Las Vegas – Financial advisers in the United States are attached to negotiated funds in exchange for crypto (ETF) and are ready to increase their assets this year.

During a presentation at the Las Vegas discussion conference, TMX Vettafi, research manager, Todd Rosenbluth and the main investment strategist, Cinthia Murphy, presented the results of a survey sent to thousands of financial advisers to the United States, arguing that the crypto is part of “everyone’s conversation”.

The results have shown that 57% of advisers plan to increase their allowances in Crypto FNB, while 42% will probably maintain their position. Only 1%, almost no one, wants to reduce its position.

“I think last year, the message was that it was a risk of reputation. Today, there is no advisor who can at least have a basic conversation in crypto,” said Murphy.

Although the American Securities and Exchange (SEC) commission approved the Bitcoin Spot ETF in January 2024, a year before US President Donald Trump took office, the enthusiastic adoption of the new administration of the cryptographic industry has probably supported its broader institutional adoption. The regulators, including the dry and the commodity future trading commission (CFTC), have reversed the course on Crypto since the start of the Trump presidency, signaling a more friendly and clearer approach.

Respondents said they are particularly interested in the Crypto Equity FNB, who are funds that invest in listed companies with an exposure to cryptographic industry, such as the strategy (formerly Microstrategy) or Tesla.

“You cannot follow the space which, I think, explains why Crypto Equity was popular because it may be a little easier to understand and put your fingers around it,” added Murphy.

Since Trump took the Oval Office, Michael Saylor’s MSTR actions have experienced a rally of more than 100%, which makes actions related to more lucrative cryptography for retail and institutional investors. MSTR’s actions have carried out some of their gains since he has reached heights of all time; However, the results of the survey seem to suggest that it still arouses the interest of all market parts.

ETF Spot and Multi-TOKEN

The FNB linked to cryptographic actions are not the only ones to grow with financial advisers. About 22% of respondents in the survey said they were trying to allocate capital ETFs Spot, such as Bitcoin Spot (BTC) or Ether (ETH) ETF.

The third largest group, which said about 19% of respondents, was cryptographic asset funds that hold several tokens.

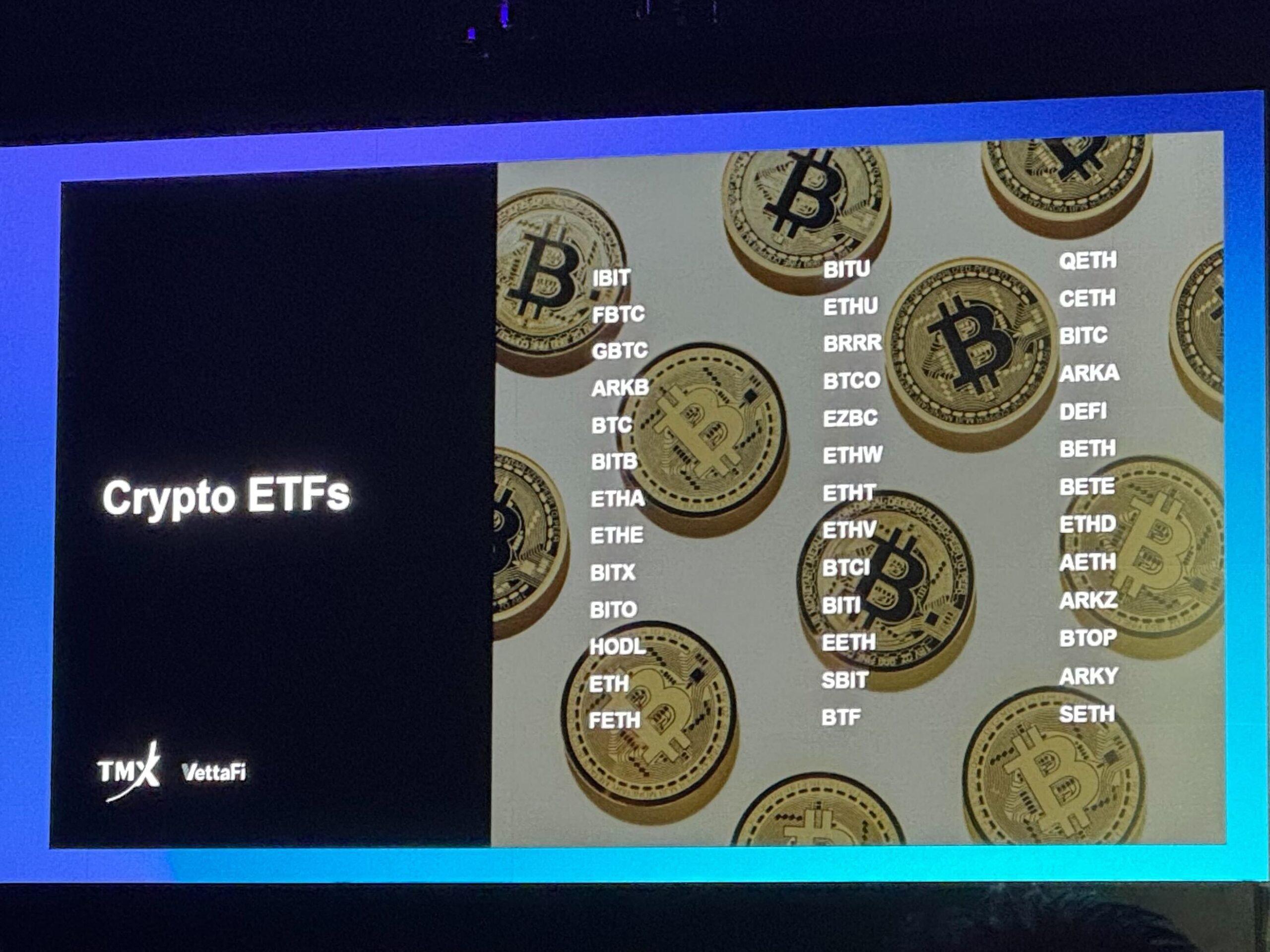

There are many cryptocurrency ETF on the scholarships, with several others in the process of receiving the approval of the SEC which will be listed in the future.

The last months have experienced a particularly large number of ETF based on the index, which means that they have a basket of cryptographic assets that go behind bitcoin and ether. Other launches have included managed funds that offer downward protection for price volatility by allocating a percentage in American treasury bills, for example.

Several issuers have submitted a file to provide other ETF Crypto-Spot, notably Solana (Sol), XRP and Litecoin (LTC), but the dry has not yet examined.

“It is a space that is only growing, and I strongly recommend that you learn experts in space … because it evolves quickly, and there is a lot to learn,” said Murphy.

Cheyenne Ligon has contributed to history.

Read more: Clarity Calpoto Clarity Top Catalyst for Industry Growth: Coinbase & Eyp Survey