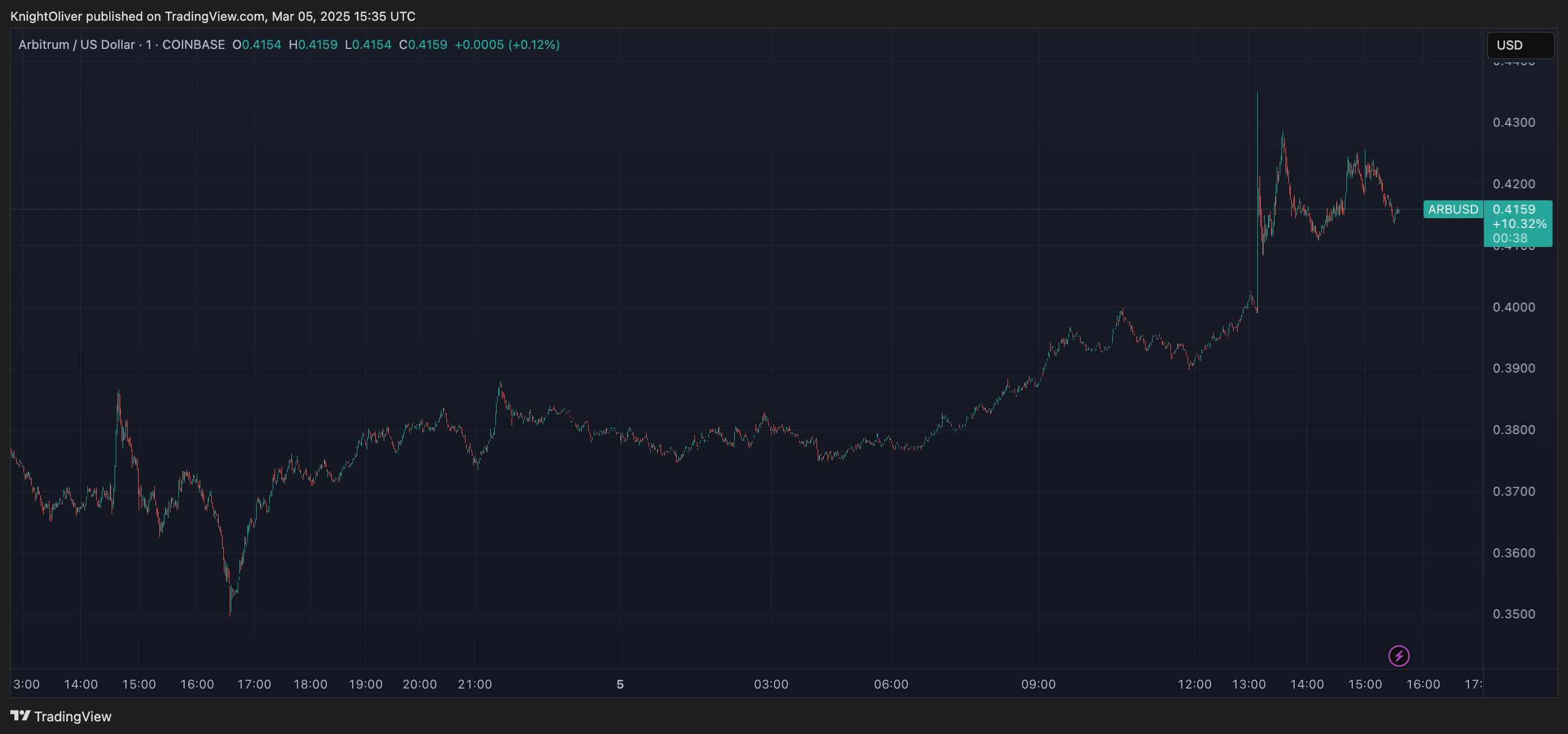

On Wednesday, the trading application based in the United States Robinhood (Hood) scored Arbitrum (ARB), which resulted in a 12% increase in the native token of the layer 2 network.

ARB is currently negotiating at $ 0.42 after falling to a hollow of $ 0.35 on Tuesday. The negotiation volume has also increased by 10% to $ 400 million in the last 24 hours.

The total locked value (TVL) remained stable on arbitrum recently, located at 2.8 billion dollars after having increased by $ 2.5 billion in early November, according to Defillama.

But this relative success has not been successful in terms of token prices, ARB, now 82% compared to the 2024 record of $ 2.41.

This is due in part to tokens programs; Since March 2024, the traffic supply has increased from 1.5 billion to 4.4 billion, which means that market capitalization has remained more stable than the price itself. The market capitalization is developed by multiplying the offer in circulation with the price of assets.

ARB was not the only token to be listed on Robinhood, he joined XRP, Shiba Inu (Shib) and Bonk (Bonk), who all increased between 4.5% and 7% on Wednesday.

The extensive rise in power of the ARB in relation to the other listed tokens could be due to the fact that it is the main layer of layer 2 in terms of secure total value (TVS) and user operations per second (UOPS), according to L2Beat.

XRP, despite his name in the American strategic reserve plans of Donald Trump, has only $ 80 million locked up in his decentralized XRPL lonely exchange, while Shib and Bonk and the same trade in retail.