The majority of legislators in the American House of Representatives voted to cancel an IRS rule dealing with cryptographic entities such as brokers and forcing them to collect certain information on taxpayers and transactions, including decentralized financing platforms (DEFI).

With a vote of 292-132, a majority bipartite in the House joined the US Senate to advance the resolution of the law on the revision of the Congressal to cancel the finalized rule in the closing days of the administration of former President Joe Biden.

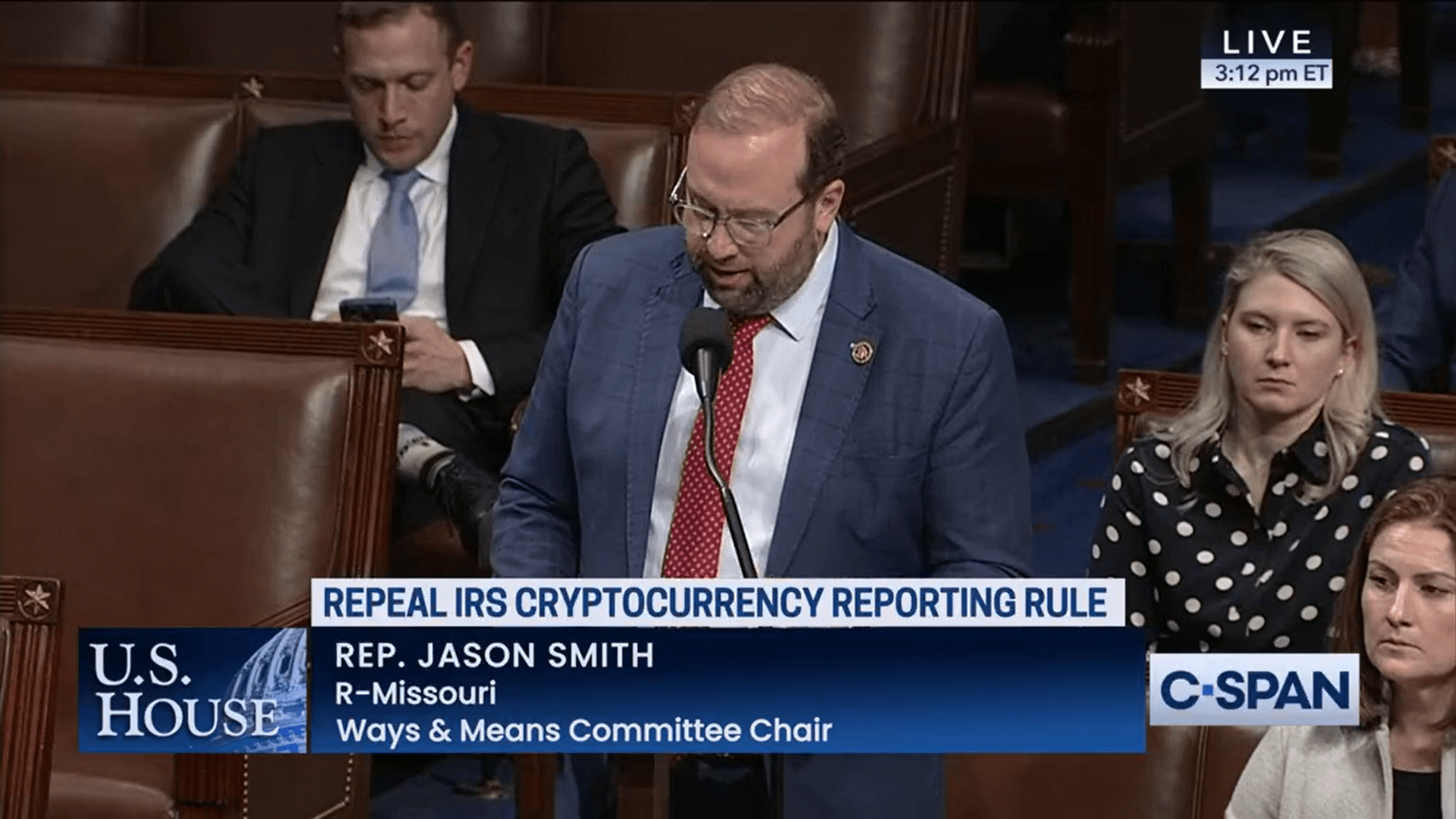

The Missouri republican, Jason Smith, urging his legislator colleagues to vote for the resolution earlier in the day, said that the IRS rule was likely to harm American businesses and disincure innovation.

“There are real questions that the rule can even be administered,” he said. “DEFI exchanges are not the same as centralized cryptography exchanges or traditional banks or brokers. DEFI platforms cannot even collect information from the users necessary to implement this rule.”

Last week, 70 senators voted to cancel the rule, and the senior advisers of President Donald Trump have already recommended to sign the provision. However, the Senate will have to approve the resolution again due to the budgetary rules, noted the representative Jason Smith (R-MO). If he approves the resolution and Trump signs, the IRS will be forbidden to resume a similar rule.

The Democrat of Illinois, Danny Davis, rejected the resolution, noting that he came from the law on investments and bipartisan jobs of the bipartisan infrastructures and comparing the crypto to the actions.

“When you sell actions with a broker in equity, the broker declares the product of the sale to you and the internal in return for service,” he said. “Probably to anyone’s surprise, when there are independent reports on these sales, taxpayers are more likely to report their income to the Internal Revenue Service.”

North Carolina Republican Tim Moore said that the rule “goes far beyond” the intention of the congress with the law of 2021.

“This rule has placed impossible burdens on software developers threatening American leadership in digital asset innovation,” he said.

The Texas Democrat Lloyd Doggett described the resolution of “special interest legislation”, adding that it could be “exploited by rich tax cheaters, drug traffickers and terrorist financiers” and add $ 4 billion to national debt, in conflict with US president Donald Trump to reduce debt.

Tuesday’s vote was preceded by the House vote on a continuous resolution to finance the US government until September 30, 2025, which was adopted with 217 votes in favor of 213 votes against. This financing resolution is now going to the Senate.