Geopolitical tensions and the evolution of trade policies continue to shape the markets of cryptocurrencies, Solana emerging as a focal point in the middle of global economic uncertainty.

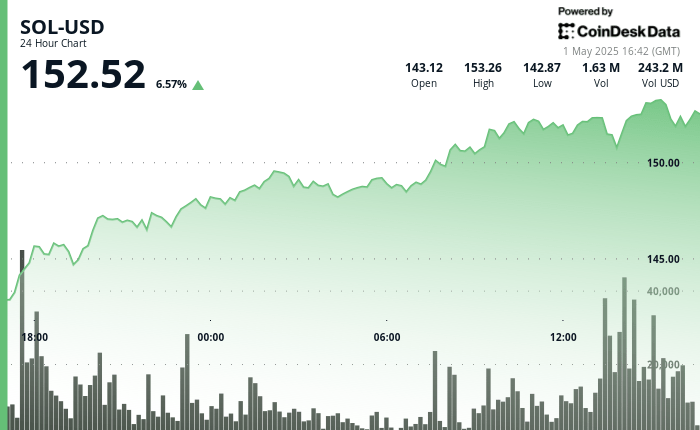

Sol has shown an impressive recovery force, climbing 8% compared to its lowest April 30 from $ 140 to around $ 152, the daily negotiation volume jumping 35% compared to 24 hours. This resilience comes as the American-Chinese trade relations are deteriorating, the creation of training effects on the markets of traditional and digital assets.

This decision comes as the wider index of the market gauge 20, climbed approximately 4% on Thursday.

Strengths of technical analysis

- Soil was awarded a significant correction of 7.4% on April 30, from 148.03 to 140.63 before reaching new heights at 152.69.

- The overall negotiation range of 12.04 points (8.3%) presents volatility, with solid support established at 140.65.

- The volume analysis reveals an increased exchange during the correction (volume of 2.4 m +) Monitoring of the purchase interests supported during the recovery.

- The recent price action constitutes an upward channel with resistance to 152.50, while the area 148.50-149.50 serves as a key level of support, according to the technical analysis of Coindesk Research.

- The bullish momentum seems durable with higher training, suggesting a potential continuation to the psychological level of 155.00.

- In the last 100 minutes, Sol has experienced significant volatility, strongly from 152.38 to a hollow of 150.74 before staging a V recovery to 152.49.

- The key support established at 151.10, where a substantial purchase volume (44K +) emerged.

- A mid-session rally from 151.22 to 152.60 coincided with the highest volume point (126k at 2:00 p.m.), indicating a strong institutional interest.

- The short -term ascending channel was established with resistance to 152.68 and support at 152.32.

- Zone 152.45-152.50 is now used as immediate resistance which could determine the short-term management.

Warning: This article was generated with AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy. This article may include information from external sources, which is listed below if necessary.

External references:

- Newsbtc, The monthly candle Solana recovers key levels – is $ 240 the next target?Posted on April 30, 2025.

- Newsbtc, Solana: analysts provide the Q3 ATH rally while Sol Retests is or breaking the levelPosted on April 29, 2025.

- Cointelegraph, Why is Solana (soil) up today?Posted on April 17, 2025.

- Cryptopote, Tension buildings: Solana (floor) on the verge of a huge movement?Posted on April 30, 2025.