This is a daily technical analysis of the Coindesk analyst and technician of the approved market Omkar Godbole.

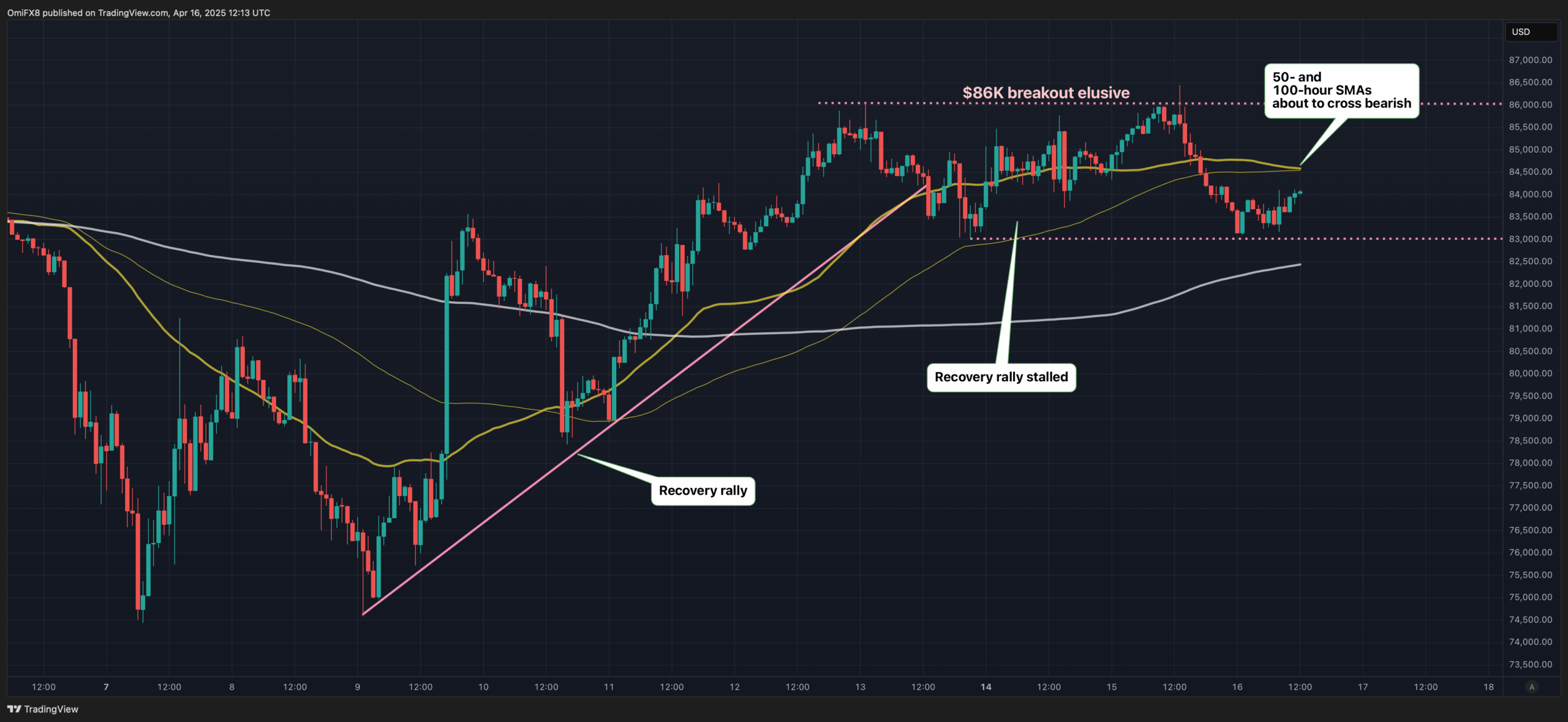

The Bitcoin recovery rally (BTC) has been in a standstill since Sunday, increasing the risk of a lower change in key indicators.

Since Sunday, the $ 86,000 mark has become a resistance and supply zone, the bulls cannot maintain gains above this level. Elusive escape has increased the risk of a lowering of a lowering in key momentum indicators – simple mobile averages of 50, 100 and 200 hours (SMA). The three averages stacked under the others and the southern trends represent the lowering alignment.

The 50 and 100 -hour SMAS have peaked and appear on the right track to produce a lower crossover that will see the first to move under the second. While the price of cryptocurrency remains higher than the 200-hour SMA, the imminent bear cross of the other two SMAS indicates that sellers seek to reaffirm themselves.

In addition, the MacD histogram of the daily graphic has stopped successively print higher bars above the zero line, reflecting a loss of momentum up to support the concept of potential lower developments on the market.

All this, given in the context of the tendency of SMS downwards 50 and 100 days, calls for caution on the part of Bulls. A movement of less than $ 83,000, the hourly support for graphics, would validate the lowering developments, which potentially gives a sale at recent stockings nearly $ 75,000.

Meanwhile, a UTC fence above $ 86,000 is necessary to report a continuation of the recovery rally.