Recently, very trembling risk assets – Crypto among them – may be trying a rally on Tuesday. Supported by a chatter that Donald Trump’s prices will not be as strict as fear.

At the start of the afternoon, Bitcoin (BTC) had climbed to just over $ 85,000, in advance by 2.1% in the last 24 hours. Previously, cryptographic majors such as ether (ETH), Dogecoin (Doge) and Cardano (ADA) had already been very blurred.

Crypto stocks also work well, with Bitcoin Miners Core Scientific (CORZ) and Cleanspark (CLSK) jumping almost 10% per day. The strategy (MSTR) increased by 5.4% and Coinbase (room) 2.1%.

American shares reversed the losses at the start of the session to also increase, the NASDAQ is now ahead of 1% for the day.

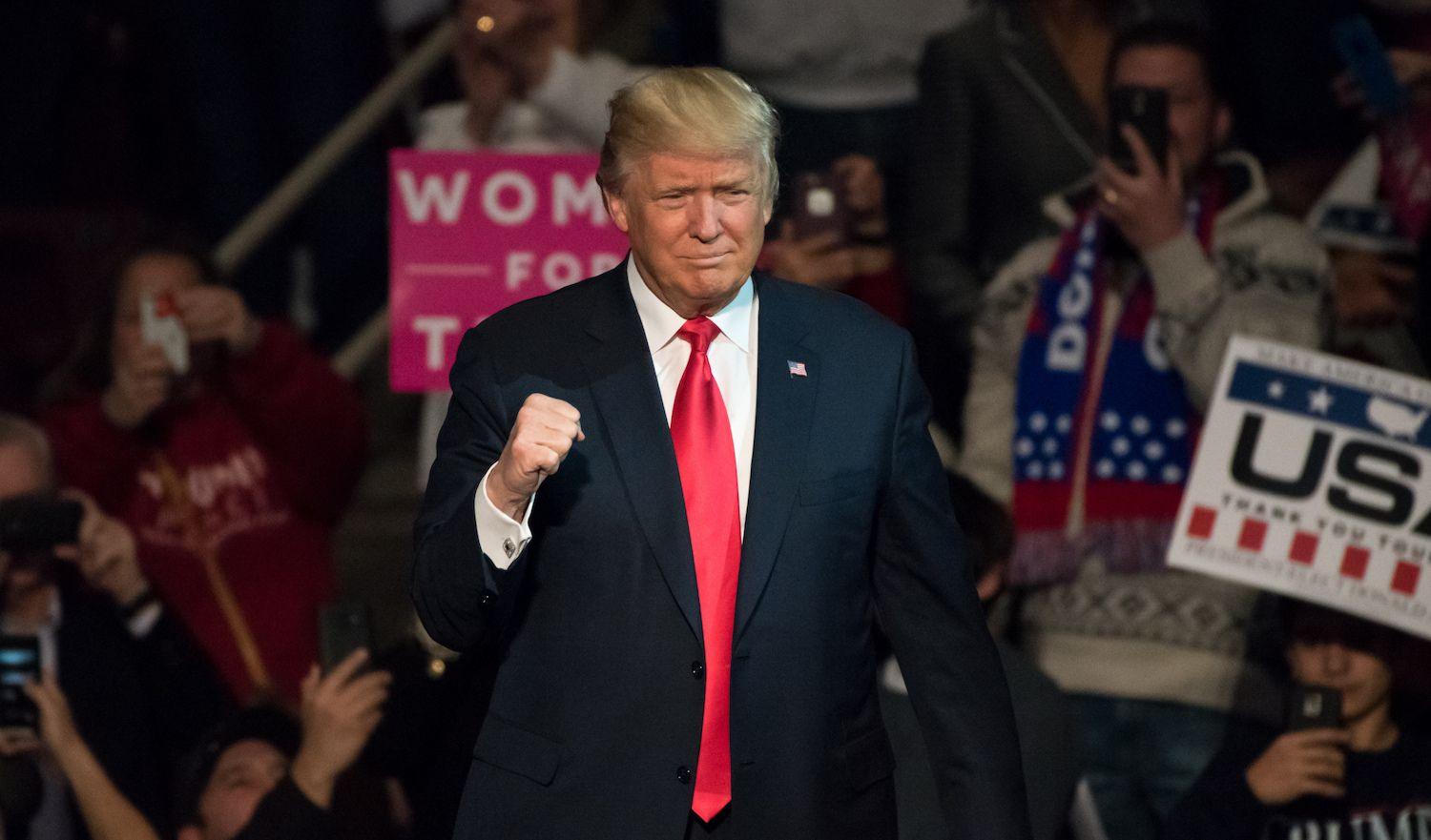

The action comes from the advance on the so-called deployment of the price of the “Liberation Day” of the Trump administration planned for tomorrow after the end of the American negotiation.

Hope?

A report by NBC News suggested that the most dreaded option on the market – coverage of 20% prices at all levels – is “less likely” to be the direction taken by the White House. Instead, depending on the report, a “system on several levels” of different rate or country rate rate could be announced.

Perhaps also help what seems to be the first recognition that the administration is aware of the tumult of the market resulting from all tariff chat. Speaking today during her daily briefing, the press secretary of the White House, Karoline Leavitt, said that there were legitimate concerns about market oscillations.

Meanwhile, the Israeli finance minister Bezalel Smotrich announced on Tuesday that a process had been launched to get rid of American import prices in this country.