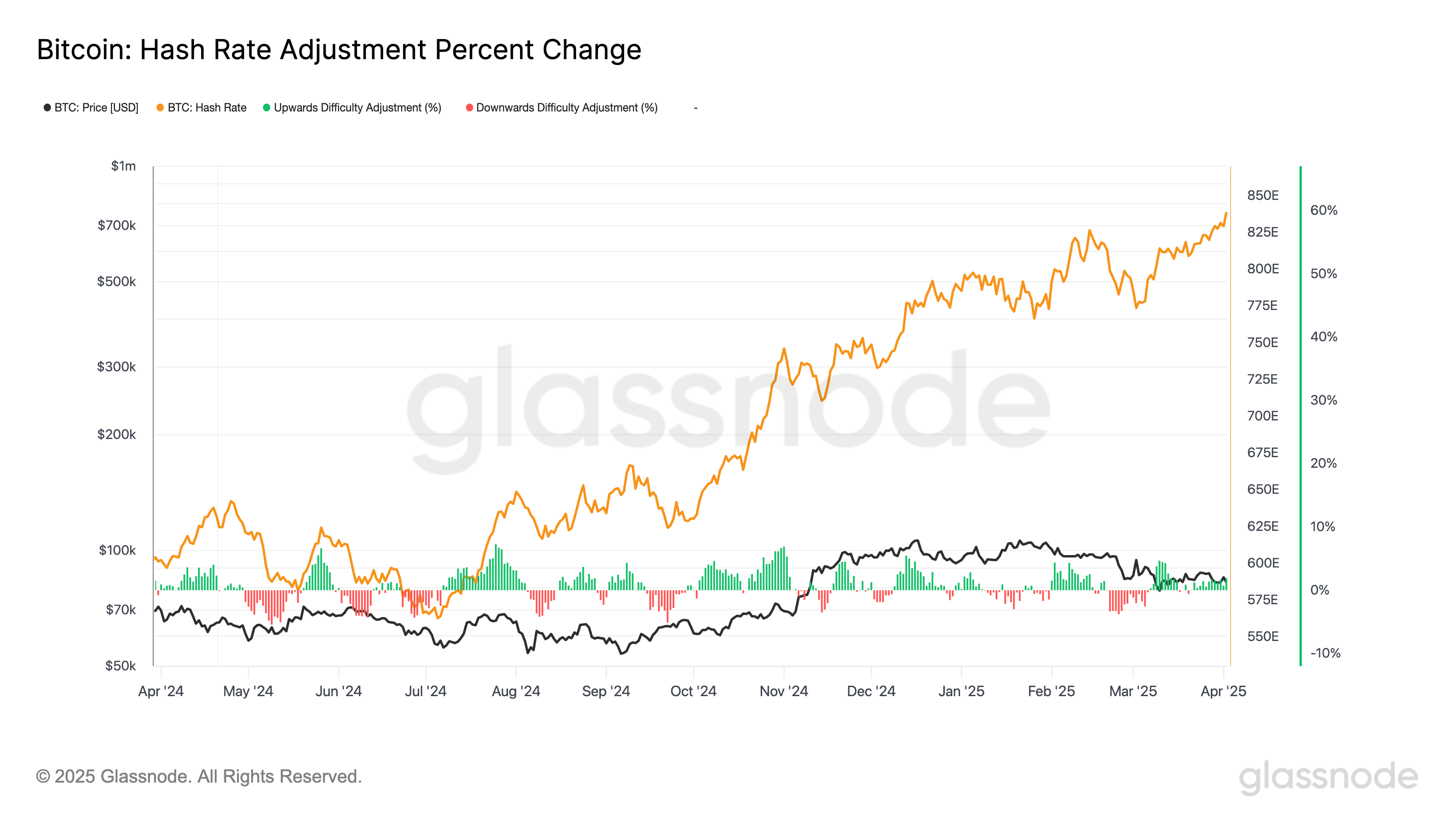

The Bitcoin Blockchain hashrate increases, revealing an increasing dislocation between the activity of the network and the prices of its native Bitcoin Token (BTC).

On a 14 -day mobile average, the hashrate, representing the computing power necessary to exploit a blockchain Bitcoin of evidence of work, recently reached a summit of 838 exams per second (EH / S), and over a period of 24 hours, according to Glassnode data.

The measurement on a 24 -hour window can be misleading due to the variability of the block time, therefore longer deadlines give more reliable information. In two days, the Bitcoin difficulty adjustment – which recaliburs all the 2016 blocks to maintain a 10 -minute block interval – should increase by more than 3%, reaching a new peak.

This divergence between the hash and the price is notable. While Bitcoin remains about 25% below its top of all time, mining costs continue to increase. For minors to remain profitable and cover operational expenses and capital expenses, a high bitcoin price, complete blocks and high transaction costs are essential.

Currently, minors gain income on two channels: block rewards (3.125 BTC per block in the current era) and transaction costs. However, the transaction costs are extremely low – on average approximately 4 BTC per day, or about $ 377,634. While the subsidy of Bitcoin blocks continues to reduce by half every four years, a sustained or increasing transaction activity will be essential to maintain mining incentives.

Near empty blocks

The developer Mononaut, of Mempool, recently noted that Foundry USA Pool extracted the first block of “non -empty” in more than two years, containing only seven transactions – a rarity was only exceeded by a block with four transactions in January 2023.

In other words, while the hashrate increasing an image of a booming network, the almost empty blocks make it the case of a powerful train accelerating the tracks but without passengers.

It is a concern for Nicolas Gregory, creator of the Mercury layer and former director of the Board of Directors of the NASDAQ.

“The half -empty bitcoin blocks tell a story – peddling the value store line could stimulate its future,” said Gregory on X.

“I hope that bitcoins realize that space is more than simple podcasts, spaces and the digital gold story ”` `”. If we do not accept people who use Bitcoin for a real business, it’s the game,” added Gregory.