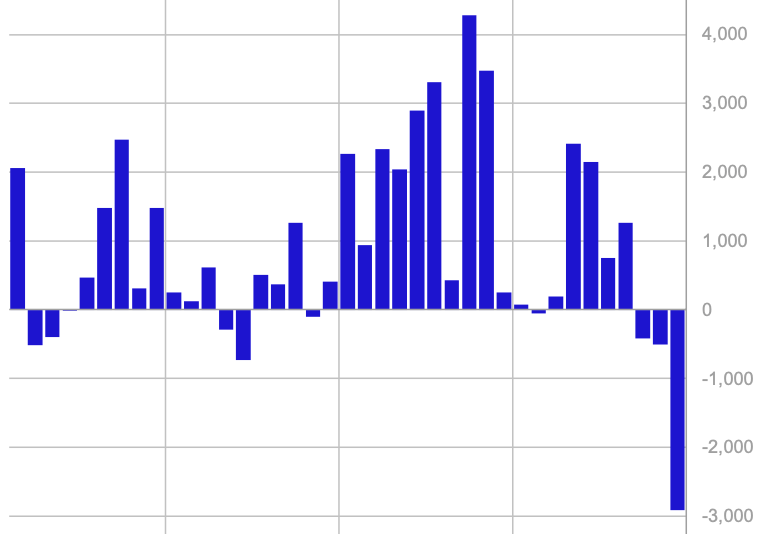

The products negotiated in exchange for crypto (ETPs) have undergone their greatest weekly sale recorded, investors pulling around 2.9 billion dollars in these funds, according to a Coinshares report published on Monday.

Massive outings mark a significant change in feeling after a prolonged period of constant investment in digital asset products.

This last wave of withdrawals has extended a sequence of three weeks outings, now totaling $ 3.8 billion. Coinshares’ research analyst James Butterfill, underlined several factors behind the sale, including concerns of growing investors following the recent hacking of $ 1.5 billion on the Bybit of the exchange of crypto and the increasingly bellicist position of the federal reserve on monetary policy.

Before this slowdown, Crypto Investment Products had benefited from 19 consecutive weeks, which suggests that certain investors were locking the profits in an increasing uncertainty of the market.

Bitcoin (BTC), the largest cryptocurrency by market capitalization, bore the weight of outings, losing $ 2.6 billion in last week. Meanwhile, funds that bet against Bitcoin, known as Bitcoin ETPS, have seen only a modest influx of $ 2.3 million, indicating that the lowering feeling has not yet completely taken root.

While most of the assets were struggling, some have shaken up the trend – SUP (SUI) has become the most efficient with $ 15.5 million in entries, followed by XRP (XRP), which has also attracted new investments.

The FNB Bitcoin Spot had to face one of their most difficult weeks to date, investors drawing significant capital from these funds. Depending on Coinshares, the highest weekly withdrawal, the highest withdraws when it was launched.

Likewise, the interests open to the term of CME Bitcoin have dropped sharply in the past two weeks, going from 170,000 BTC to 140,000 BTC, signaling a potential change in institutional positioning. At the same time, the three -month annualized rolling base gives 7%, only slightly higher than the yield of 4% offered by short -term US Treasury, which makes trade less attractive for investors.

“This tells me that hedge funds are starting to relax their basic commercial position, which is a neutral position of the net,” said James Van Stratot, analyst at Coindesk. “With a propagation of narrowing between term yields and risk -free yields, traders can reallocate the capital far from Bitcoin derivatives in favor of safer and more liquid assets.”

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.