Remember the last time you went on vacation? After locating the door and directed to your car, you probably turned suddenly to make sure that the lock was secure before continuing your trip.

The financial markets, led by a range of human emotions, have similar behavior. After a convincing step beyond long-term resistance, the assets generally return to confirm the validity of the break. This serves as a test for the strength of the old resistance that has become a support, depending on what larger rallies take place.

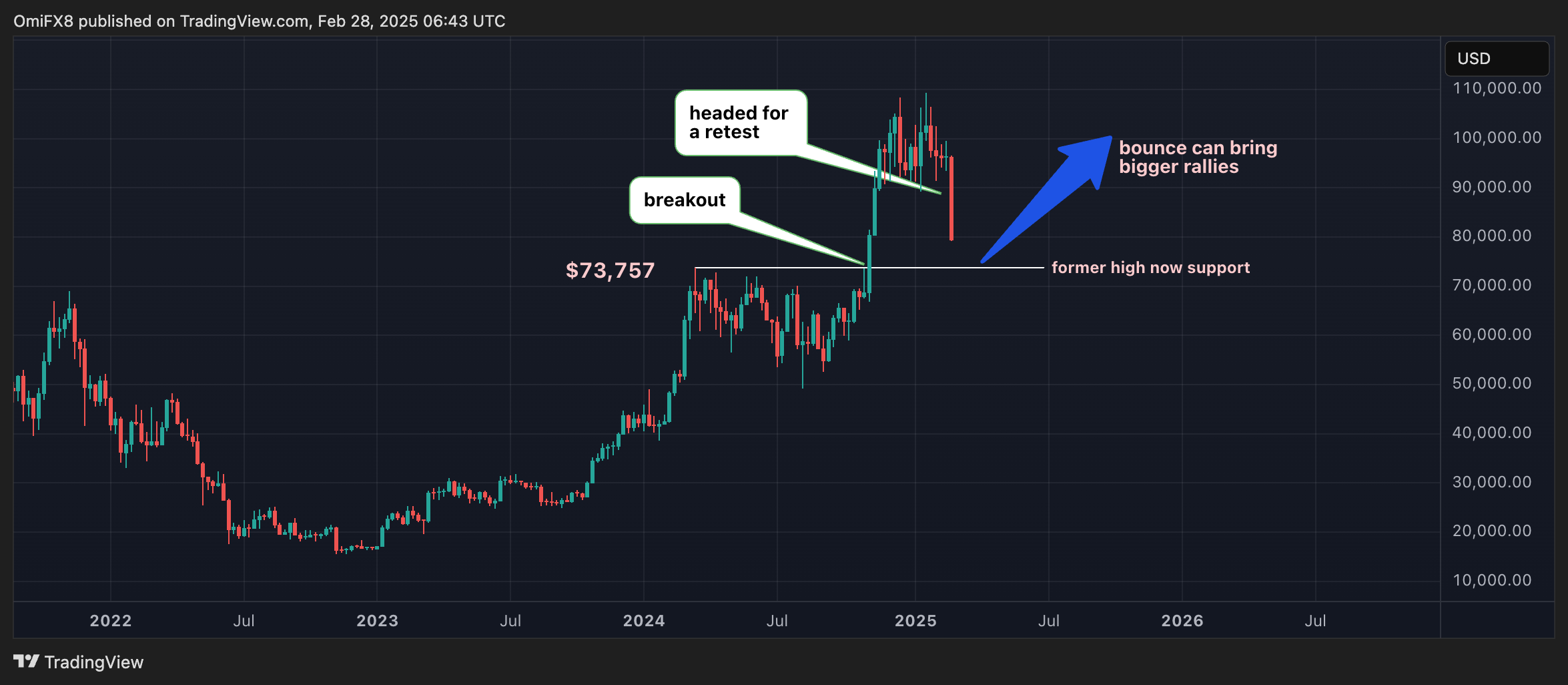

The phenomenon “Breakout and Reteste Play” is well known in all asset classes. The sale during Bitcoin (BTC) could simply be that – a healthy remediation of the break point or the old resistance support of $ 73,835 violated in November.

In other words, the momentum could be lacking in steam or closer to these levels, potentially preparing the terrain for a larger race higher.

BTC fell by more than 15% to less than $ 80,000 this month, exposing the former resistance support to $ 73,835. The prices broke out above this level in early November, ending a consolidation of a month after the Pro-Crypto Donald Trump won the American presidential election.

The market trend to retrace or review the breakdown before staging more enormous rallies to its roots in the behavioral aspects of investment.

People are generally opposed to risk when it comes to getting gains. Thus, when they are faced with profits, traders quickly reserve those instead of allowing the winning trade to go wild. The so-called perspective theory explains why post-elimination gatherings suddenly lack steam, often leading to a reinstatement of the breakdown. BTC holders have benefited from the $ 100,000 mark since December.

Now, as prices decrease and near the breakdown point, in this case, $ 73,835, market players who missed the initial rally intervene, ensuring that the level is valid. The rebound that results from the old resistance to assistance which has become more and more buyers, potentially producing a larger rally.

This is precisely what happened in the third quarter of 2023 and August 2020.

On occasion, escape and the retest produced greater rallies for new records. Merchants, however, should note that a stranded retest or a significant lack of rebound indicates an underlying weakness which can evolve into a downward-down trend.

Over the years, I have seen many examples of eruption / breakdowns reluctantly leading to larger movements in traditional markets.

Consider the yield on the Japanese government’s obligation at 10 years old. He sparked an escape from two basins in January 2024 and revised the level of escape several times before moving on to multi -year summits.

The Aud / USD pair plunged from a major support trend in December, referring to a deeper slide. The pair rebounded to resistance to the trend line at the beginning of the month to see net losses this week.