An Ethereum user saved several Makerdao positions on the edge of a liquidation cascade of 360 million dollars on Tuesday, adding guarantees at the last hour while the price of ETH was tuning.

One of the positions had a liquidation price of $ 1,928, it was launched alongside a market dive during American negotiation hours. The ETH was less than two minutes from the liquidation and sold during an auction Makerdao until the owner of the portfolio deposits 2,000 ETH of Bitfinex in additional warranty. He also reimbursed $ 1.5 million from Stablecoin Dai.

The portfolio in question has taken some surprise by saving the position because they were previously inactive since November.

This particular position is not yet out of the woods; It will be liquidated if ETH falls to $ 1,781 or until the owner adds more warranty. Ether is currently negotiating at $ 1,928 after rebounded compared to $ 1,788 on Monday.

Another portfolio, which according to the X Lookonchain account is suspected of being the Ethereum Foundation, deposited 30,098 ETH ($ 56.08 million) to reduce the price of liquidation of its position to $ 1,127.

While hundreds of millions of dollars in liquidations are quite common in the derivative markets, decentralized financing protocols (DEFI) like Makedao only use punctual assets. This means that when liquidation takes place, the Liquidity DEFI is unable to deal with the bias of the cash supply to the cash. This does not happen on derivative exchanges because there is generally more volume and liquidity driven by the lever effect.

In this case, only one of the nine -digit liquidations on Markerdao would probably send the price of the price of the ETH, liquidated the other vulnerable position on its way.

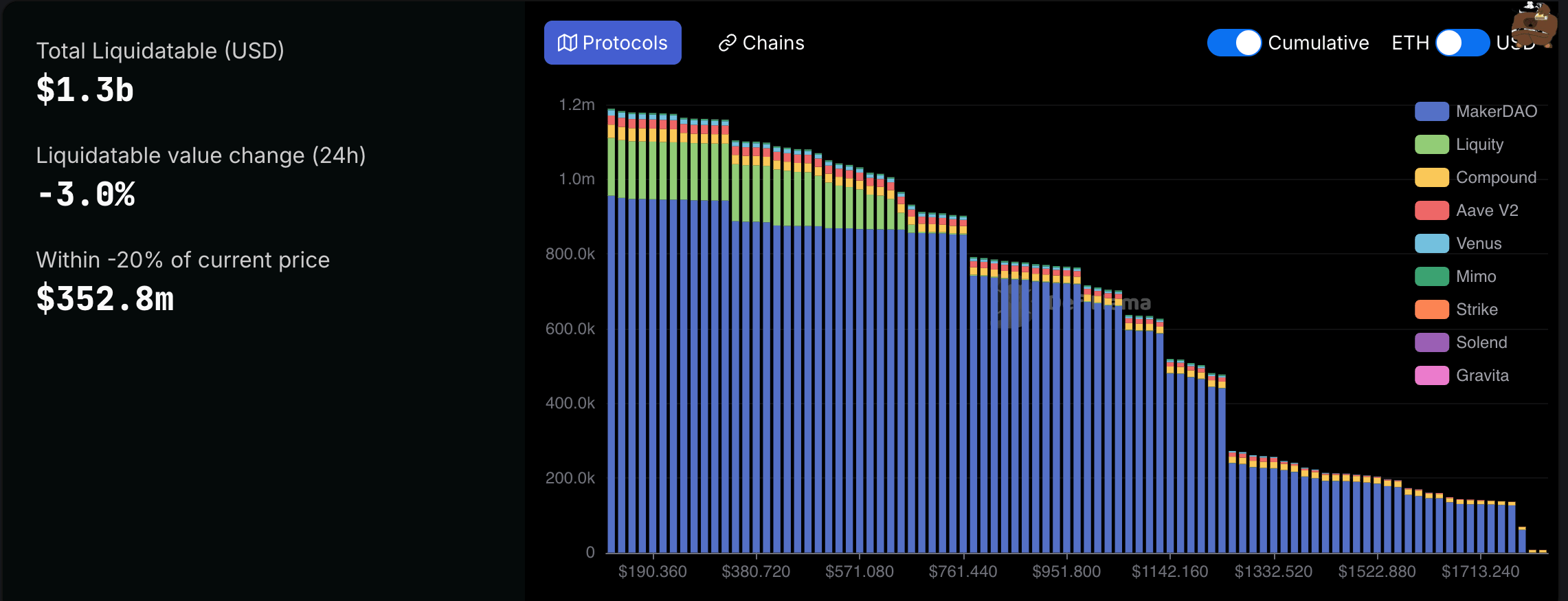

Defilma shows that there are $ 1.3 billion in liquidable assets on Ethereum, with $ 352 million in the 20% of the current price.