XRP could be the next cryptocurrency to obtain a list of ETF Spot in the United States after Bitcoin (BTC) and Ether (ETH), analysts have argued this week. However, the market of options classified by Déribit does not share this optimism.

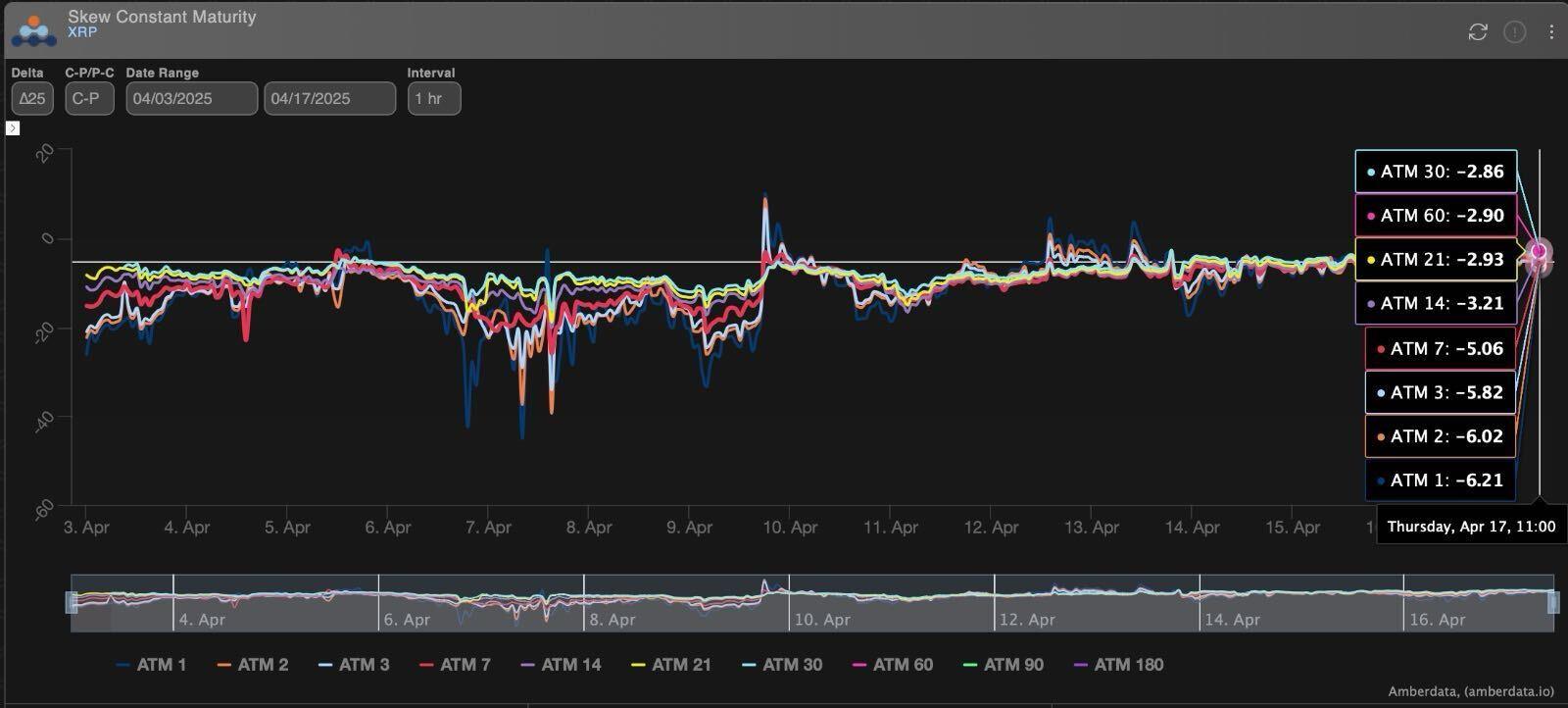

At the time of writing, the Deribit Put options linked to XRP were more expensive than calls on several deadlines, according to the amberdata data source. It is a sign of persistent fears down.

An option to sell provides insurance against price reductions and traders buy it when you are looking to hide or take advantage of a planned price drop.

The bias for puts was obvious from negative biases through deadlines. SCKEW options measures the implicit volatility bonus (request) for calls in relation to puts.

XRP plunged from an ascending corner early Wednesday, reporting a possible recent stockings at around $ 1.6.

Earlier this week, analysts declared that XRP had a relatively better command book depth, which implies an ease of negotiation of significant orders at stable prices, compared to Solana soil and other tokens. This meant that the coin focused on payments used by Ripple to facilitate cross-border transactions could be the next digital asset to obtain an ETF spot approval in the United States