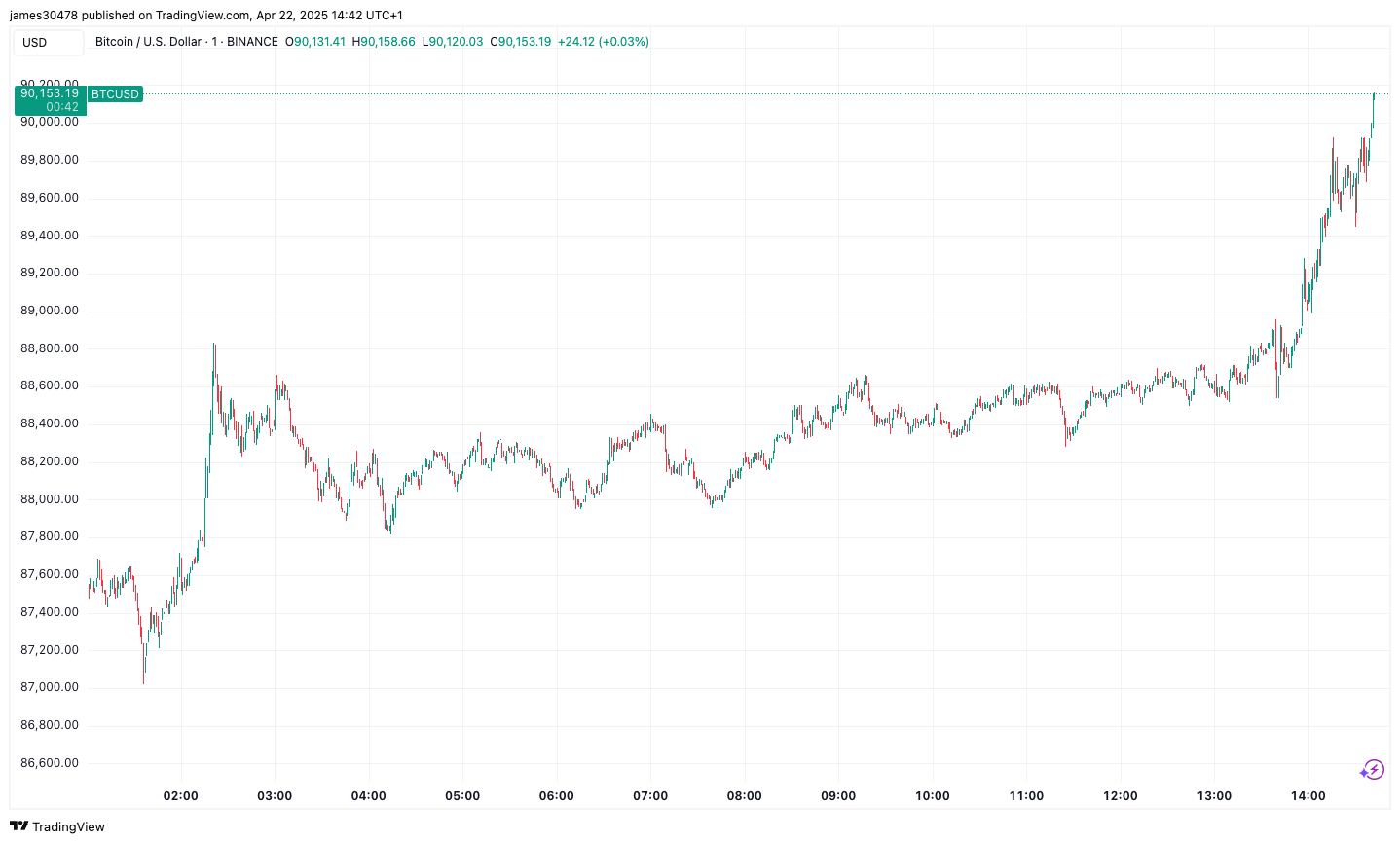

Bitcoin (BTC) has increased to $ 90,000 for the first time since March 7, adding more than 5% in the last five days, because the paths of the largest cryptocurrency and traditional actions divergent.

In comparison, the S&P 500 was exchanged above 5,700 points on March 7 and has since slipped below 5,200.

Despite the recent rebound, Bitcoin remains down more than 5% over a year. However, it has recovered considerably from its lower April 8, when it fell by almost 20% over the year and more than 30% below its record of around $ 109,000 in January. This marked the most steep correction of this cycle and overshadowed the downside of August 2024, when it slipped to $ 49,000.

From the point of view of the market structure, the average perpetual financing rate between exchanges is currently negative.

Perpetual financing rates reflect the cost of keeping long or short positions on the term markets. When the rate is negative, this means that the uncovered sellers pay long holders to maintain their positions, a configuration that can speed up prices increases because shorts are forced to cover their positions in what is called short pressure.

Adding to the bullish momentum on Monday has marked the biggest entry into a day in the Bitcoin Bitcoin FNB since January 30, totaling more than $ 380 million. With the Nasdaq up more than 1% on what some observers call the “Tuesday turnaround”, Bitcoin can gain upwards, although the main levels of technical resistance are still in advance.

Non-liability clause: This article, or part of IT, was generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.

Update (April 22, 13:55 UTC): Add the history of price movements in the third paragraph, the market structure starting in fourth.