The recent slowdown in the cryptography market caused paries to Bitcoin (BTC) options of $ 120,000 in the past popular to lose its crown at the bet of $ 100,000 in a sign that traders re -evaluate their bullish expectations.

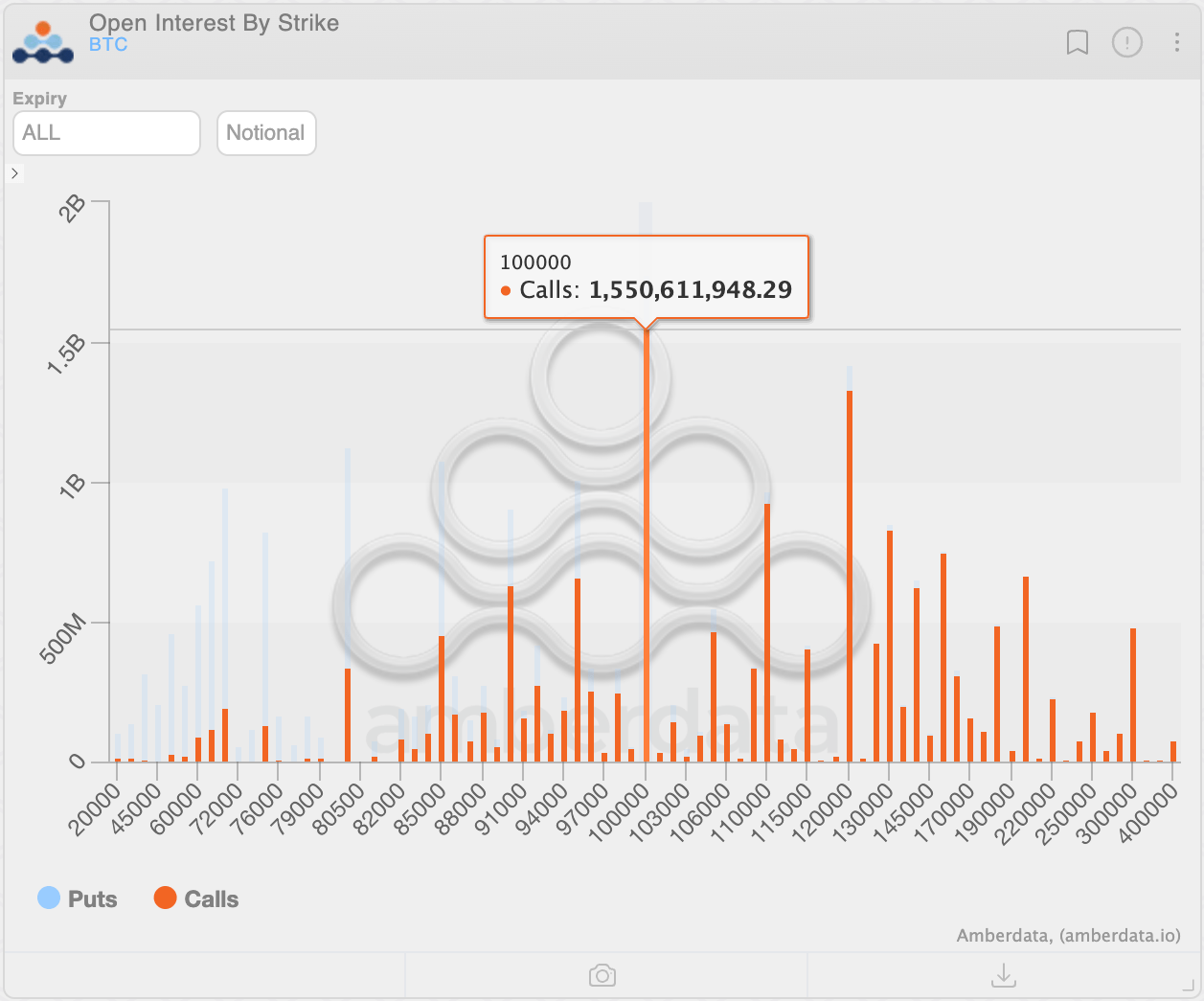

At the time of the press, the $ 100,000 call was the most popular BTC options on the stock market, with an open notional interest of $ 1.55 billion. Open notional interest represents the value in dollars of the number of active options contracts at a given time.

Meanwhile, the call of $ 120,000, the former leader until last month, was held in position number two, with an open notional interest of $ 1.33 billion.

A call gives the buyer the right but not the obligation to buy the underlying asset at a predetermined price on a later date. A call buyer is implicitly optimistic on the market. Consequently, a major open interest in a higher strike of outdoor calls, such as $ 100,000 and $ 120,000, reflects bullish expectations.

The change lower in the most preferred call to the $ 100,000 strike probably shows that traders opting for a more conservative bet following the recent price crash at less than $ 80,000. In addition, it can point out a broader reassessment of the bullish feeling.

The 25-Delta risk inversions, which measure the difference between implicit volatility (demand) for higher strike calls compared to lower strike putting, show negative readings or an bias for protection protection options at the expiration of May. It is representative of the fears of a prost -priced slide on the market.

The price remains optimistic in favor of purchase options after May. In addition, the value in dollars in the total number of calls opened at the time of the press was greater than $ 16 billion, almost doubled $ 8.35 billion in sales options.