Crypto -related actions jumped on Tuesday, going up the momentum of a wider crypto rally that has rekindled risks on digital assets with Bitcoin (BTC) crossing $ 90,000.

Strategy shares (MSTR), the largest business BTC holder, and Crypto Exchange Coinbase (corner) increased from 8% to 9% during the session.

Bitcoin minors have led Bitcoin minors, many of whom showing two -digit gains, exceeding 5% BTC advance. Bitdeer Technologies (BTDR) rallied some 20%, while Bitfarms (BitF), Cleanspark (CLSK), Cipher Mining (CIFR), Mara Holdings (Mara) and Riot Platforms (Riot) climbed between 10% and 15% during the session.

Meanwhile, the wider stock market also rebounded yesterday, with the Nasdaq and the S&P 500 up 2% and 1.7%, respectively. The rally on the Tradfi market came while the potential de-escalation reports of American-Chinese tariff tension raised the feeling of investors.

Minors and tariff risks

The rebound in mining actions comes after months of underperformance, weighed down by compressed margins, an increase in hash competition and difficulties induced by prices, which are all combined with a larger low market for risk assets. Most, if not all, the minors listed on the stock market are still negotiated nearly more.

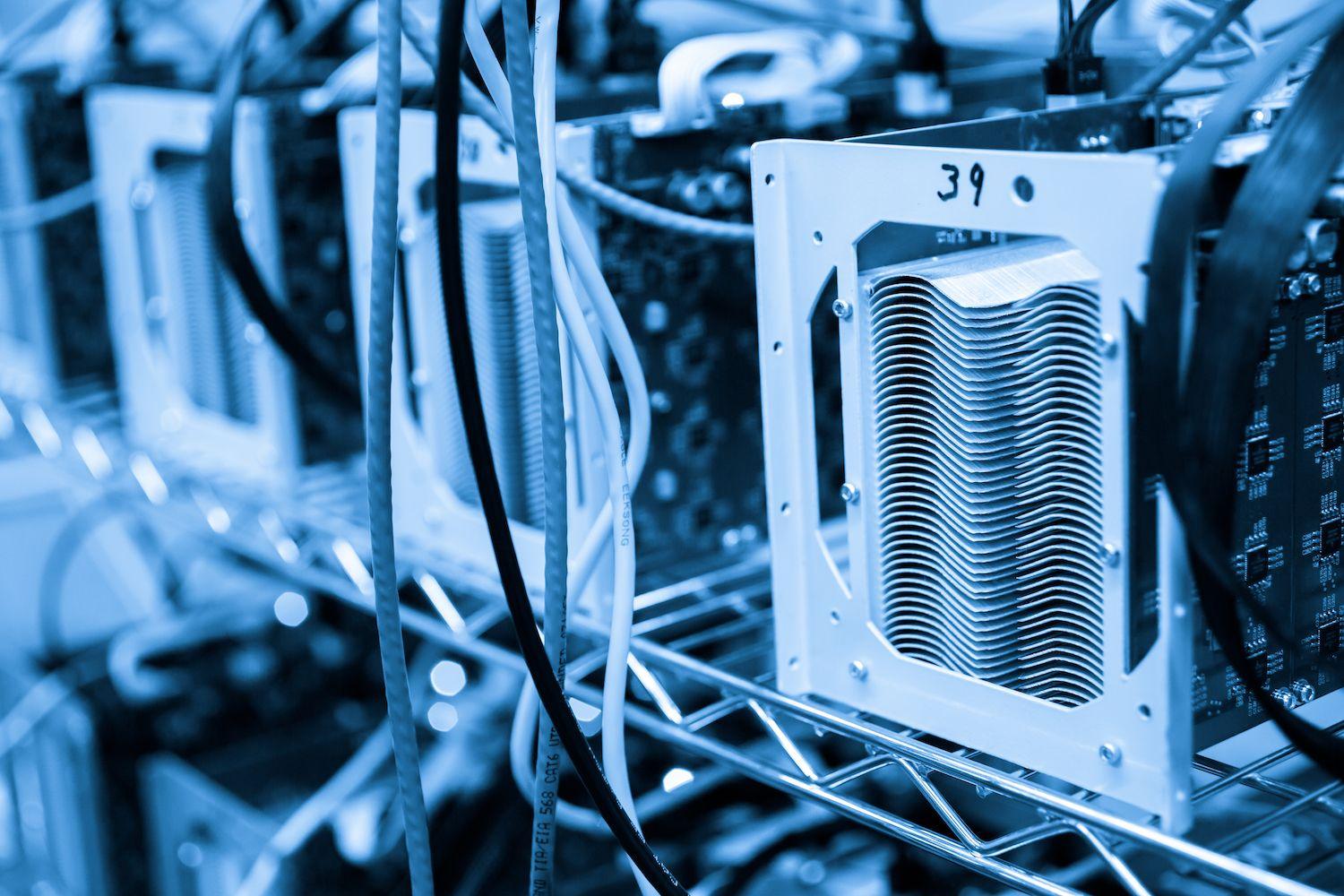

The problem for mining operations based in the United States is the Trump administration pricing policy, which threatens to make the ASICs (machines used to exploit Bitcoin) much more expensive to import. This means that mining operations in the United States will probably develop at a much slower pace or even stop growing completely.

The prices “will materially allocate future expenses and the CAPEX in the United States,” Taras KULYK, co-founder and CEO of the Mining Equipment Supplier, Synteq Digital, recently.

“Other jurisdictions that had previously looked at a higher cost [will] Become objectives sought for a new infra and capex deployment. Canada in particular will probably be a benefactor for the implementation of the global tariff regime which has been set up by the White House. »»

Likewise, one of the reasons for the outperformance of Bitdeer can be that the company develops its own ASIC manufacturing company and has recently made the decision to strengthen its self-exploitation capacities instead of selling its platforms on a slower market. The stable giant, Tether, was also on a wave of purchase of BTDR shares; Last Thursday, the company had invested $ 32 million in Bitdeer.

Despite this, most minors’ actions have been down since December, long before the White House revealed its new pricing policy. Now, with BTC climbing above the main technical levels and the liquidity that go up in space, minors probably catch an offer as a lever effect for the BTC rise.

Whatever outperformance today, prices will continue to play a key role in minors and most of the crypto -related actions, as well as other risk assets. With the profits season that starts soon, all eyes will be on the comments of CEOs on how the price situation will modify the company’s prospects. In particular, Tesla d’Elon Musk, who also holds Bitcoin in her treasure, will report her profits after the market on Tuesday, potentially offering an overview of the way traders should price in the uncertainties of the trade war.