Since the beginning of April, Bitcoin (BTC) has experienced an unusual increase in the conviction of short and long -term holders.

According to Glassnode, short -term holders – those who have held Bitcoin for less than 155 days – are generally more reactive to price movements, often buying during periods of euphoria and selling during slowdowns.

However, recently, short -term holders seem to have become value -oriented buyers despite Bitcoin which is currently sitting around 25% below its top of all time.

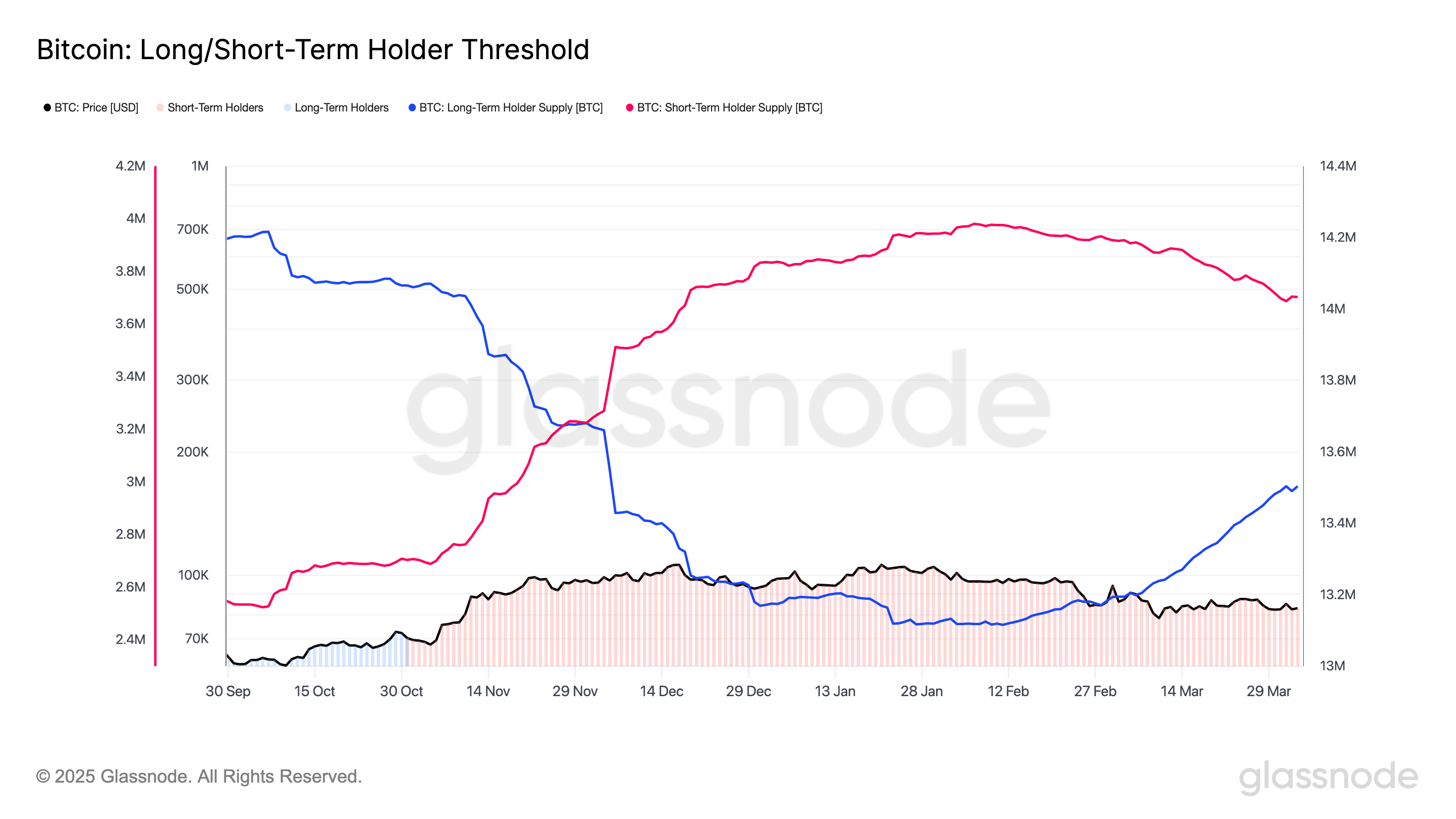

Since the beginning of April, this group has increased by around 15,000 BTC, now holding a total of more than 3.7 million BTC. That said, since February, they have distributed around 280,000 BTC – a combination of profits from the November -December rally, which followed the electoral victory of President Donald Trump. This is added to the sale of panic during the 30% bitcoin levy of its summit of all time in January.

Long -term holders – those who lasted at least 155 days – have increased their hiding place by 400,000 BTC since February, with small amounts acquired this month, bringing the overall count to more than 13.5 million. This suggests a growing conviction among long -term holders, even in the middle of recent prices.

While Bitcoin has remained relatively flat since the beginning of April, the NASDAQ is down 3.5% in the same period of time, with term contracts pointing to an additional decrease of 3%.