The US Slide of the stock market market was invited to President Donald Trump’s global tariff announcement on Wednesday sent the NASDAQ composite index to one of its largest funks since the start of the century.

The technological index lost 5.5% Thursday, just outside the 20 worst titles of one day since 2000, according to PK Press Club. Most of the largest samples occurred during the Dot-Com Krach of 2000-2001 and the 2008 global financial crisis. Other equity measures have also undergone, the S&P 500 index lowering almost 5%.

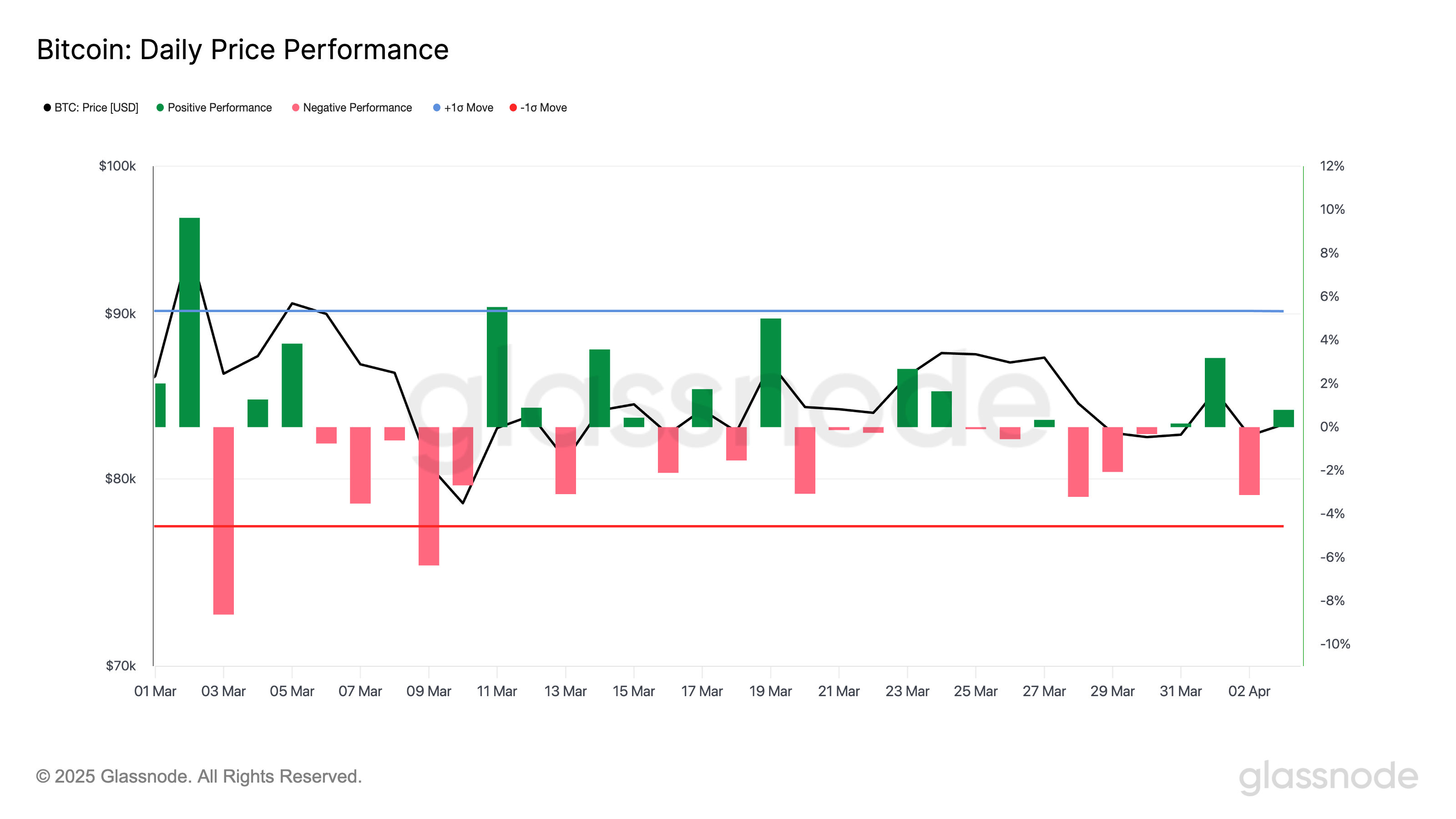

On the other hand, the price of Bitcoin (BTC), which is generally correlated with American actions on short deadlines, has shaken the trend. The largest cryptocurrency, which dropped immediately after the announcement while the stock markets were closed, increased by 0.7% the next day, with momentum between Friday, according to Glassnode data.

Bitcoin is now negotiated over $ 84,000, against around $ 87,000 before Trump started talking. The term contracts on the Nasdaq, on the other hand, are lower on the American job report later due to the day.

Bitcoin completed its lower 2025 in mid-March at around $ 76,000, while the Nasdaq reached a hollow on Thursday. An updated year, Bitcoin surpasses the Nasdaq, losing 10% compared to the 11% of the index.

The Franzen Caleb analyst has highlighted the relative force of Bitcoin compared to the S&P 500 in this risk environment, noting its resilience around the 200 -day mobile average.

“It is quite remarkable to see that Bitcoin is up + 3.4% today compared to the S&P 500, in particular in a risk environment. As I recently emphasized, BTC / SPY continues to keep its number of mobile average at 200 days,” said Franzen in an article on X.