of Bitcoin, would have become the last state legislature to withdraw a Crypto reserve bill. But states have continued such a wide variety of digital asset initiatives that they are difficult to identify as a common effort. And some states move to other aspects of the participation of cryptography, such as the Indiana house bill weighing the blockchain for the effectiveness of the government and Arizona advancing a technical bill through its house which would maintain non -claimed goods in the form of crypto, rather than converting it to species – a result which would imply managing it in a state fund.

While the efforts of the Northern Dakota to set up a reserve failed, the State House has also approved a separate resolution which encourages its treasurer to invest certain public funds in digital assets. This resolution is now in the hands of the State Senate.

Garcia predicted that “many of these states will likely authorize digital assets in the context of their pension and state investment options before moving to more aggressive digital asset reserves”.