The American Securities and Exchange (SEC) commission has agreed to remove its application file against Cumberland DRW, the Crypto Commercial Branch of the Commercial Company based in Chicago, DRW, according to an ad Tuesday of the company.

The SEC continued Cumberland DRW last October, accusing the firm of acting as a securities merchant not registered and alleging that it sold more than $ 2 billion in unregistered titles, appointing tokens like Polygon (POL), Solana (soil), Cosmos (Atom), Algorand (Algo) and Filecoin).

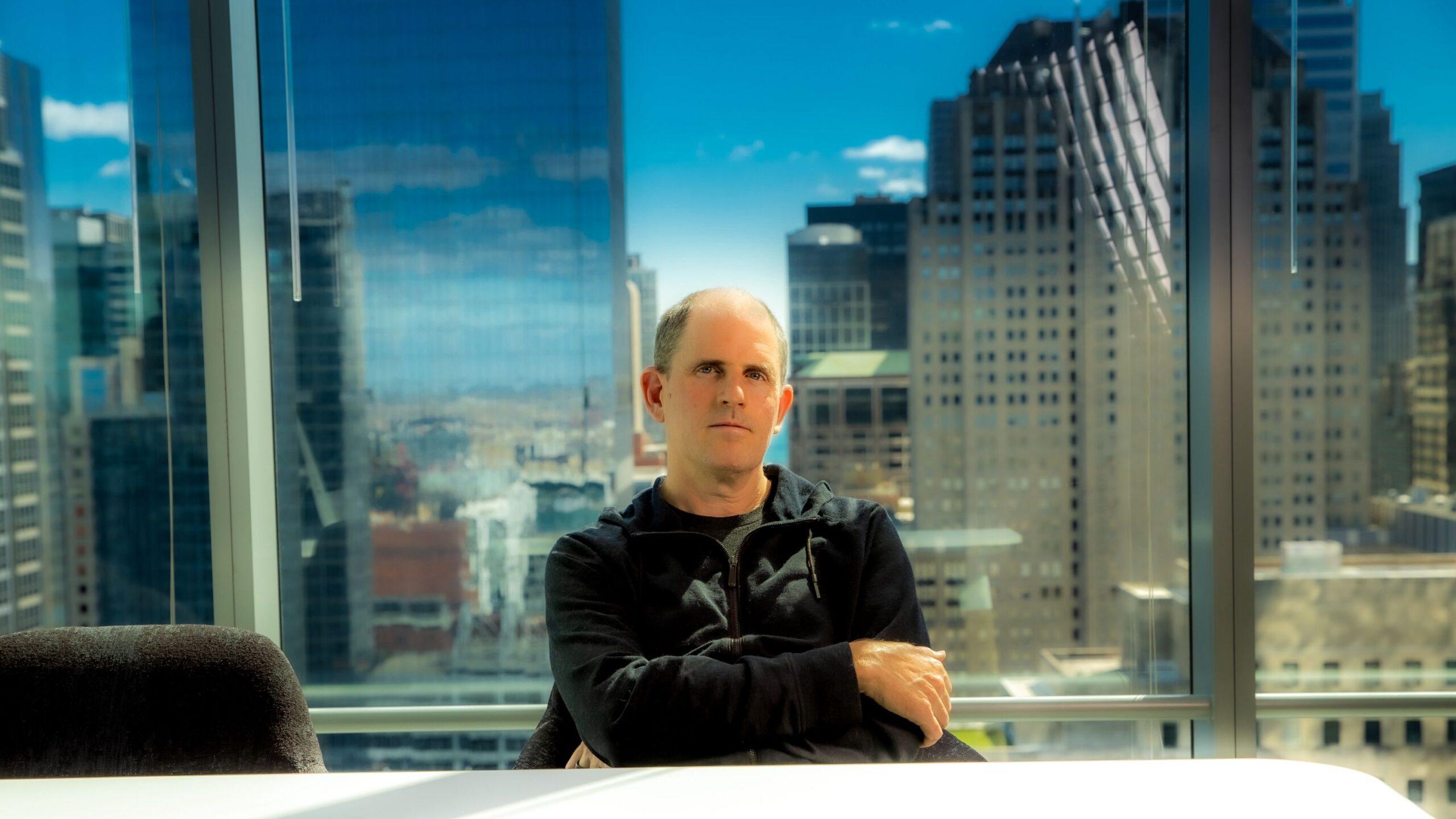

As the prosecution was filed, Cumberland DRW and his CEO Don Wilson undertook to fight the accusations. In an interview with Coindesk last October, Wilson said that his business had tried and failed to register as a securities merchant with the SEC, and suggested that the lack of clarity for cryptographic companies under Gary Gensler of the time was a characteristic, not a bug of the agency’s regulatory approach.

Read more: Who is afraid of Gary Gensler? Not Don Wilson, the merchant who beat the regulator once before

“This dynamic has put dry in a position where it could say that everyone breaks the rule, and we will simply continue whoever we want,” Wilson told Coindesk. “”[It] It reminds me of “Atlas haus my shoulders”. If everyone breaks the law, he can selectively harass who they want. »»

Barely five months later, under the new management of the acting president Mark Uyeda, the SEC completely overturned the course. The agency’s decision to delete its pursuit against Cumberland DRW is the last in a series of abandoned proceedings: the SEC also abandoned its file against Coinbase and agreed to remove its affairs against consensys and Kraken. He also closed a multitude of probes on cryptographic societies, notably Gemini, Opensea, Robinhood Crypto and Yuga Labs. As with its Consensys and Kraken agreements, the CUMBERLAND’s CUMBERLAND agreement is awaiting approval of the majority of the three commissioners currently in the panel. The commission voted to abandon its Coinbase case last week.

“As a deeply committed business in the principles of integrity and transparency, we are impatient to continue our dialogue with the dry to help shape a future where technological progress and regulatory clarity go hand in hand, ensuring that the United States remains at the forefront of global financial innovation,” said Cumberland in his announcement.

A representative of Cumberland DRW refused to comment beyond the company’s post X.

The dry did not respond to the request for comments from Coindesk.