USDC at the Center for Major Financial Developments

Global economic tensions and changing trade policies create subtle undulations on the Stablescoin market, the USDC undergoing minor volatility while retaining its ankle in dollars.

The Stablecoin recently traveled a brief drop below parity before recovering quickly, demonstrating resilience in the middle of a wider uncertainty of the market while investors are looking for shelters during geopolitical instability.

The Introduction on the Stock Exchange of Circle has revealed unprecedented information on the Stablescoin ecosystem, including the surprising arrangement where Coinbase receives half of the USDC reserve income. With the large Banks JPMorgan and Citibank Backing Circle in public to target an evaluation of $ 4 to 5 billion, the move indicates increasing institutional confidence in the regulated stablecoins despite the current commercial disputes affecting the traditional markets.

As geopolitical tensions are increasing, exchanges like Binance report stable recording deposits, USDC playing a crucial role in derived trade markets.

The stability of the stablecoin made it particularly attractive during the recent market volatility, commercial volumes culminating during the transition phases while investors are looking for protection against economic benefits linked to international commercial conflicts.

USDC Saisiones Technical Analysis

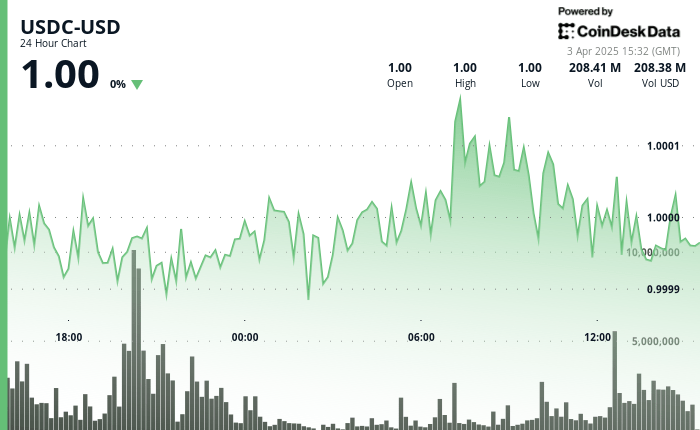

The USDC maintained a narrow range of 0.000829 (0.083%) with annualized volatility of 1.58%.

Price action has shown a gradual drop of 1,0006 to subparity levels around March 31.

A clear support area was formed at 0.9999, with culminating trading volumes during the transition phase.

The recent price action shows a modest recovery trend with the increase in purchase pressure.

Higher hollows and coherent volume models greater than 50m hourly units suggest renewed confidence.

A brief decrease below parity (0.9999) between 09: 53-09: 57 marked the first trades in the subparity during the session.

The increase in trading volumes culminated at 4.1 million units at 09:56 during volatility

Buyers intervened decisively to defend the ankle, causing stabilization of around 1,0000.

Warning: This article was generated with AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy. This article may include information from external sources, which is listed below if necessary.

External references:

Cryptopolitan, “Binance shoots in a record entry of stablescoins”, accessed April 3, 2025

Cryptonews, “Coinbase receives 50% of the reserve of the USDC of Circle reserve, reveals the Introduction file on the stock market”, consulted on April 3, 2025

Bitcoinworld, “Circle IPO EYES 5B VALUATION SUMMARY BY USDC Stability”, accessed April 3, 2025

Cryptonews, “Stablecoin transmitter circle files for the IPO”, accessed April 3, 2025

The Coin Rise, “Circle Files for Nyse Listing in the middle of the rise in Stablecoin’s income: details”, consulted on April 3, 2025