Bitcoin (BTC) still derived as slowly on Monday while the wider market adapts favorably to new trade.

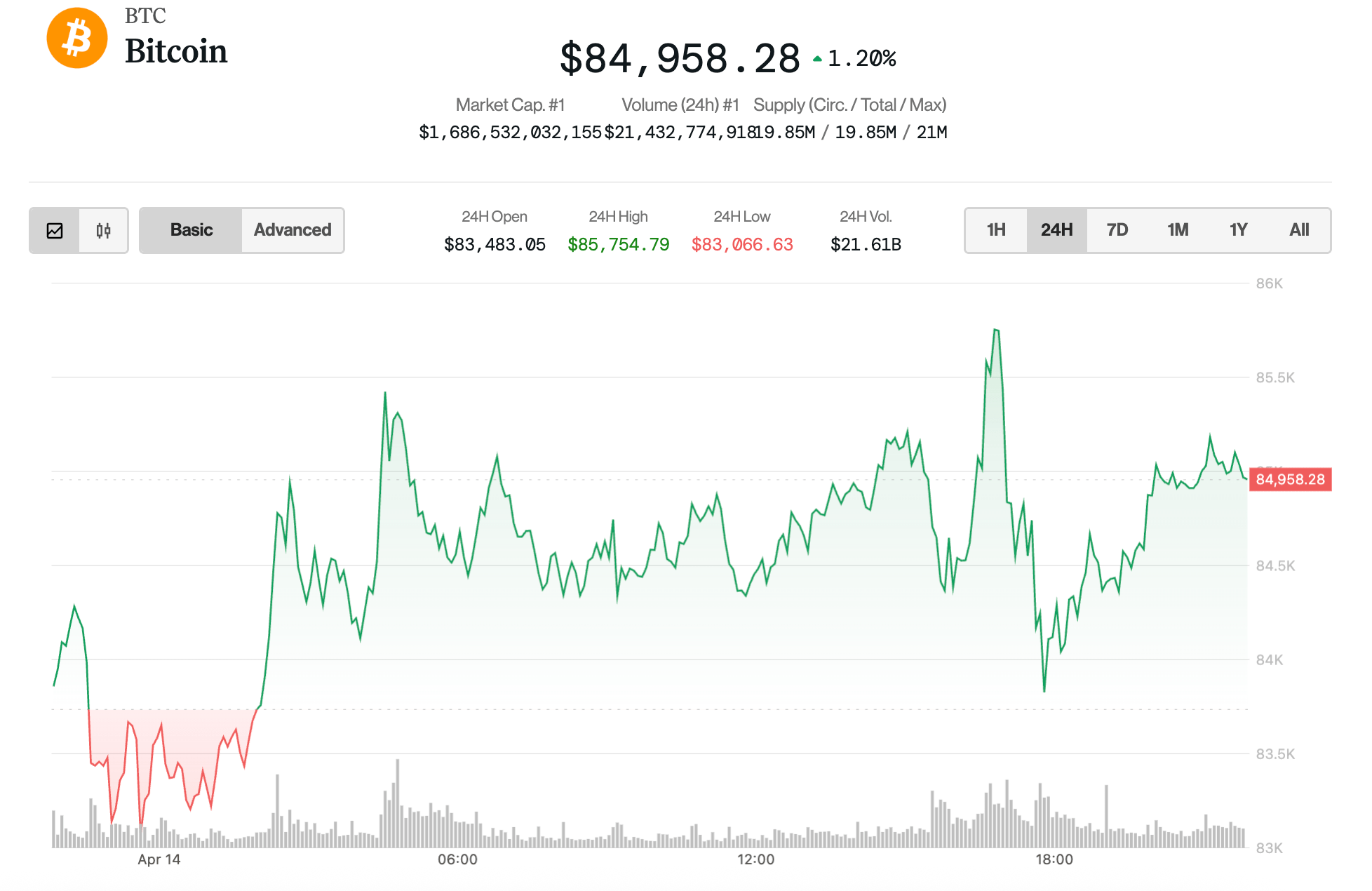

The largest cryptocurrency increased 1.6% in the last 24 hours and is now negotiated at just under $ 85,000. Ether (ETH), on the other hand, increased by 2.7% during the same period to $ 1,630. The Coindesk 20 index with a large market – consisted of the 20 best cryptocurrencies by market capitalization, with the exception of stablescoins, the same and exchange parts – advanced of 1.2%, led by ground and Avox gains.

After a few wild weeks, the stock market has also increased today, the NASDAQ closes with a gain of 0.6% and the S&P 500 increasing by 0.8%. The strategy (MSTR) and Mara Holdings (Mara), led among the cryptography actions with around 3% of gains.

The modest rally came while the governor of the Federal Reserve Christopher Waller reporting that a return of the Punump Prices of Trump Original would trigger the need for low -size “bad news” drops.

“”[Tariff] The effects on production and employment could be more sustainable and an important factor in determining the appropriate position of monetary policy, “said Waller in a speech.” If the slowdown is important and even threatens a recession, then I would expect to promote the reduction of the FOMC policy rate earlier, and to a greater extent than I had thought previously. “”

The European Commission of Europe has been supported, the EU executive branch, confirming to preserve the reprisals on American goods worth 21 billion euros until July 14 to “allow a place for negotiations”.

It is likely that the United States and the EU will reach a trade agreement to prevent prices from 65% on the prediction market based on blockchain after US President Donald Trump said that an agreement was in preparation.

Bitcoin Fundamentals Recuring

The Bitcoin rescue gathering of last week’s pricing disorders stopped around the level of resistance of $ 85,000, but the fundamental principles of the improvement of the network stimulate hopes for an eruption of Swissblock Technologies of the Cryptographic Analysis Society.

“Since March, we have seen an influx coherent of new participants,” wrote Swissblock analysts in a telegram program. “Liquidity is stabilized, more erratic swings from the beginning of 2025.”

“Once the liquidity gauge lies above line 50, short-term price action tends to follow with force,” said Swissblock analysts. “With the alignment of network growth, key levels are not only revised, they are accumulated.”

“This is the type of structural support that underpins sustainable rallies,” they concluded.