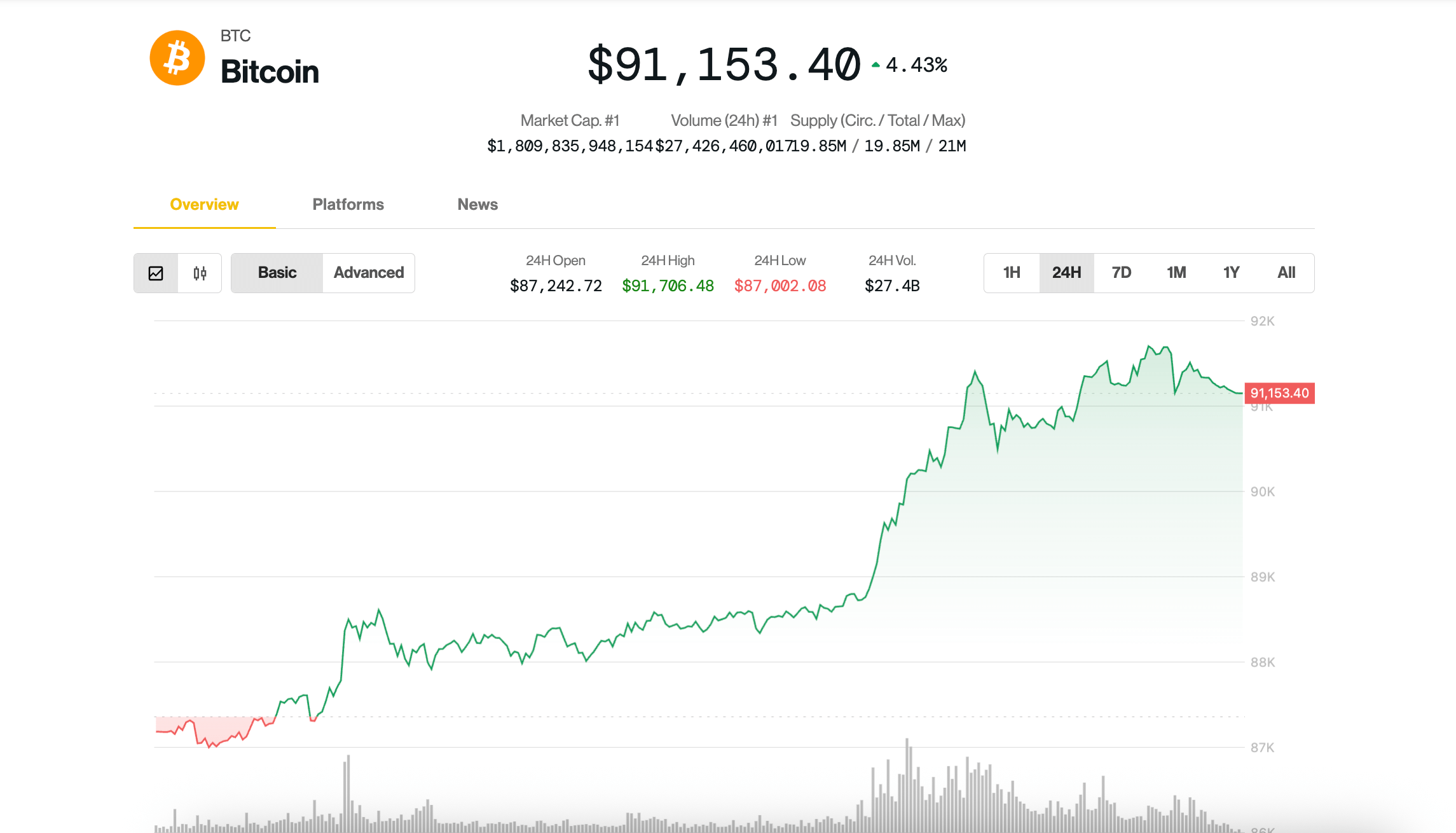

Bitcoin (BTC) exceeded $ 91,000 on Tuesday, climbing almost 5% in a renewal of the optimism of investors and new hopes of a thaw in American-Chinese trade tensions, but the opposite winds persist which could increase more, the cryptotic analysis company has been warned.

The largest crypto by market capitalization has reached $ 91,700 in the American afternoon, its highest price since early March. Altcoins followed BTC above, with Ethereum ether (ETH) increasing by 8% in the last 24 hours over $ 1,700, and Dogecoin (Doge) and the indigenous token of Sui (sui) winning respectively 8.6% and 11.7%. The CROPTO 20 Crypto 20 -market reference index advanced 5.2%.

The markets were raised by remarks from the American secretary of the Treasury, Scott Bessent, who reportedly told investors during a JPMorgan door event that the price with China was not durable. Bessent said that de -escalation would come “in the very close future”, characterizing current conditions as a “commercial embargo”. However, he warned that a more complete agreement between the two nations could even take years.

The shares have recovered from yesterday’s drop, the S&P 500 and the NASDAQ, heavy in technology, ending the 2.5% and 2.7% session respectively. Gold, on the other hand, has strongly reversed its record price of $ 3,500 during the day and dropped by 1%.

“While the capital runs in safe and inflation cashier, BTC and gold prove to be the main beneficiaries of the exodus from the USD risk,” said hedge fund QCP capital analysts in a telegram program.

They highlighted rejuvenating entries to identify the FNB BTC classified in the United States and the return of the so-called Coinbase price premium, suggesting the demand of American institutional investors. BTC ETF reserved more than $ 381 million in net entries increased on Monday to $ 107 million on Thursday, according to Farside Investors data.

But not all signs point to a sustained break.

Despite the price leap, data on the chain indicate fragility below the surface, said cryptocurrency analysts in a Tuesday report. The apparent demand for Bitcoin has decreased by 146,000 BTC in the last 30 days – an improvement compared to the clear drop in March, but still negative. The demand for momentum of the crypto -friendly demand, which follows the new interests of investors, has deteriorated more at its most lower level since October 2024, noted the report.

The liquidity of the market remains gentle, the report using the growth of the USDT market capitalization as an indirect indicator of cryptographic liquidity. The USDT has increased by $ 2.9 billion in the past two months, below its 30 -day average. Historically, BTC rallies have coincided with USDT growth over $ 5 billion and above the trend-a threshold not yet reached.

Adding to caution, Bitcoin is now faced with a key resistance zone between $ 91,000 and $ 92,000 in the metric of the price made “of the merchant”, a level which has often served as resistance in leased conditions. The cryptocurrency chain bull score has classified current market conditions, suggesting that a break or a decline could follow if the feeling is weakening.