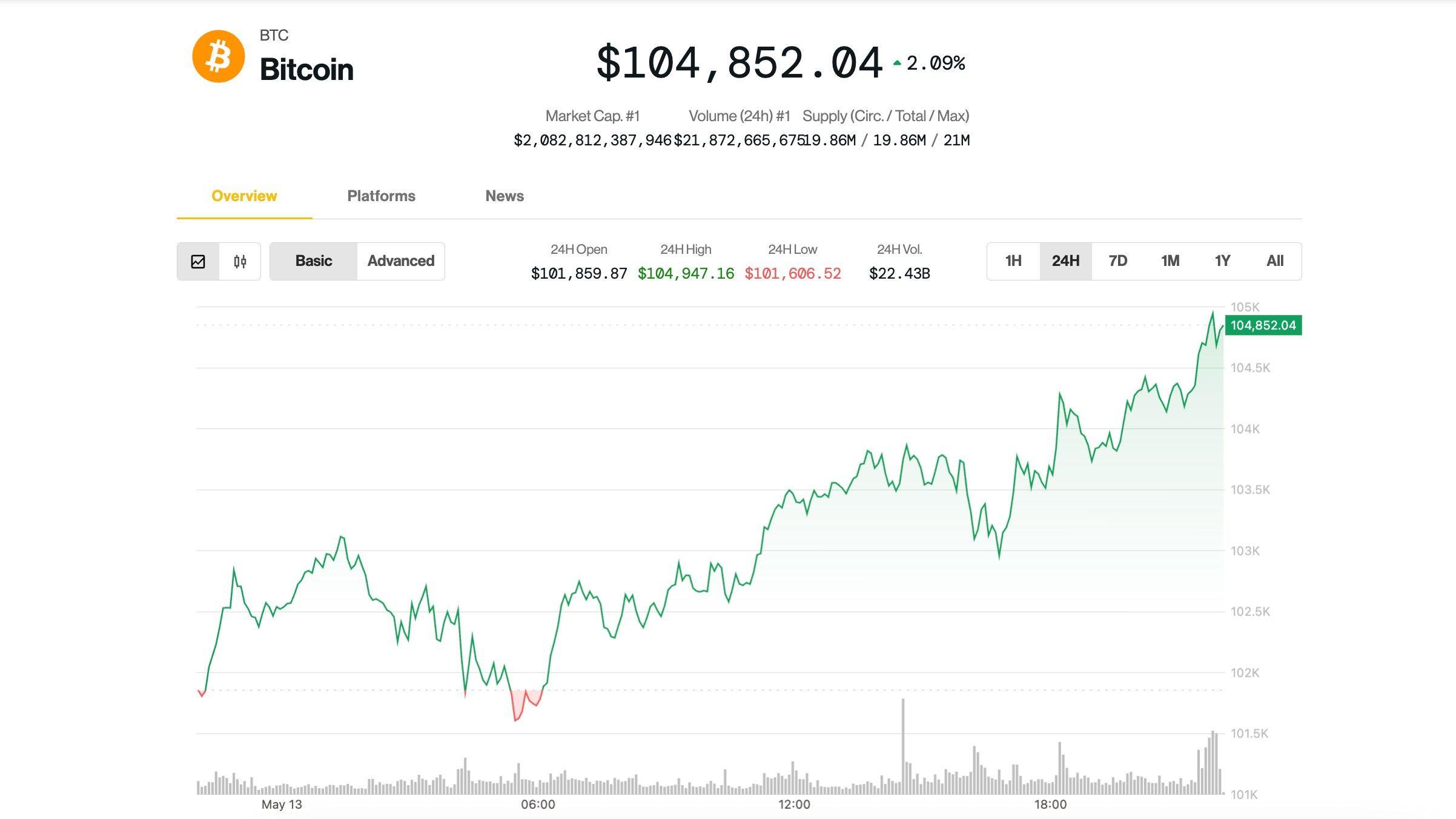

Bitcoin BTC$104 391.11 Mounted on Tuesday above $ 104,000 with data on welcome fresh inflation, the optimistic perspective of President Trump on the financial markets and the inclusion of Coinbase in the S&P 500 among the catalysts for the advance.

The APRIL consumption price index (IPC) has arrived cooler than expected, which may increase pressure on the federal reserve concerned with inflation due to prices. The planned speech by the president of the Fed, Jerome Powell, could provide additional political guidelines.

The optimistic atmosphere was lifted by Donald Trump, who told participants in the Saudi-American investment forum in Riyadh that the markets “could go much higher”.

Bitcoin (BTC) almost touched $ 105,000 before retreating, at the time of the press, exchanging 2.4% more in the last 24 hours at around $ 104,400. Most altcoins of the Coindesk 20 indexes have outperformed. Etherum ether Ethn$2,680.60 continued its resurgence advancing more than 9% to $ 2,700. Reaffirming protocol and the decentralized financing protocol (DEFI) Ethfi$1.36 Reserved more than 20 to 30% of daily earnings.

The shares have added to their recent gains, the Nasdaq and the S&P 500 up 1.6% and 0.75%, respectively, when the session is closed. Crypto exchange corner classified by the Nasdaq (corner) jumped 24% during the day, because the stock should benefit from the S&P 500 index. The change could release $ 16 billion in purchase pressure for the shares, Jefferies has planned.

Joel Kruger, market strategist at LMAX Group, said that the cryptography market is still digesting last week gains, but that the rally is still momentum. “Currently, the market seems to stop for breathing, but the feeling in force in recent titles suggests that this rally still has room to grow,” said Kruger.

He underlined a rebound in the appetite for global risks and an increasing number of institutional tail winds. “A notable factor is the growing adoption of cryptocurrency, as evidenced by developments in American financial markets. The inclusion of Coinbase in the S&P 500 marks a historic stage, which established it as the first native cryptographic enterprise to join this prestigious index,” said Kruger.

He also cited the improvement in feeling around regulations. The President of the SEC, Paul Atkins, is committed to making the United States a center for the innovation of the cryptocurrency, which, according to Kruger, could unlock a new wave of institutional interest if it was followed by significant political clarity.

Paul Howard, principal director of the commercial company Wincent, echoes this point of view, saying that while Altcoins followed the wider rally, institutional capital is likely to become more selective. “This scalable landscape seems to lay the foundations for increased institutional participation,” he said in a telegram message. “The most resilient Altcoin projects could benefit, while the weakest can gradually eliminate.”

New BTC recording next month?

While Bitcoin is less than 5% compared to its record prices of January, Bitfinex analysts noted that neutral financing rates and stable trading volumes show no sign of market foam. Consolidation, which means that a new summit of all time could be delayed in June while supply / demand stabilizes more than $ 100,000, “Bitfinex analysts wrote.

Zoom out for the coming months, Bitfinex analysts have said that medium and long-term configurations remain optimistic, setting a price target of $ 150,000 to $ 180,000 for 2025-2026.

“Bitcoin’s long-term perspectives are the strongest it has ever been,” they wrote. “With the progression of sovereign and institutional adoption, the RAils ETF developed worldwide and the policy of American dial cryptography more positively, the BTC is evolving towards a global macro reserve asset.”