The cryptography market seems to have stabilized, but traders are cautious while dealing with altcoins, like XRP, while continuing to rotate money in the Bitcoin market leader (BTC).

The XRP focused on payments, which Ripple uses to facilitate cross -border payments, has increased by $ 2.24 in the last 24 hours mainly in the hope that the legal battle between the Blockchain Ripple and the Securities and Exchange Commission (SEC) company could conclude soon.

In the middle of the rise in prices, the cumulative interest opened in perpetual term contracts listed on the main exchanges stabilized almost 1.35 billion XRP, with annualized financing rates and a cumulative volume of negative printing, according to the Velo data source.

Negative financing rates mean that short films pay fees to counterparts to keep their bets open. It shows the domination of short lowering positions on the market. The Cumulated Delta cumulative volume, which measures net capital inputs on the market, indicates that the sales volume has accumulated more than the volume of purchase, potentially signaling a downward trend.

The two indicators, therefore, cast a doubt that the increase in XRP prices has legs. At the time of the press, several other large capitalization tokens such as Doge, Sol, Suis, Hbar, LTC, BTC, TRX and Hype had negative CVDs on a 24 -hour basis.

Speaking of DOGE, the simple 50-day mobile average (SMA) of the price of the token is about to cross the 200-day SMA, confirming the so-called death of death. The disturbing consonance scheme indicates that the short-term impulse of prices now underforms long-term momentum, with the potential to evolve into a major downward trend.

These SMA multisgments are widely followed by trend traders, which means that confirmation of the death cross could bring more pressure on the market. That said, long -term SMA multisgments are late indicators, reflecting the sale that has already materialized and has a mixed recording of price movements on the BTC and ETH markets.

Note that DOGE has already dropped by 65% since its peak at more than 48 cents in December.

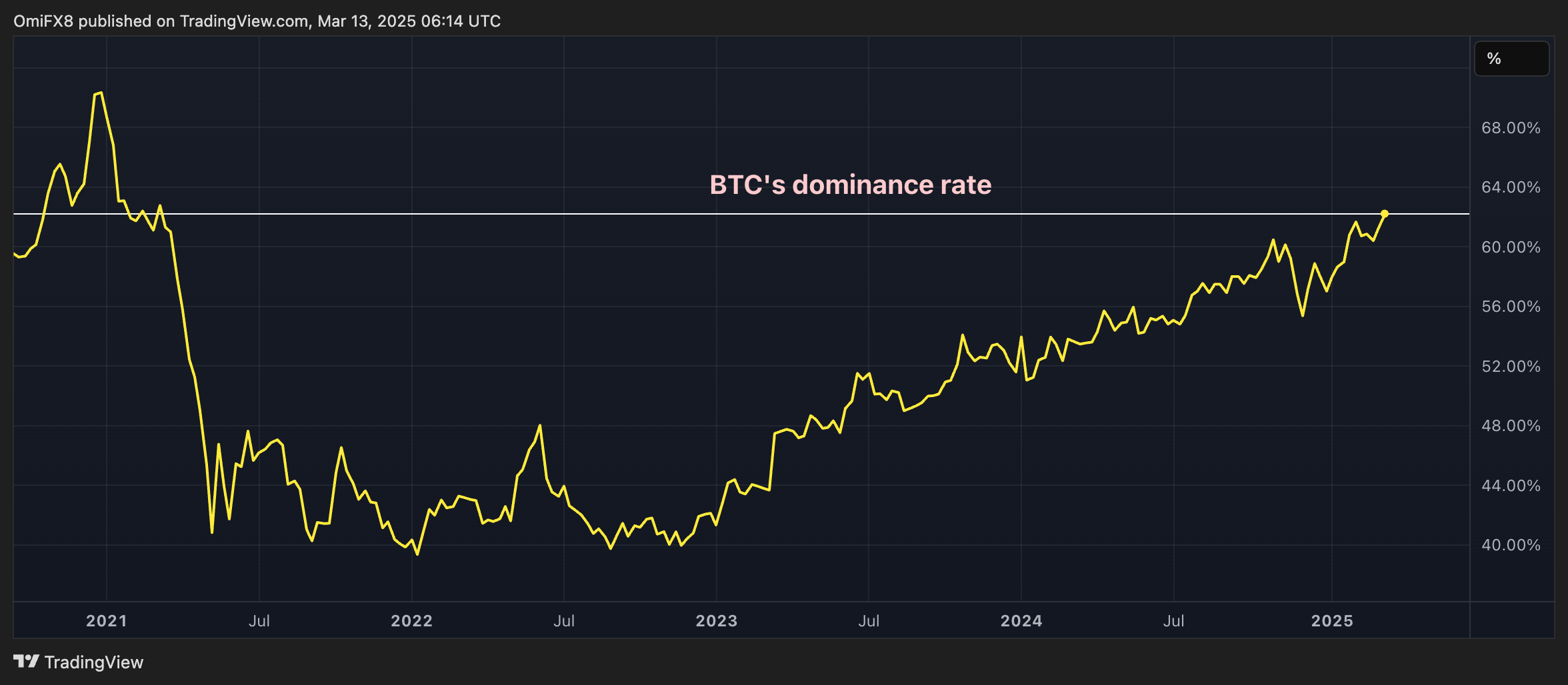

Most dominant BTC in four years

The rate of Bitcoin domination, or the share of cryptocurrency in total market capitalization, has increased to 62.5%, the highest since March 2021, according to Data Source TradingView.

In particular, metrics increased from 55% to more than 62%, because the total market capitalization of cryptography culminated above 3.6 billions of dollars in December.

It means continuous preference for BTC, especially during wider market slowdowns.