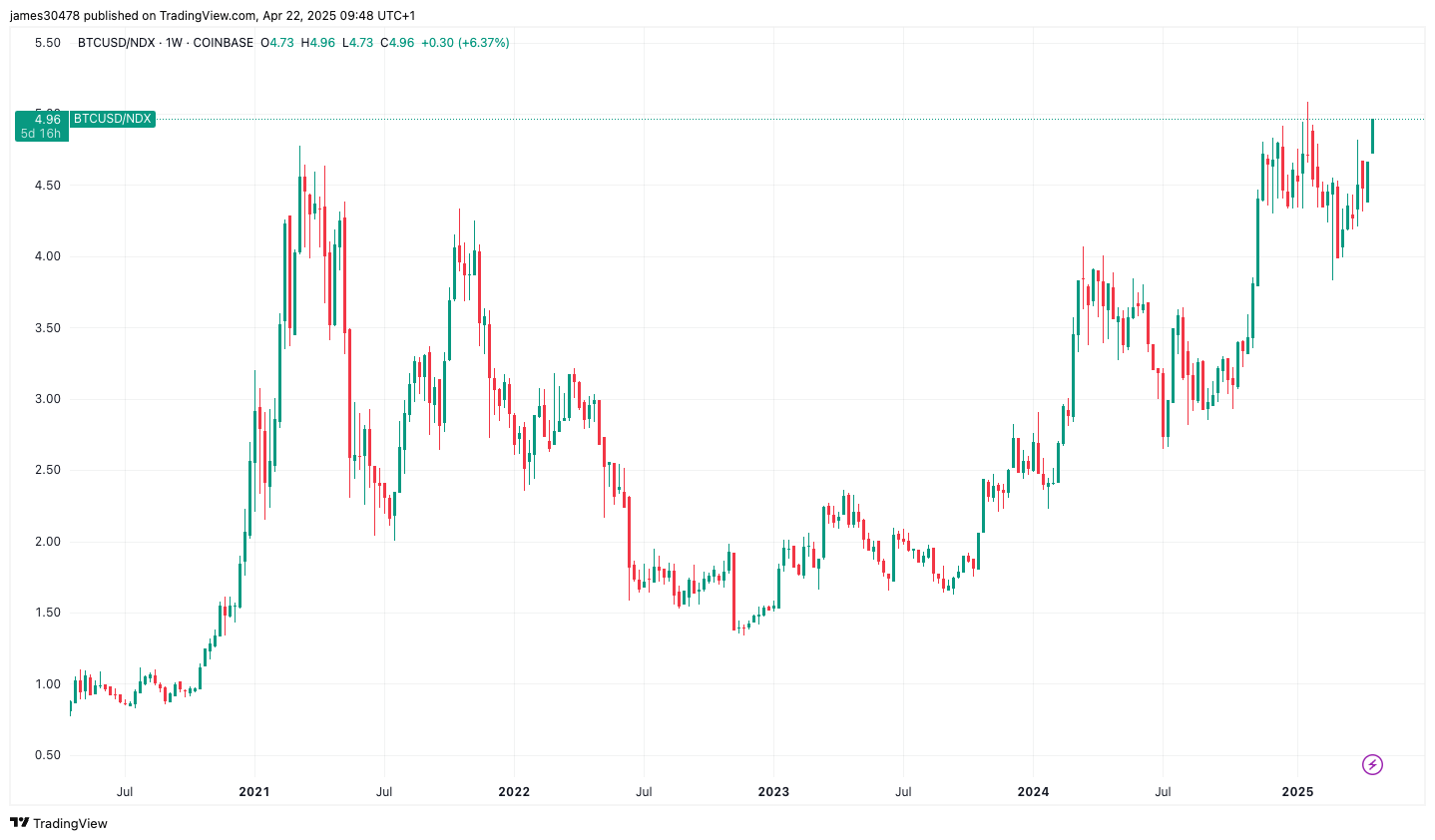

Bitcoin (BTC) is about to go out compared to the NASDAQ 100 composite, with the current BTC / NASDAQ ratio seated at 4.96. This means that nearly five Nasdaq units now need to correspond to the value of a bitcoin. The previous record of 5.08 was set in January 2025, when Bitcoin reached its summit more than $ 109,000.

Historically, each market cycle has seen the ratio reach new heights – 2017, 2021 and now 2025 – continuous outperformance of Bitcoin against the Nasdaq.

On several deadlines, Bitcoin dives more and more American technological actions. An updated year, Bitcoin is down 6%, compared to the 15% drop in NASDAQ. Since Donald Trump’s electoral victory in November 2024, Bitcoin has joined 30%, while the Nasdaq has dropped 12%.

When measured compared to the “magnificent seven” technological actions of mega-captain, Bitcoin remains at around 20% below its summit of all time from February this year. This indicates that although Bitcoin has shown strength, the best technological names resist better than the larger Nasdaq composite.

Strategy (MSTR), a well -known proxy for Bitcoin exposure, is also better than American technological actions. Since he joined the qqq ETF on December 23, MSTR is down 11%, while the ETF itself fell by more than 16%. The divergence became more pronounced in 2025: the MSTR is up 6% of up to date, compared to the decrease of 15% of qqq.