Solana’s most profitable protocol pump.

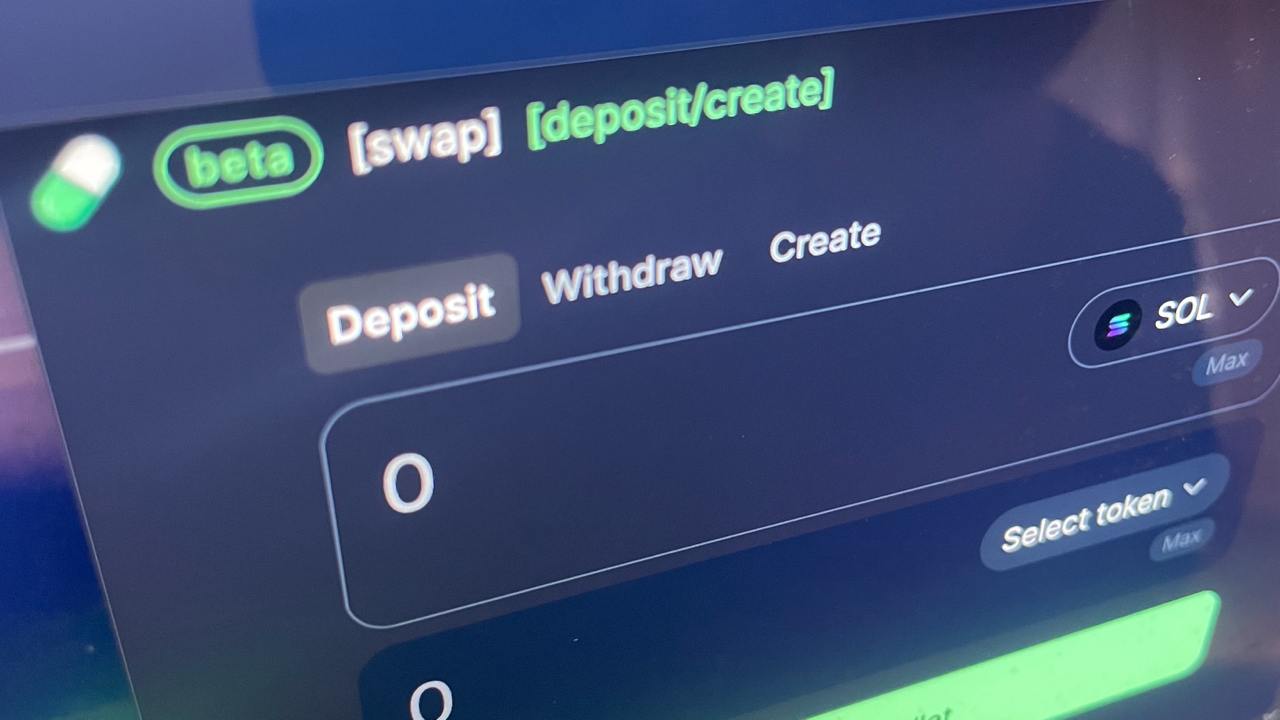

The massively popular Launchpad Memecoin unveiled on Thursday a service to exchange tokens powered by the liquidity pools of the protocol. Called Pumpswap, he puts the project in direct competition with Solana Coterie of Automated Market Manufacturers (AMMS) which facilitate the chain chip trades.

Instead of “graduation” of the same, highly negotiated in Raydium, a longtime center of Solana Defi Pools, pump. This entirely internal configuration will reduce the launch costs, the founders told Coindesk and modify the way Pump.

The founders of Pump. Fun believe that Pumpswap can become the beating heart of negotiation infrastructure without authorization on Solana for all tokens, according to launch documents examined by Coindesk. They have negotiated agreements with a number of token projects which will now be established their liquidity on the rails of Pumpswap.

If the AMM is based on a technological advantage that is not disclosed to users to court – tokel traders and liquidity suppliers who chasing the yield – of the established commercial outposts of Solana, then the founders of Pump.fun would not say. Coindesk asked them as much – repeatedly.

What service has for him, at least in the minds of his donors is distribution. For almost a year, the explosion of fun of Pump. His profit tickets have reshaped the way chain researchers think and talk about income -generating protocols.

Tuesday Pump.fun saw $ 1 million in income. The sum is a relative bread chest compared to the mining gold of the previous year in the trenches. But this also underlies the figures published by numerous major cryptography projects, notably Ethereum himself. Such benefits give a dividend of mind that could give Pumpswap its competitive advantage.

Raydium should be the largest loser. A large part of its trading volume in the past year has occurred in Pools for the first time caressed by the Pump graduation mechanism. It will be missing the future activity which now flows towards Pumpswap. That said, the new same launch of Raydium could blunder the pain by giving Raydium its own flow of mecoins.

The creators of tokens, on the other hand, can possibly win a victory. Pumpswap will ultimately allow the sharing of income to give them a slice of 25 base points of the protocol on the trades, said the founders. But they refused to say how much the creators would flow, or when the switch would turn.