Record summits – whether $ 20,000 in 2017, $ 69,000 in $ 2021 and $ 109,000 this year – are perfect for big titles and fast comparisons, but in reality do not do a great job to describe prices.

Follow -up of the “price made” or the average price to which Bitcoin

is removed from all exchanges to estimate a market -scale cost base is a more precious tool for assessing the profitability of investors and potential inflection points in the feeling of the market.

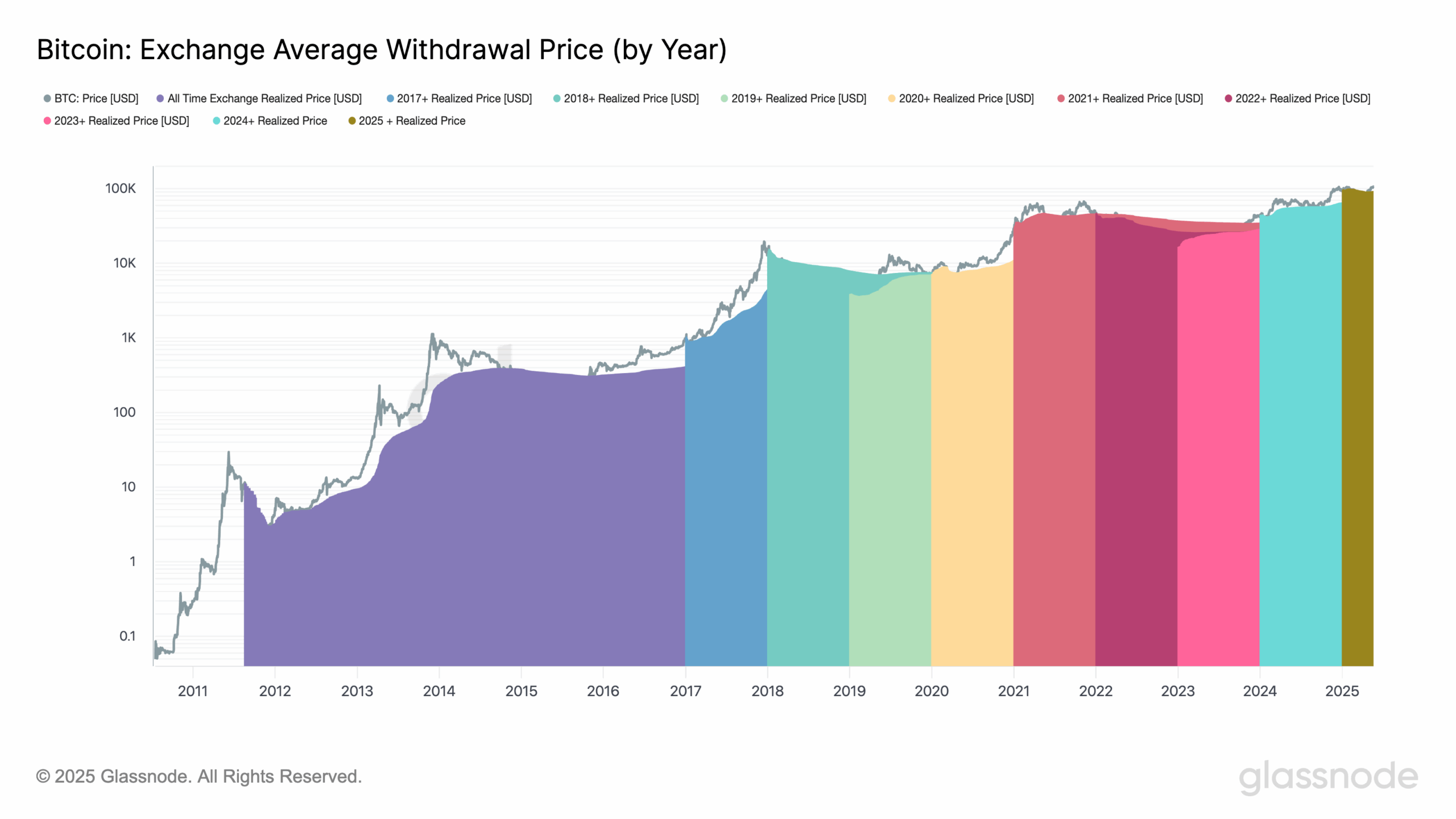

The graphics (above and below) illustrate the average withdrawal prices of different cohorts of investors, segmented by the year when they entered the market from January 1 from each year from 2017 to 2025.

The average price made for the 2025 so far is $ 93,266. Bitcoin currently negotiating at $ 105,000, these investors increased by around 12% on average.

When Bitcoin began its decline from the highest of all time of $ 109,000 at the end of January, it fell under the price made of 2025, a historic capitulation signal. This stress period lasted until April 22, when the price recovered the basis of the cost of the cohort.

Historical context: capitulation models

Historically, when the price falls below the price made of a cohort, it often marks the capitulation of the market and the low cyclicals:

- 2024: After the launch of the FNB in January, Bitcoin fell below the base of the average cost before bounced back. A greater capitulation followed in summer, linked to the transport of transport of Yen relaxes when Bitcoin plunged at $ 49,000.

- 2023: The price followed near the average cost base during the support levels, only shifting itself only during the Silicon Valley Bank crisis in March.

The data suggest that a capitulation phase has probably occurred, positioning the market for a more constructive phase. Historically, the recovery of these events mark transitions to healthier market conditions.

Realized, do not record

When Bitcoin exceeded $ 20,000 for the first time during the 2017 Haussier market, it marked a significant divergence between the market price and the price made of only $ 5,149, highlighting an exuberant speculation phase. Unsurprisingly, the prices very shortly afterwards have entered a brutal reversal.

On the other hand, by the depths of the 2018 bear market when Bitcoin has the lowest of about $ 3,200, the price at this stage converged with the price made of all time, a metric which brings together the cost base of all investors through cycles.

This long -term cost base acts as a fundamental level of support on the bear markets and gradually increases over time as new capital enters the market. Consequently, the Bitcoin assessment only by comparing cycle peaks, for example, from $ 69,000 in 2021 to just over $ 100,000 in 2025, the situation as a whole.

The most relevant point of view is that the aggregate cost base of all investors continues to climb, stressing the long -term maturation of the assets and the growing depth of the capital engaged in the network.