Bitcoin (BTC) returned to a positive territory for the year for the first time in almost two months, approaching $ 95,000 and erasing a drop of 18%.

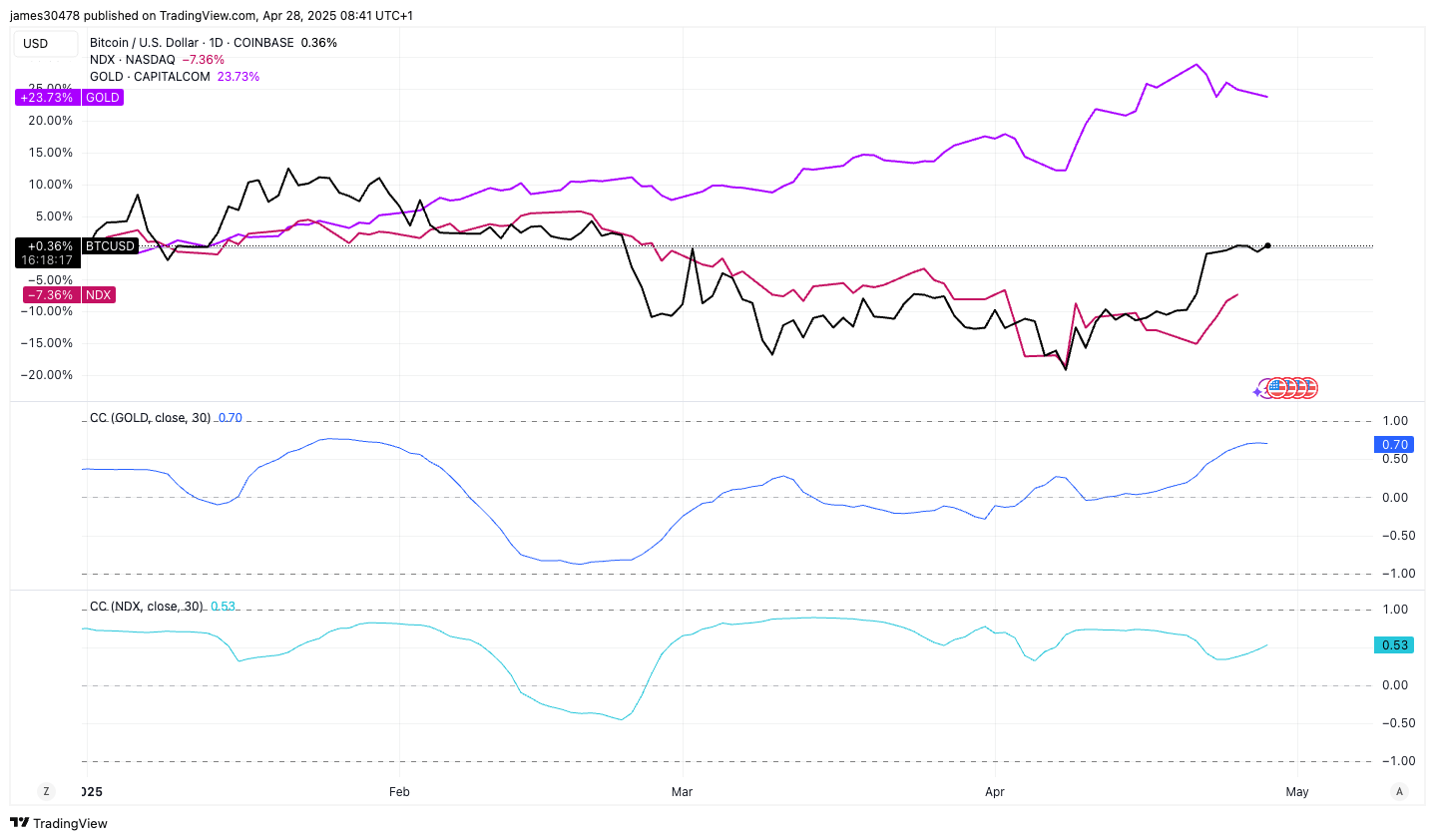

Its current performances, up 1.5% since December 31, place it between gold, which won 24% and the Nasdaq 100, which is down by more than 7%. Consequently, the Bitcoin narrative positioning as a stock of technology with leverage or digital gold is slightly leaning towards the digital gold story. But only.

The analysis of the Bitcoin correlation coefficients on a 30 -day mobile average, the largest cryptocurrency by market capitalization now shows a strong correlation of 0.70 with gold and a lower 0.53 correlation with the NASDAQ 100. The correlation values can work between 1, a strong positive correlation and -1, a strong negative correlation.

Last week, the Bitcoin price increased by 10%, its strongest performance since the end of the week ending on November 17 during the management of prices after the electoral victory of President Donald Trump.

Meanwhile, Trump’s prices continue to feed economic uncertainty. According to Bloomberg, the American samples from Chinese goods were raised to 145% earlier this month, resulting in a significant drop in the demand for shipping goods. As indicated in the report, large retailers like Walmart warn that empty shelves and higher prices could return, recalling the cocovio era.