Bitcoin (BTC) commanding position in the cryptographic ecosystem continues to strengthen.

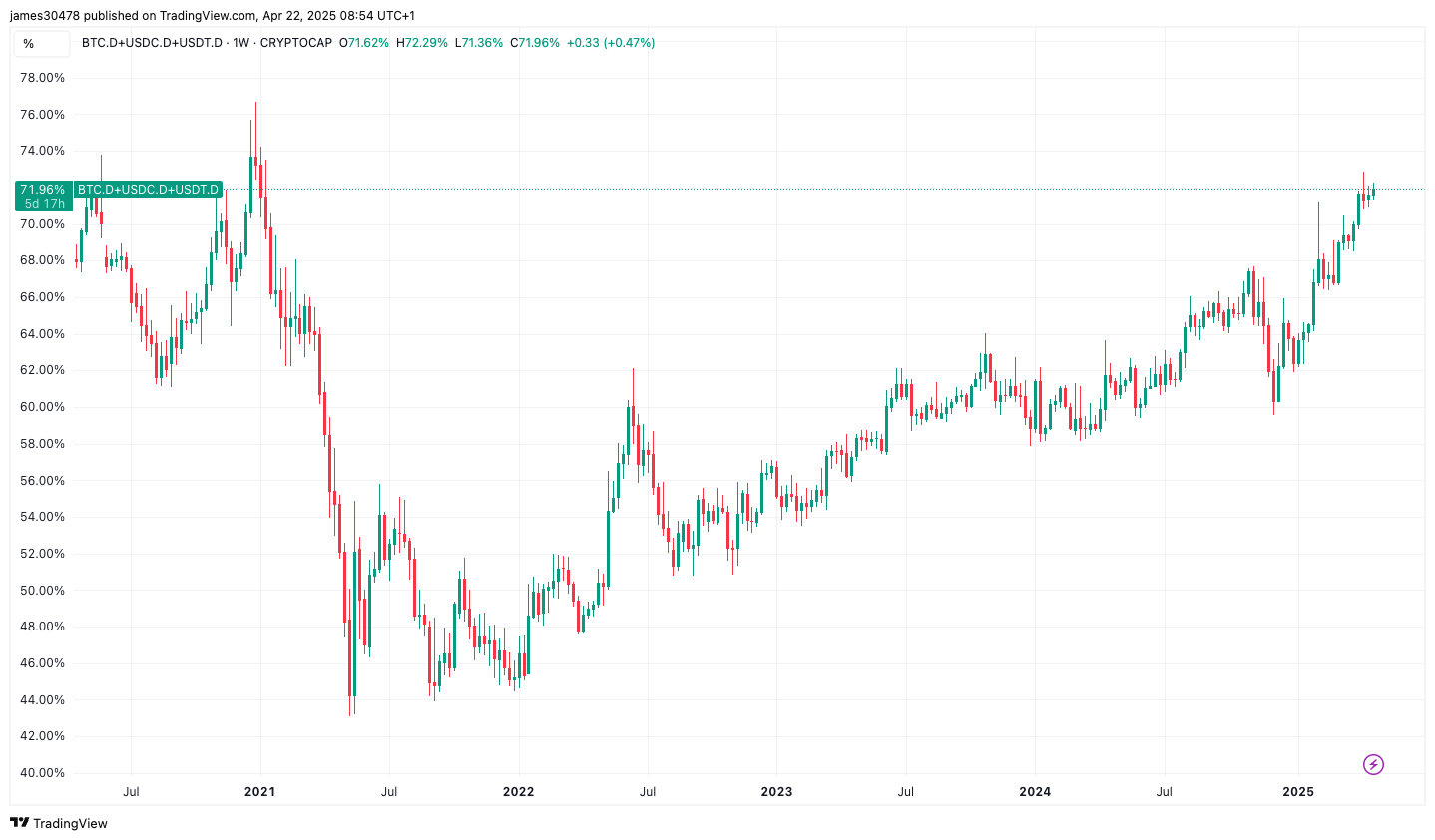

When combined with the first two Stablecoins by market capitalization – TETHER (USDT) and CIRCLE (USDC) – These three assets now represent approximately 72% of the total cryptocurrency market. This dominance highlights a broader consolidation at the top of the digital asset market, while capital revolves towards security and perceived strength.

The BTC alone has reached a share of 64.60% of cryptographic market capitalization, briefly affecting the levels that have not been seen since January 2021. This increase in domination reflects an increasing preference of investors for bitcoin in the macroeconomic and the uncertainty of the current market.

While Bitcoin consolidates its leadership, its closest competitor, Ether (ETH), continues to fight in 2025. ETH fell by more than 50% year to appointment, underperforming Bitcoin. The ETH / BTC ratio slipped to 0.01765, a level given for the last time at the beginning of 2020, highlighting the performance widening gap between the two main digital active ingredients.

Bitcoin has also diverged American actions in particular. Since the “Liberation Day” at the beginning of April, the S&P 500 has been down 6%, while the BTC is up 4%, actually holding the ground despite external market pressures. During the editorial staff, Bitcoin is slightly negotiated more than $ 88,000, while Ether just holds more than $ 1,600.

Key technical levels to watch for Bitcoin

Bitcoin is currently just under several critical levels on the chain and techniques that could influence the short -term prize management:

- Mobile average at 200 days: $ 87,965

- 2025 Prize achieved (Average cost base on the chain for 2025 BTC buyers): $ 91,565

- Short -term holder prize achieved (average entry price for the BTC held in less than six months): $ 92,385

Historically, Bitcoin tends to enter a bullish market supported during negotiations above these key technical levels.