Bitcoin of the list of the United States

Stock market negotiated funds (ETF) recorded $ 667.4 million in net entries on May 19, the largest total of a day since May 2, reporting a renewal of institutional interests.

Almost half of these entries, $ 306 million, entered Ishares Bitcoin Trust (IBIT), now at $ 45.9 billion in net entries, according to the Farsid Source Farsid investors.

The renewed demand follows the high performance of Bitcoin prices, after exchanging $ 100,000 for 11 consecutive days, which helped restore market confidence.

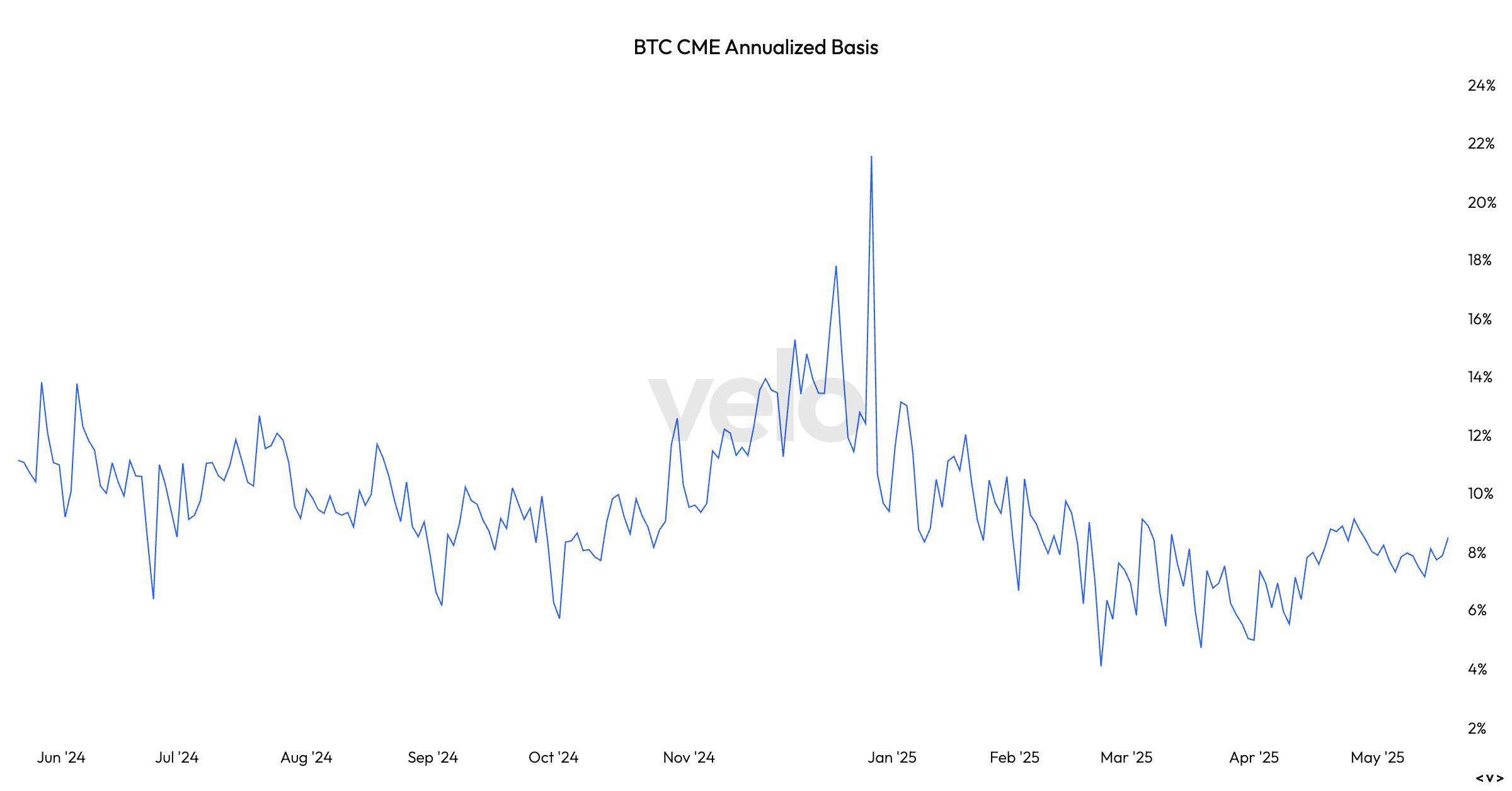

In addition, the basic annualized trade, a strategy where investors go to the ETF Spot for a long time and simultaneously of the Bitcoin term contracts in the short term on the CME, has become more and more attractive with yields approaching 9%, almost double what was observed in April.

According to VELO data, this triggered a modest increase in basic commercial activity, as evidenced by an increase in commercial activity in CME’s term contracts.

On Monday, CME’s long -term volumes reached $ 8.4 billion (around 80,000 BTC), the highest since April 23. Meanwhile, open interests amounted to 158,000 BTC, up more than 30,000 BTC contracts from the bottom of April, further highlighting the growing appetite for leverage and arbitration strategies.

That said, both the long -term volume and open interests remain below the levels observed when Bitcoin reaches a summit of $ 109,000 in January, which indicates that there is still a significant head margin for subsequent growth.

The resumption of the base suggests that growth can already occur, bringing the actors who left the market at the start of this year when the base fell to less than 5%.

The recent deposits of 13F revealed that the Wisconsin State retirement commission left its ETF position in the first quarter, probably in response to an even less favorable basic business environment. However, given that the 13F data is late in a quarter and the basic difference has been expanded from 5% to almost 10% for almost 10%, it is plausible that it is reintegrated the market in the second quarter to capitalize on the improved arbitration opportunity.