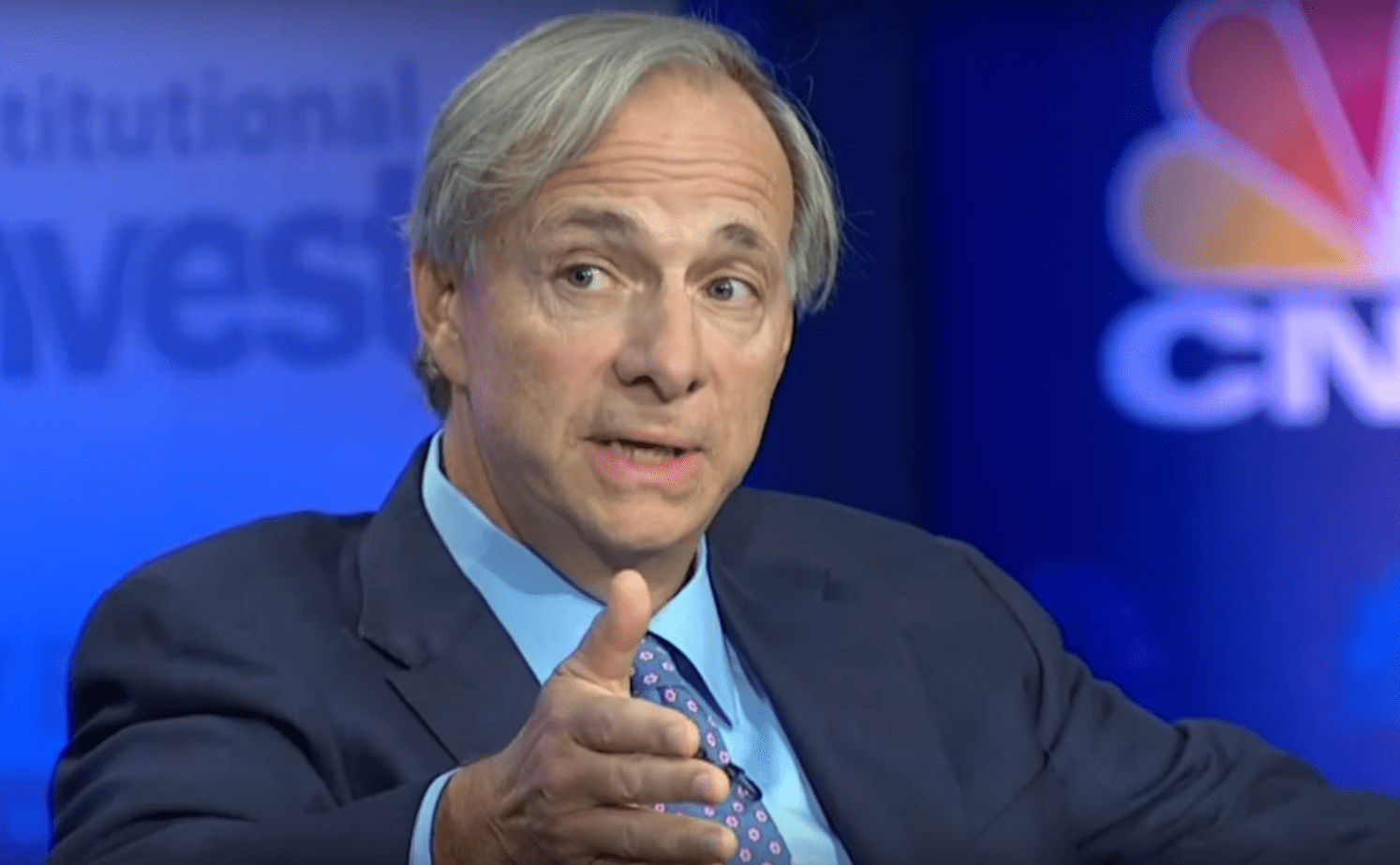

Ray Dalio rings the alarm – not only a potential recession, but a deeper and systemic break in the global economic and political order in an interview with CNBC on Sunday. His concerns are not only concerned with market volatility; They indicate a broader structural fragility.

Interestingly, Bitcoin (BTC) showed resilience in the middle of chaos. Digital assets broke a three -month downward trend and approaches $ 85,000, reporting that it could fall into a role as potential alternative refuge.

The mixed signals continue from the White House on the prices, adding to the growing uncertainty weighing on the world markets. Consequently, the markets continue to be extremely volatile, especially in the past two weeks, while Trump’s pricing policies settle.

Dalio, the founder of the Bridgewater investment giant, is particularly focused on the debt and the United States deficit. He argues that the congress must bring the federal deficit to 3% of GDP, warning that the imbalance between the debt supply and the demand for investors could cause serious dislocations, according to CNBC.

This already takes place on the bond market, where the yields of the US Treasury are climbing. The 10 years is just under 4.5%, while 30 years oscillate just below 5%. These high yields are rattling markets and could force the federal reserve to intervene to calm the markets.

Dalio also warns that tariff uncertainty feeds wider macro instability. The US dollar, as measured by the index Dxy, has now fallen below 100 for the first time in years – a potential sign of capital leakage from the American Dalio requires a complete trade agreement with China and an adjustment of the currency to strengthen the Yuan, aimed at stabilizing a system that seems more and more fragile.

In a comparison that gives to think, Dalio compares the risks of today to those observed during the American exit of the OR stallion in 1971 and the global financial crisis in 2008. The two were inflection points that reshaped the financial system.

Non-liability clause: This article, or part of IT, was generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.