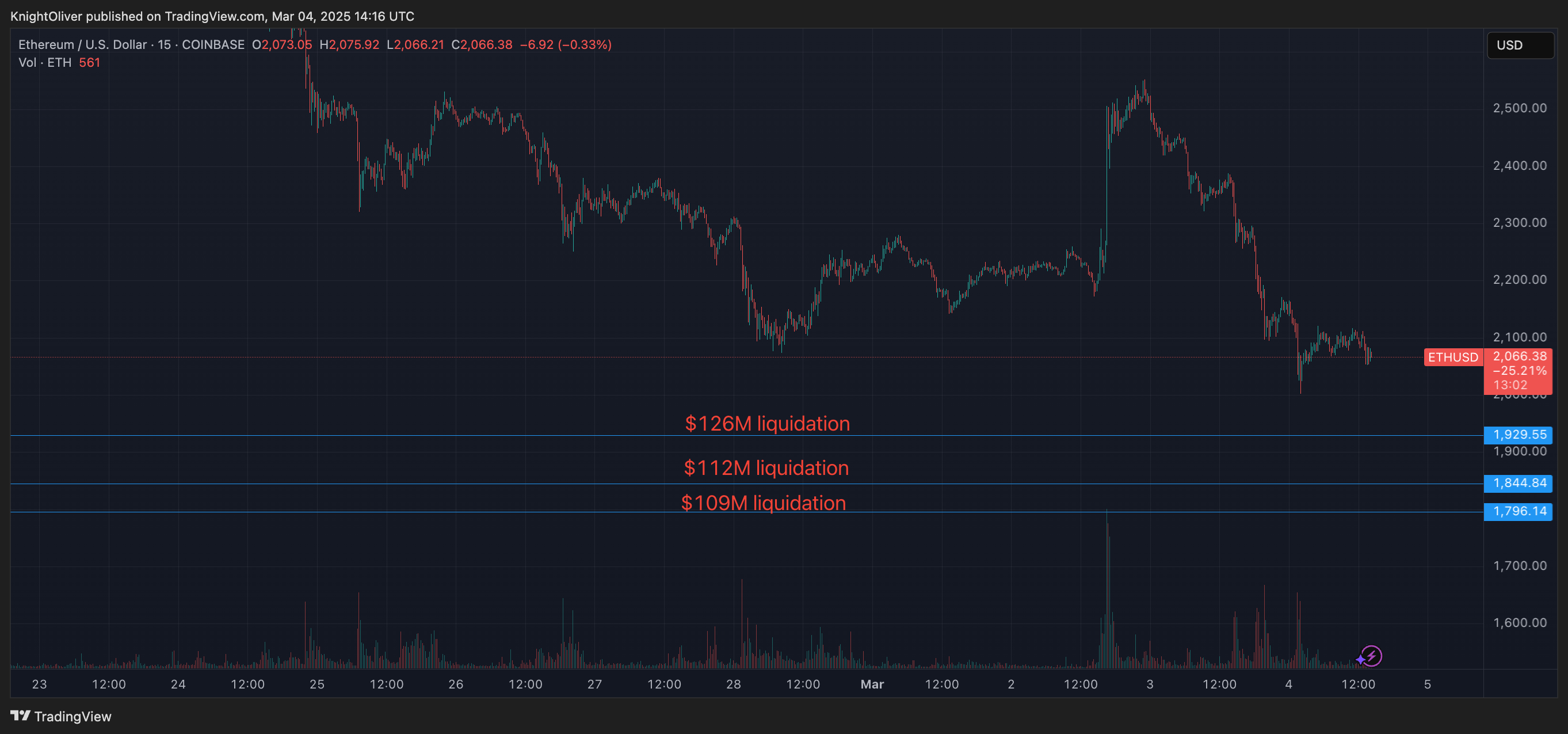

An ether position (ETH) worth more than $ 126 million took place at less than 4% after being liquidated in the middle of a diver of cryptography on Tuesday.

ETH has now retraced more than the entire Sunday rally, losing 22% of its value in the last 48 hours, because it is negotiated at $ 2,080.

A fortuitous rebound at $ 2,000 protected the decentralized financial ecosystem of Ethereum (DEFI) from a series of liquidations on the Makerdao guaranteed debt platform.

The first level was $ 1,929 with two other positions set at $ 1,844 and $ 1,796. The combined value of the three positions is $ 349 million.

Price action is often attracted to liquidation levels because commercial companies target supply areas. When a liquidation is triggered on Makedao, the ETH promised as guarantee will be sold or sold at auction, with part of the costs going to the protocol. In terms of makedao, the ETH is often bought at a discount and later sold on the wider market for a profit – which has the potential to cause an additional price catch -up.

Defi liquidations have more impact than term contracts because it involves cash and not derivatives, which have higher liquidity levels due to the high lever effect.

In this case, it is advantageous for commercial companies to target these levels, because liquidation would provide short-term volatility and potentially a cascade, that is to say when a liquidated position in force with several others.

Once a cascade is concluded and buyers have absorbed the new offer, the price is generally withdrawn, which can try the liquidated merchant to buy its long position.

Defillama’s data show that $ 1.3 billion in ether is liquidable with $ 427 million at less than 20% of the current price.

The ETH underperformed against Bitcoin (BTC) throughout the recent Haussier market, going to a report of 0.0235 compared to the summits of the previous cycle at 0.156 and 0.088. This is partly due to institutional entries in many ETF BTCs, but also due to the rise of other blockchains like Solana and base which stole a market share.