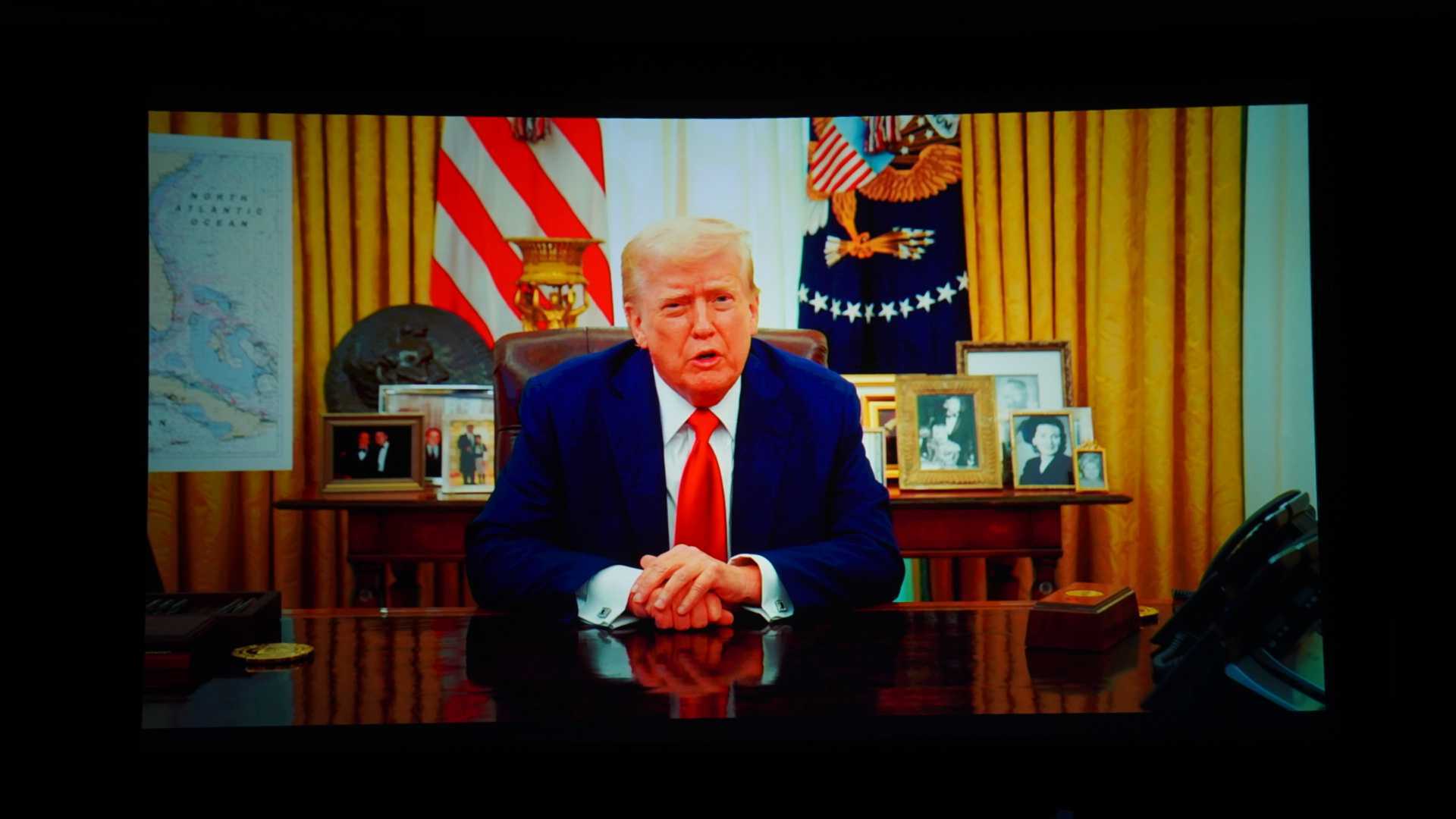

It is a day of risk in Asia when traders turn to Beijing’s response to the reciprocal prices of US President Donald Trump on China and other Asian nations.

Trump on Wednesday announced that reciprocal prices on imports of 180 nations, including higher taxes on business partners identified as the worst offenders, such as China and the European Union.

Trump imposed a new price of 34%on goods from China in addition to the existing tax of 20%, bringing the total levy to 54%, the highest for any nation. Meanwhile, the last action did not affect Canada and Mexico.

The observers say that the ball is now in the Chinese court and that the nature of its reprisals could determine the reaction of the market.

“It all depends on China now. If China devalues the Yuan in response to today’s major American rates, this triggers a global risk that first strikes EMS, then – if he persists – is spreading in the United States. China has so far kept a very low profile.

Early Thursday, Beijing urged the United States to raise prices while immediately producing reprisals. Meanwhile, the Chinese yuan fell to a seven -week 7 RMB / USD as well as losses in Asian actions and an imminent death cross on Bitcoin (BTC).

Leaving the yuan to depreciate, which makes Chinese goods more attractive in international markets, is a way of countering Trump’s prices. That said, it could express trouble for transport transactions (currency) and scare financial markets, as observed in 2015 and 2018.

In addition, the potential intervention of the Banque Populaire de China (PBOC) to block a rapid drop in the Yuan can stimulate the dollar index, inadvertently weighing on risk assets, including shares and cryptocurrencies.

It is not a coincidence that Asian actions have negotiated in the red at the time of the press, Nikkei in Japan reaching an eight -month hollow. US stock contracts have dropped by 2%, pointing to the risk mode.

Bitcoin (BTC), the main cryptocurrency by market value, exchanged nearly $ 83,300, after falling from $ 88,000 to $ 82,500 after the announcement of Trump prices, according to Coindesk market data.

The simple 50-day mobile average (SMA) of the cash price of the cryptocurrency appears on the right track to cross its 200-day SMA, confirming what is called the Dam of Death Cross Technical Model.

Although it has a mixed assessment of prediction of price trends, the last cross which happens in the context of the climbing of trade tensions attracts attention – even more, because the pricing of options now shows biases for put or protection at the end of the end of June, according to Deribit and Amberdata.